June 16th – June 22nd

PERSPECTIVES by Eric F. Risley

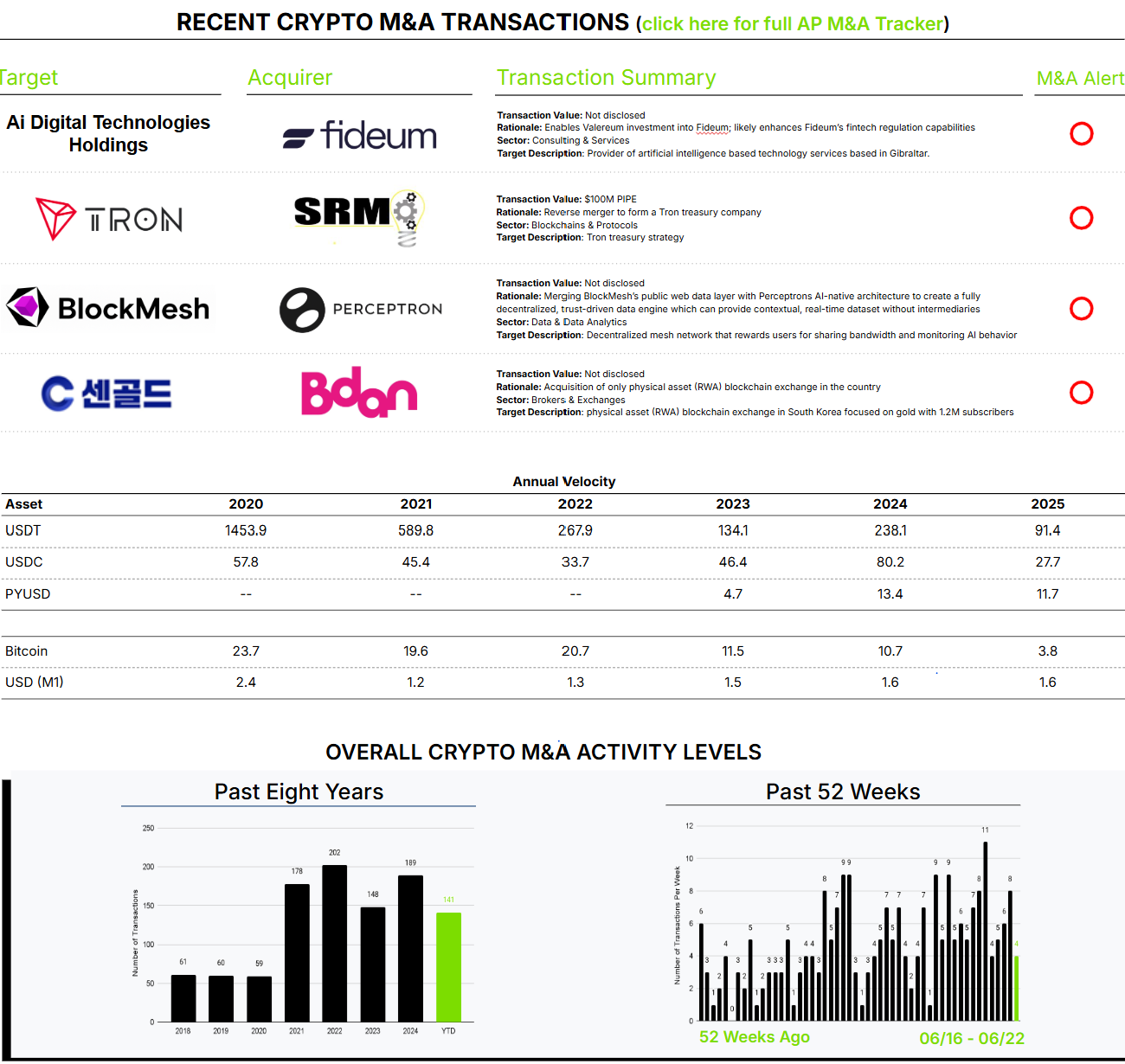

Crypto payments are one of the most promising real-world use cases for crypto. Over the past several weeks, we have published the first three parts of Crypto Payments and Infrastructure: Part I: Why Crypto Payments?, Part II: Momentum Is Building, and Part III: Market Map. This coming week, we will turn to Part IV: Capital and M&A.

Stablecoins have long served as a bridge between the fiat and crypto worlds, primarily used for crypto trading. More recently, stablecoins have emerged as a preferred real-world payment asset used by both individuals and businesses. These payments often—though not always—cross borders. Architect Partners estimates that real-world transactions account for only 1.4% to 4.2% of stablecoin trading volume but are growing rapidly.

Stablecoin use continues to be dominated by crypto trading, as the data clearly shows. In calendar year 2024, the implied average holding period for USDT and USDC was 37 and 109 hours, respectively. This is calculated using the velocity of each asset, as described in the table to the right. In essence, crypto investors are rapidly exchanging stablecoins for a variety of other crypto assets as part of their trading strategies.

Stablecoin-based real-world payments may follow different dynamics, which will be important to monitor closely. Will payers and payees quickly convert their stablecoin holdings into fiat currency, or will they choose to hold a stablecoin balance? If the former, current velocity levels may remain unchanged—or even increase. If the latter, this would suggest lower velocity and higher aggregate outstanding stablecoin balances.

Time will tell, but it’s fascinating to compare stablecoin velocity with that of the most widely used fiat currency: the US Dollar. Today, on average, a US Dollar changes hands once every 228 days (measured using M1—cash and checking account bank deposits).

The current stablecoin revenue model is directly correlated to the size of invested collateral. Both demand (use cases) and velocity are critical factors to better understand as crypto payments—whether using stablecoins or other crypto assets—continue to evolve.

All of this falls under the broader question of how crypto payments will develop and the strategies required to build successful revenue and business models.