June 16 – June 22 (Published June 25th)

PERSPECTIVES by Todd White

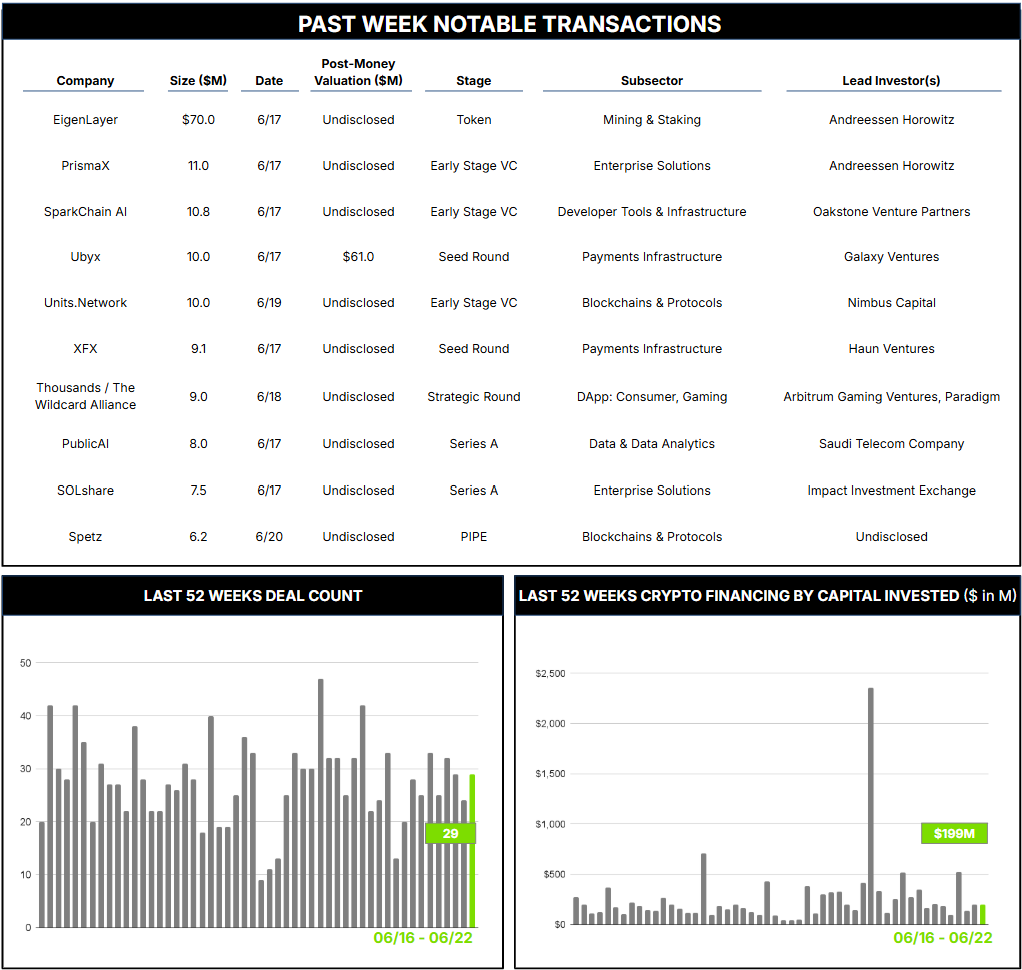

29 Crypto Private Financings Raised: $199.1M

Rolling 3-Month-Average: $257.6M

Rolling 52-Week Average: $256.3M

Staking has become an intuitive concept to those steeped in the world of crypto and decentralized finance, but it can be elusive and confusing for those outside or newly interested in the sector. The most common analogy is to interest earned on bank deposits, where banks pay account holders a return in exchange for the right to lend or otherwise rehypothecate their funds to third parties. This is both fundamental to how banks operate and central to concerns about the stability of the “fractional reserving” system, which allows the same funds to be re-lent and re-deposited almost infinitely.

Staking permits crypto holders to receive a yield on their assets, but through a fundamentally different mechanism that was originally designed to avoid the systemic risks of fractional reserving. Transactions on a blockchain must be validated in order to be executed and recorded on the chain. This can be done through “proof-of-work,” where bitcoin miners compute complex calculations to compete for rewards, or “proof-of-stake,” where users of blockchains like Ethereum lock up (or “stake”) their cryptocurrency to help verify transactions and secure the network. In return, they earn rewards that are similar to interest in a savings account. The more you stake, the greater your chance of being chosen to validate transactions and receive rewards.

But traditional staking ties up the assets, making them illiquid and inaccessible for other uses while they’re staked. To solve the problem, liquid staking was developed, where users receive a “liquid staking token” (LST) in return for their staked assets. This LST represents an interest in staked assets and can be traded, used in DeFi, or lent out, providing liquidity or potentially additional yields while the original tokens remain locked up. This has led to the next step, known as “restaking,” which allows users to take their LSTs and “restake” them to secure not just the main blockchain (like Ethereum) but also additional networks or applications, which are known as Actively Validated Services (AVS). Examples of AVS include rollups, oracles, data-availability layers, and other decentralized protocols that need security but don’t want to build their own validator networks.

If this sounds confusing, that’s because it is complicated. But it is probably no more so than the world of repackaged security interests known as ABS, MBS, and CDSs that nearly took down the financial system in 2008 and begat the whole crypto world in the first place. Whether the advent of LSTs and liquid restaking is re-introducing systemic risk can be actively debated. Suffice it to say the space is receiving significant interest among users and investors alike. Major players now include EigenLayer, Lido, Ether.Fi, Renzo, and StakeStone, among others.

EigenLayer, one of the concept’s pioneers, received a meaningful $70 million token investment from a16z, one of its early and consistent supporters. EigenLayer is a blockchain infrastructure protocol built on Ethereum that helped pioneer the concept of restaking. EigenLayer now acts as a marketplace connecting restakers and will use the new funds to launch EigenCloud, a new platform offering “verifiability-as-a-service” that lets developers build off-chain applications that are cryptographically verifiable, thus extending blockchain-grade trust to any computation or data workflow.

This certainly sounds intriguing, but let us hope that the evolving complexity does not also bring unmanageably complex risks.

Contact ryan@architectpartners.com to schedule a meeting.