June 23rd – June 29th

PERSPECTIVES by Eric F. Risley

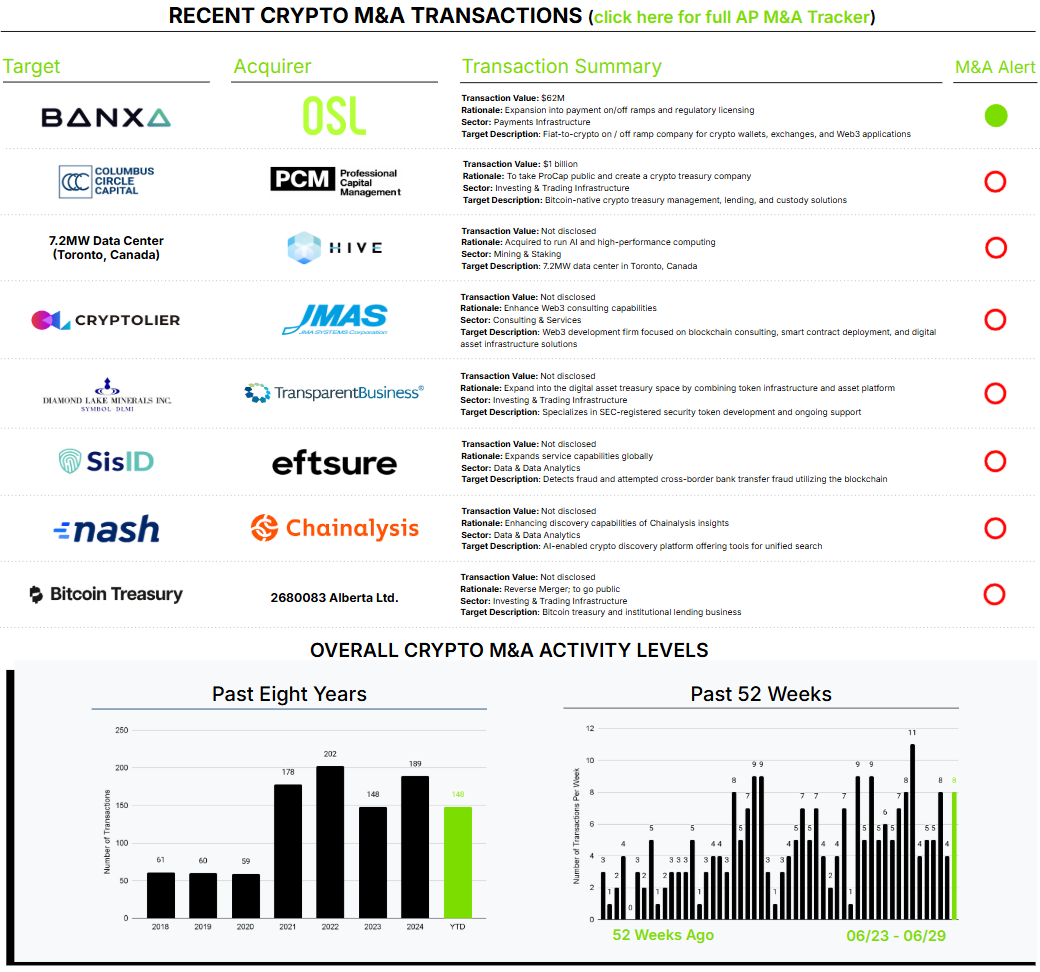

One of the more unique characteristics of the crypto industry is how it transcends borders. This is well illustrated by the acquisition of Architect Partners’ client, Banxa, by OSL. Find our M&A alert on the deal here.

Banxa is headquartered in Australia and publicly traded in Canada and, until recently, the United States. The company facilitates the conversion of fiat currency into a variety of crypto assets and back again, effectively bridging the traditional financial system and the crypto ecosystem. Banxa delivers these capabilities to crypto exchanges, wallets, and a wide range of Web3 dApps located across the globe, enabling consumers in over 150 countries to access these products and services.

Banxa is being acquired by OSL Group (HKEX: 863.HK), a Hong Kong-based, SFC-licensed crypto exchange that offers trading, insured custody, and white-label crypto payments infrastructure for institutional and retail clients worldwide. In a crowded field of fiat-to-crypto on/off-ramp providers, OSL selected Banxa for its unmatched regulatory license coverage, strong conversion performance, deep relationships with banks, payment processors, and compliance partners, its ability to accelerate the rollout of OSL Pay, and a compelling relative valuation.

Separately, the Bitcoin treasury strategy continues to gain traction, despite over 80 announced transactions of a similar nature since January 1st. This week, Columbus Circle Capital, a SPAC, announced the acquisition of Anthony Pompliano–led Professional Capital Management, and a Canadian-listed public shell announced the closing of its previously disclosed reverse merger with Bitcoin Treasury. Architect Partners has previously written about this phenomenon and holds a number of well-developed views, which have become an increasingly frequent topic of day-to-day conversation with a wide variety of crypto market participants.