March 3rd – March 9th

PERSPECTIVES by Eric F. Risley

Is tokenization moving beyond experimentation?

This is a persistent topic within Architect Partners. We believe traditional financial services and crypto will become increasingly integrated and eventually difficult to separate. Just like the emergence of the Internet became core to virtually every business, the capabilities inherent within the term “crypto” become normal and “it just is.”

Clearly the most notable tokenization success has been stablecoins, effectively creating a digital fiat equivalent, accessible globally. There is zero debate that stablecoins are way beyond experimentation. In fact, stablecoins are now well beyond a crypto trading tool and now play an increasingly large role in cross-border payments, both consumer and business payments, and most simply as a way for non-U.S. citizens to hold U.S. Dollars, the perceived safest and most stable currency available.

In fact, “stablecoin” innovation continues with new structures like Figure’s recently SEC-approved YLDS, Arca’s ArCoin, BlackRock’s USD Institutional Liquidity Fund, and Franklin Templeton’s OnChain U.S. Government Money Fund, all structured as “old-world” securities for good reason – regulatory clarity and the ability to share yield with holders. Today the leading stablecoin providers either don’t have such capabilities (e.g. Tether) or have only recently acquired them (e.g. Circle with its acquisition of Hashnote). This may well change with a variety of global regulators weighing in; however, until then many of the most potent eventual competitors, banks and other financial institutions, have been “patient” or, as noted above, experimenting with alternative structures. The stablecoin competition has barely begun.

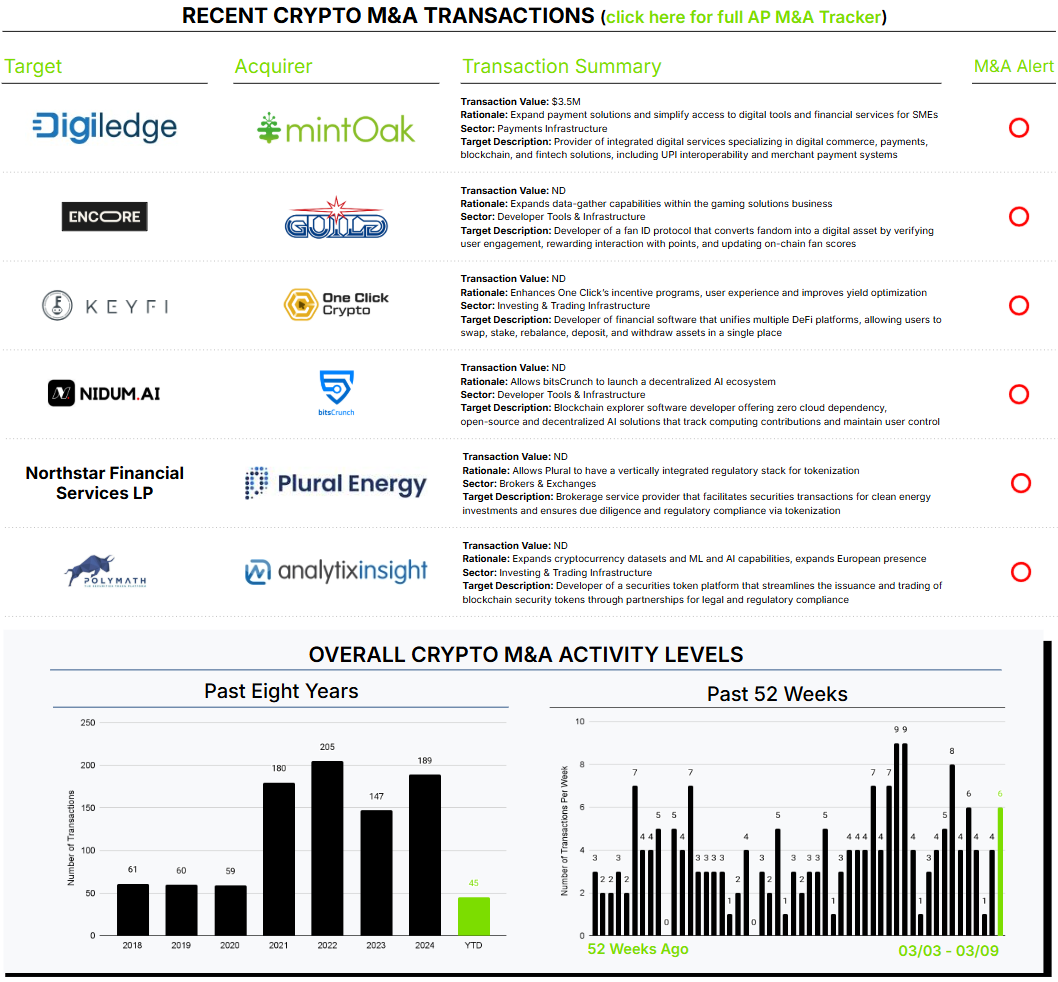

What about tokenization of securities? The value proposition could be argued to be even more compelling than tokenizing fiat currencies. The promise of global investor access for both primary issuance and secondary trading, virtually instant settlement, a single blockchain-based shared ledger, smart contract-based servicing, and definitive holder tracking allows immense cost savings. Securitize, among others, has distinguished itself as a leader in conveying this vision; however, those companies that have built themselves as specialists in origination, distribution, trading, safekeeping, and servicing of securities have an immense interest and advantage. Again, regulation has been somewhat of an inhibitor; that is changing. This week, a Canadian holder of the securitization flame, Polymath, and a clean-energy specialist were each acquired. Both are relatively nascent businesses but are surfacing the securitization topic once again.