March 31 – April 06 (Published April 9th)

PERSPECTIVES by Todd White

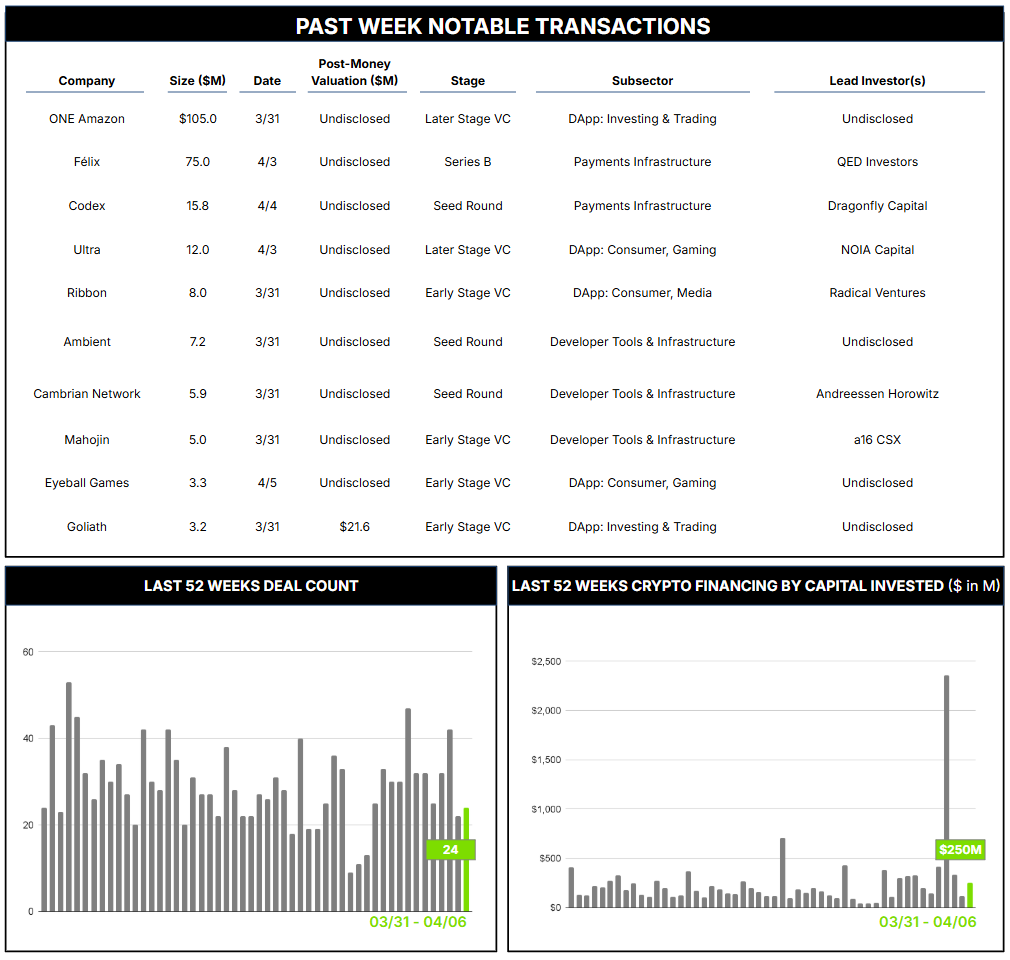

24 Crypto Private Financings Raised: $250.0M

Rolling 3-Month-Average: $437.4M

Rolling 52-Week Average: $246.5M

“Sustainable finance” has been a cornerstone of the environmentalist lexicon for at least a few decades. What it actually means, and whether it truly exists, may be open for debate. But using investment capital to incentivize conservation rather than the extraction and exploitation of natural resources seems like a good fit. For example, this might be done by issuing long-dated carbon credits tied to a forest’s ability to capture and sequester carbon, then using the proceeds to alleviate pressure to clearcut and develop the land. Numerous examples of such sustainable forestry projects exist across the world, particularly in the tropics. Still, there are clear challenges—not least the need to monitor forest growth and to quantify the “ecosystem services” that underpin these credits.

As an example, consider the now-infamous South Pole company, which fell from grace amid alleged fraud and controversy in 2023. The problem? Well, there were many, but a major one was the fact that apparently no one checked to ensure the “conserved” forests weren’t actually being chopped down for development. Oops…

The good news is that this type of moral hazard can now be addressed technologically, with the blockchain’s immutable and auditable records at the core. Benefits include the usual suspects for digitized financial products: increased transparency and accountability, the creation of tokenized financial incentives, automated regulatory and financial reporting, and potentially broader investor access through fractional ownership.

There are also numerous teams working on blockchain-enabled climate solutions. Specifically for carbon credits, teams like Triangle Digital and KlimaDAO have built infrastructure to mint and manage tokenized credits directly linked to underlying data for verification, with Triangle pioneering the first fully regulated platform to do so. Similar projects are dedicated to renewable energy and decentralized grids, supply chain and waste management, conservation and biodiversity funding, and more. The potential impact of these projects represents an exciting extension of crypto’s core technology.

O.N.E. Amazon, a project focused on large-scale ecosystem preservation in the Amazonian rainforest, achieved a significant milestone last week by securing a $100 million commitment from the Global Edge Worldwide fund, with Gorilla Technology Group as a minority investor in the round. Proceeds will be used to deploy supporting technology and issue blockchain-based securities to fund long-term preservation. Their “Internet of Forests (IoF™)” initiative—developed with MIT Media Lab and powered by Gorilla’s technology—uses satellite imagery, ground sensors, bio-sensing, and LiDAR to monitor deforestation, biodiversity, and environmental stressors in real time. The goal is to connect every hectare of the rainforest digitally, enabling data-driven conservation strategies and sustainable economic activities such as precision agriculture and eco-tourism.

While blockchain and crypto communities have been criticized for excessive energy use, they also offer much-needed climate and ecological solutions that may help belay concern over blockchain’s appetite for electricity. We are intrigued by these initiatives and look forward to working with—and reporting on—them as the sector matures.

Contact ryan@architectpartners.com to schedule a meeting.