March 31st – April 6th

PERSPECTIVES by Eric F. Risley

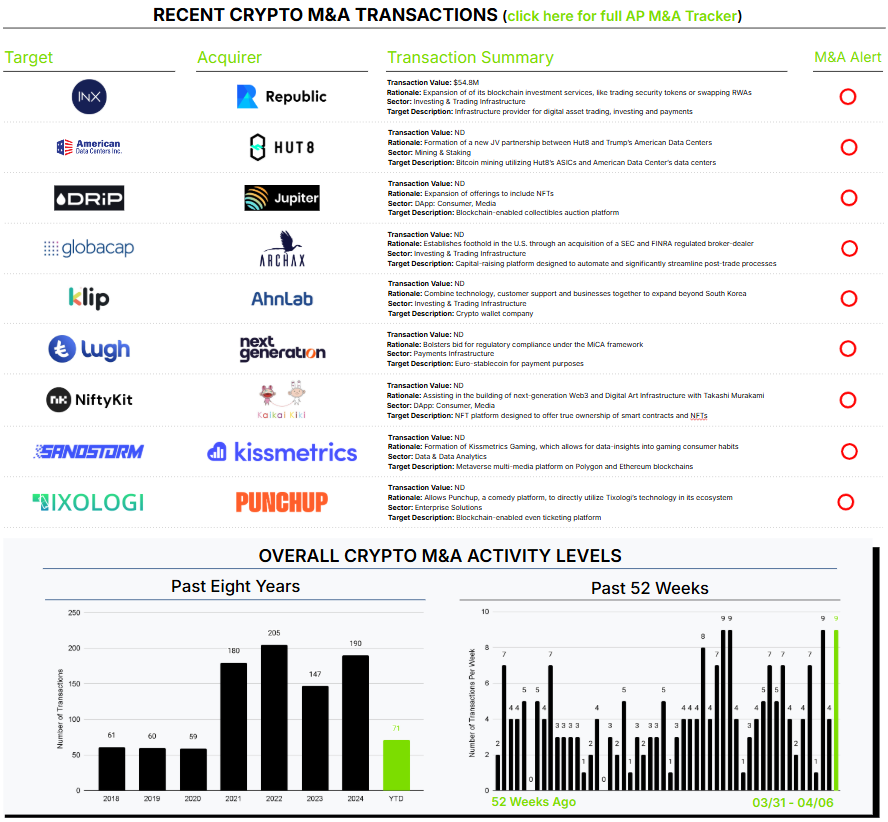

Strong week with nine crypto M&A transactions announced, but let’s talk about the big impact items of the week.

Circle’s IPO S-1 became public on Tuesday, April 1. Circle’s success is a particularly important milestone for several reasons.

First, Circle is all about payments, perfectly aligned with bitcoin’s founding intent as stated in the first line of the abstract: “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.” Payments are the second fastest-growing commercial use case for crypto.

Second, demonstrating the unpredictable nature of how markets evolve, Circle is intricately intertwined with the same financial institutions which were to be avoided. Every USDC stablecoin issued triggers the purchase, using US dollars, of an equivalent value of US Treasury bills through traditional financial institutions. This has lent legitimacy to crypto, and the IPO filing demonstrates that groups like the Federal Reserve, Office of the Comptroller of the Currency (OCC), Congress, and the Executive Branch are offering tacit approval.

Third, Jeremy Allaire, Co-founder and CEO, reminds us of the challenging ambition to recraft the global financial system in his letter to shareholders.

“What we’re doing is not easy given the complexity of navigating an evolving ecosystem where innovative technology and highly regulated, legacy financial services are intersecting in ways that will give rise to challenges and uncertainties. Building a new internet financial system, creating major new infrastructure for money and economic activity, shaping and responding to policy, and operating this infrastructure in a complex global macro environment—well, it’s hard. It’s complex and difficult, and will challenge you every day. But it is also an exciting financial and technological adventure.”

Jeremy Allaire, Circle CEO

On an equally, and perhaps more important topic, we cannot ignore the macro environment—namely, the so-called “Liberation Day” tariffs. Crypto doesn’t exist in isolation, and impacts, both negative and perhaps positive, will become apparent over time. My partner Elliot Chun offers some observations in this week’s Public Company Snapshot.