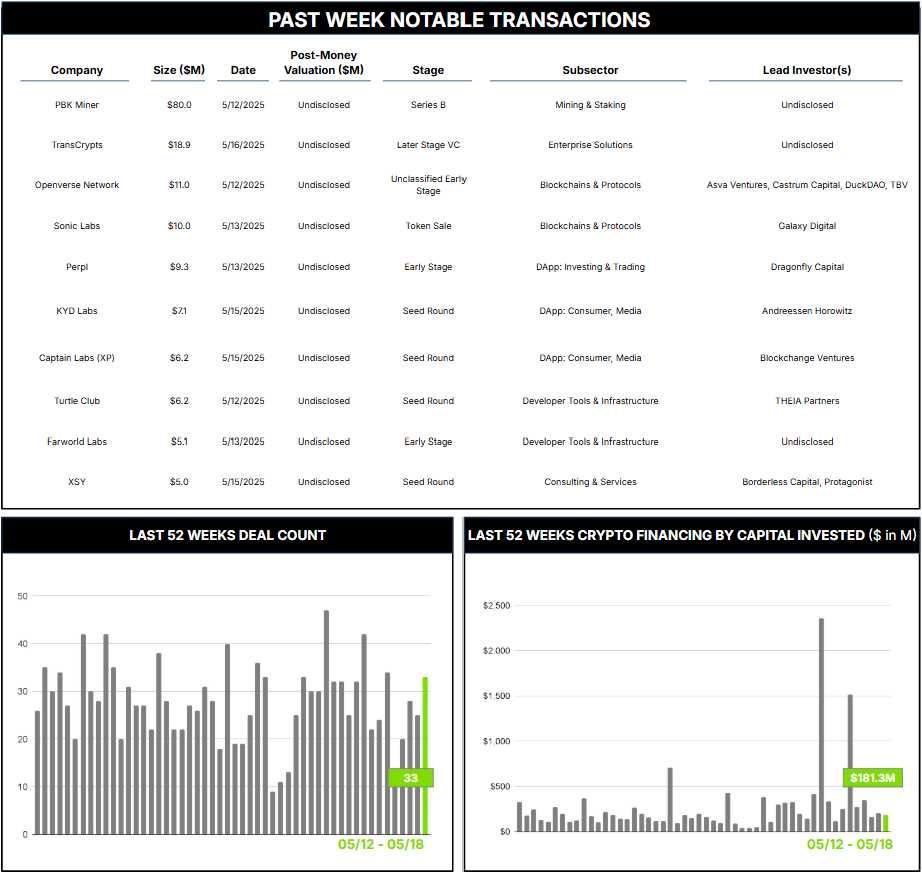

May 12 – May 18 (Published May 21st)

PERSPECTIVES by Todd White

33 Crypto Private Financings Raised: $181.3M

Rolling 3-Month-Average: $524.7M

Rolling 52-Week Average: $272.2M

Please note our partner Steve Payne will be doing a fireside chat with Tony Pecore, SVP at Franklin Templeton, at Digital Assets Week / Palo Alto on May 23rd.

Crypto mining operations, especially Bitcoin, are energy-intensive and were recently reported to consume about 0.6 % of global electricity. This high demand for power, historically sourced from fossil fuels, has raised significant concerns among environmentalists about mining’s carbon footprint, water use, and broader environmental impacts.

These environmental costs have led to strong criticism and calls for the sector to reduce consumption and transition to cleaner energy sources. While some of the criticism may be overblown, the fact remains that crypto mining is an energy hog, and the industry has begun addressing the issue. Many mining operations are shifting to renewable energy sources such as hydroelectric, solar, wind, and geothermal power. Some blockchains are moving away from energy-intensive proof-of-work (PoW) systems toward proof-of-stake (PoS) and other less demanding consensus mechanisms, aiming for net-zero carbon emissions. In a bit of irony, blockchain technology itself is being used to certify the origin of green energy, facilitate peer-to-peer energy trading, and automate renewable-energy transactions through smart contracts to improve transparency and verify claims about green-energy use and emissions.

Mining facilities and data centers can also play a pivotal role as energy off-takers, making green-energy projects more financially viable. Co-locating with energy facilities, green or otherwise, can provide assured off-taker contracts, making projects easier to finance at scale. Because data centers can shift computational workloads to periods or locations with surplus power, operators can absorb excess supply that might otherwise be curtailed (or simply burned as flare gas), thereby reducing pressure on peak loads. This demand flexibility supports grid stability, facilitates the use of green energy, and helps plan for future growth in energy demand.

PBK Miner sits at the center of this dynamic and closed an USD 80 million Series B round last week. The UK group, founded in 2019, operates a cloud-mining platform that runs entirely on renewable energy, allowing users to invest remotely in fixed-term contracts with daily returns without purchasing, maintaining, or operating physical mining hardware. The energy mix includes solar, wind, hydroelectric, and geothermal sources across a network of more than 100 large-scale data centers. PBK aims to reduce both its operational costs and carbon footprint and is integrating AI modules to optimize resource allocation and identify optimal windows to lower energy consumption. Proceeds from the round will support the development of advanced computing facilities and further integration of AI to improve mining efficiency, enhance system performance, and increase user benefits.

Contact ryan@architectpartners.com to schedule a meeting.