May 19 – May 25 (Published May 29th)

PERSPECTIVES by Todd White

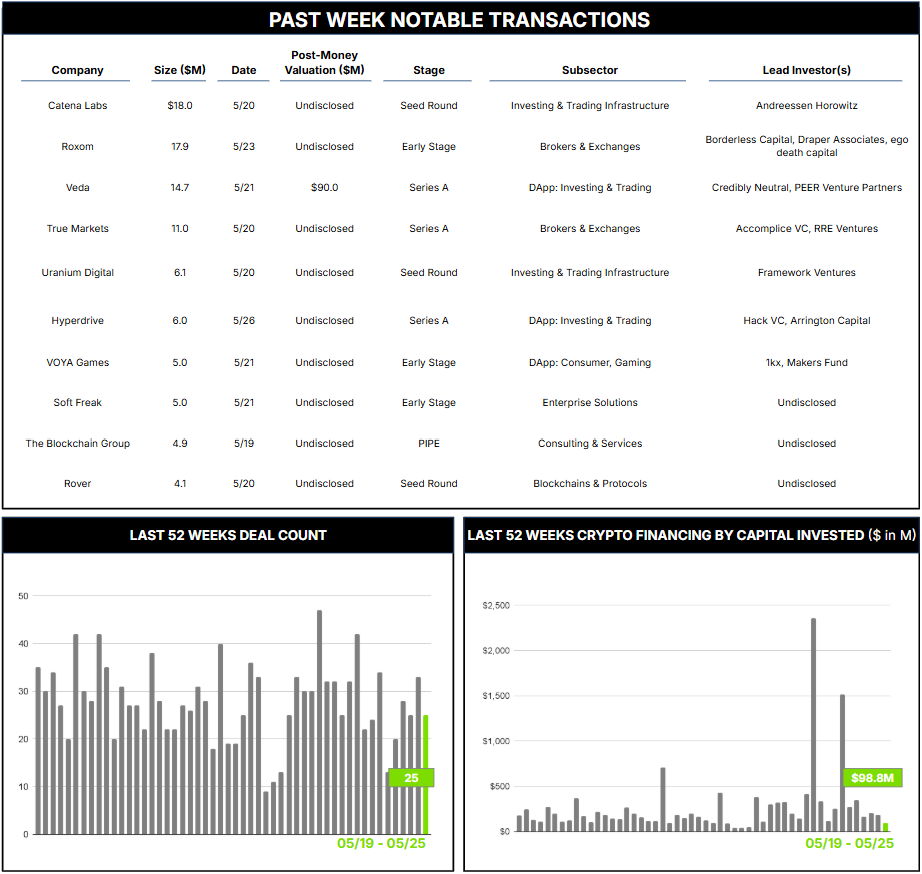

26 Crypto Private Financings Raised: $98.8M

Rolling 3-Month-Average: $521.1M

Rolling 52-Week Average: $267.8M

The global banking sector has undergone significant transformation over the past century, driven by technological advancements, regulatory changes, and shifting consumer expectations. Its evolution reflects a shift from localized, relationship-based models to global, technology-driven ecosystems.

Traditional regional banks—often community-focused institutions—emerged to serve local economies, offering retail banking services such as savings accounts, loans, and mortgages. These banks relied on physical branch networks, personal relationships with customers, and localized lending. They played a critical role in supporting small businesses and individuals, particularly in the pre-digital era, laying the foundation for trust and accessibility. Over time, however, they struggled. The 2008 financial crisis exposed vulnerabilities in risk management and capital adequacy; many consolidated or closed branches to cut costs and reallocated budgets toward digital transformation to compete with emerging fintechs. More critically, the crisis eroded consumer trust, pushing some customers toward alternative financial providers.

Global systemically important banks (G-SIBs) were better positioned because of their scale, diverse offerings, and capacity to invest in technology. They provide services worldwide but face post-crisis regulatory pressure and increasing tech-enabled competition. They also must align with environmental, social, and governance (ESG) goals, integrating sustainable-finance principles into their strategies. Yet their size can make balancing regulatory compliance, technological innovation, and customer-centricity challenging—and the very technology they embrace has heightened competitive pressure.

Digital-only financial institutions, dubbed neobanks, emerged in the 2010s and leveraged technology to offer user-centric banking without physical branches. Examples include Revolut, N26, Chime, and Monzo. They focus on mobile apps, low fees, and features such as real-time payments and AI-driven financial insights. Private credit evolved in parallel, filling gaps left by banks’ post-crisis constraints and, like neobanks, leveraging technology to enhance efficiency and access, becoming a mainstream alternative to bank lending.

Over the last decade, two other forces arrived on the scene. First came crypto, with blockchain technology challenging the sector’s foundational infrastructure. AI followed, rapidly offering analytical, computational, and cognitive capabilities that are difficult to match—let alone defend against. Banks began using AI for narrow tasks such as fraud detection and chatbots, but AI-driven platforms quickly morphed into comprehensive solutions, handling functions like credit decisioning and conversational banking.

As a result, the sector again seems poised for substantial change—this time driven by stablecoins, digital payments, and AI-powered banking platforms. Catena Labs aims to capture this zeitgeist, bolstered by an $18 million seed round led by a16z Crypto and joined by Breyer Capital, Circle Ventures, Coinbase Ventures, and investors such as Tom Brady and Sam Palmisano. Founded in 2022 by Sean Neville (Circle co-founder and USDC co-creator), Catena Labs is developing an AI-native financial institution to support the “agent economy,” in which AI agents autonomously conduct economic activities. Its core offering is the open-source Agent Commerce Kit (ACK), which integrates digital identity, smart contracts, and stablecoin payments (primarily USDC) to enable secure, compliant, and scalable transactions for AI agents. Catena seeks to address the limitations of traditional financial systems—often slow and ill-suited for AI-driven commerce. The agentic-AI market, projected to reach $150 billion by 2030 (44 % CAGR), will demand yet another massive infrastructure shift. Catena’s success—and that of the broader sector—will hinge on balancing innovation with regulation and maintaining consumer trust in an increasingly digital, interconnected world.

Contact ryan@architectpartners.com to schedule a meeting.