May 5th – May 11th

PERSPECTIVES by Eric F. Risley

Beware of pre-announcements; they may not be all they seem.

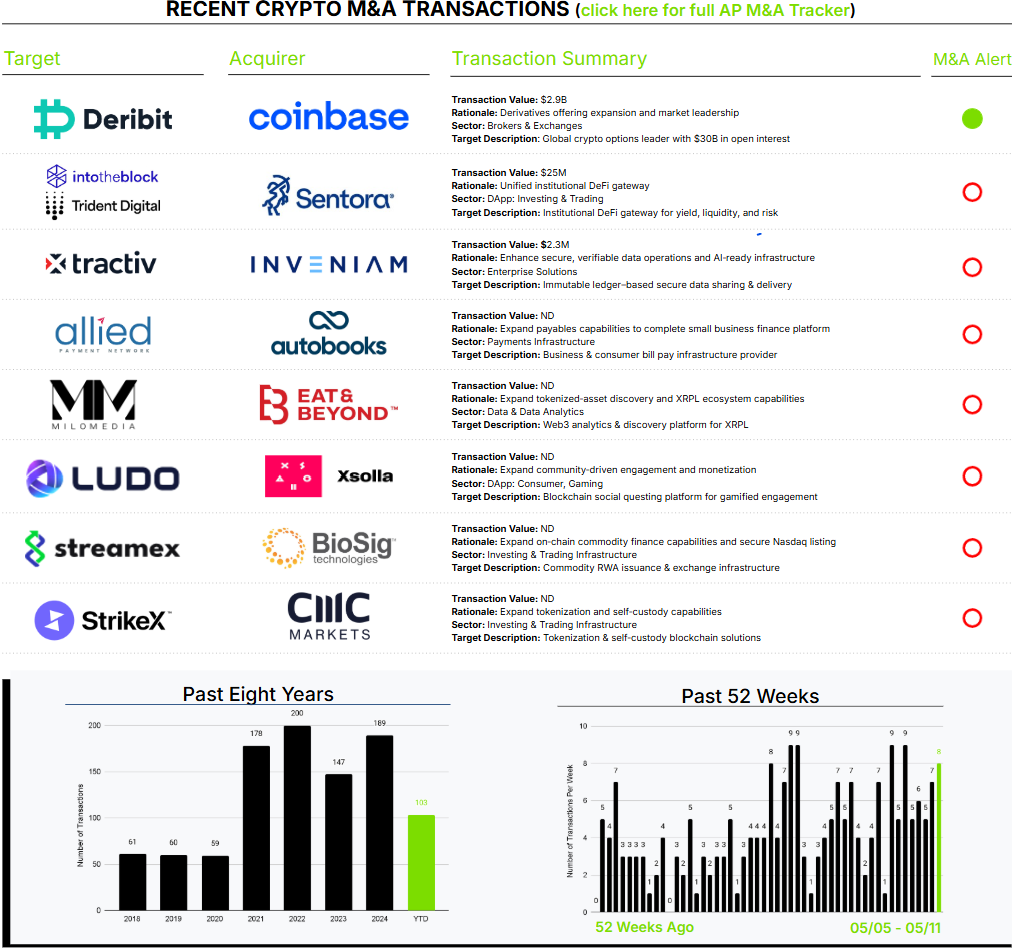

Back in January, Bloomberg reported that Deribit was in active M&A discussions and could be valued between $4 billion and $5 billion. This week, four months later, the acquisition of Deribit was officially announced for what appears, on the surface at least, to be a relatively modest $2.9 billion in consideration.

Architect Partners estimates Deribit generated $300 million in revenue in 2024. That implies a 9.7× revenue multiple, certainly healthy, but well below the 13× – 17× revenue range rumored earlier, and below the 12.5× revenue multiple Ripple reportedly paid for Hidden Road in their recently announced combination.

Regardless, this is once again the largest M&A transaction in crypto history and solidifies Coinbase as a leader in crypto-derivatives trading, a particularly lucrative segment. Coinbase entered the derivatives market with its acquisition of FairX (an Architect Partners client) a few years ago. More details are available in our M&A Alert.

The crypto M&A environment is robust, and we expect activity levels to rise further. Large, $1 billion-plus transactions will become relatively commonplace, driven by ongoing consolidation and a soon-to-emerge cohort of acquirers drawn from traditional financial institutions. This momentum will be reinforced by the coming wave of crypto IPOs.

Trading and trading infrastructure are likely to remain the most prominent M&A themes. Two other segments are also noteworthy and increasingly active: a) the rapidly growing crypto-payments sector, and b) security and fraud-prevention solutions.

Architect Partners will be at Consensus Toronto and Stablecon in NYC. Please contact ryan@architectpartners.com to schedule a meeting.