September 8 – September 14 (Published September 17th)

PERSPECTIVES by Todd White

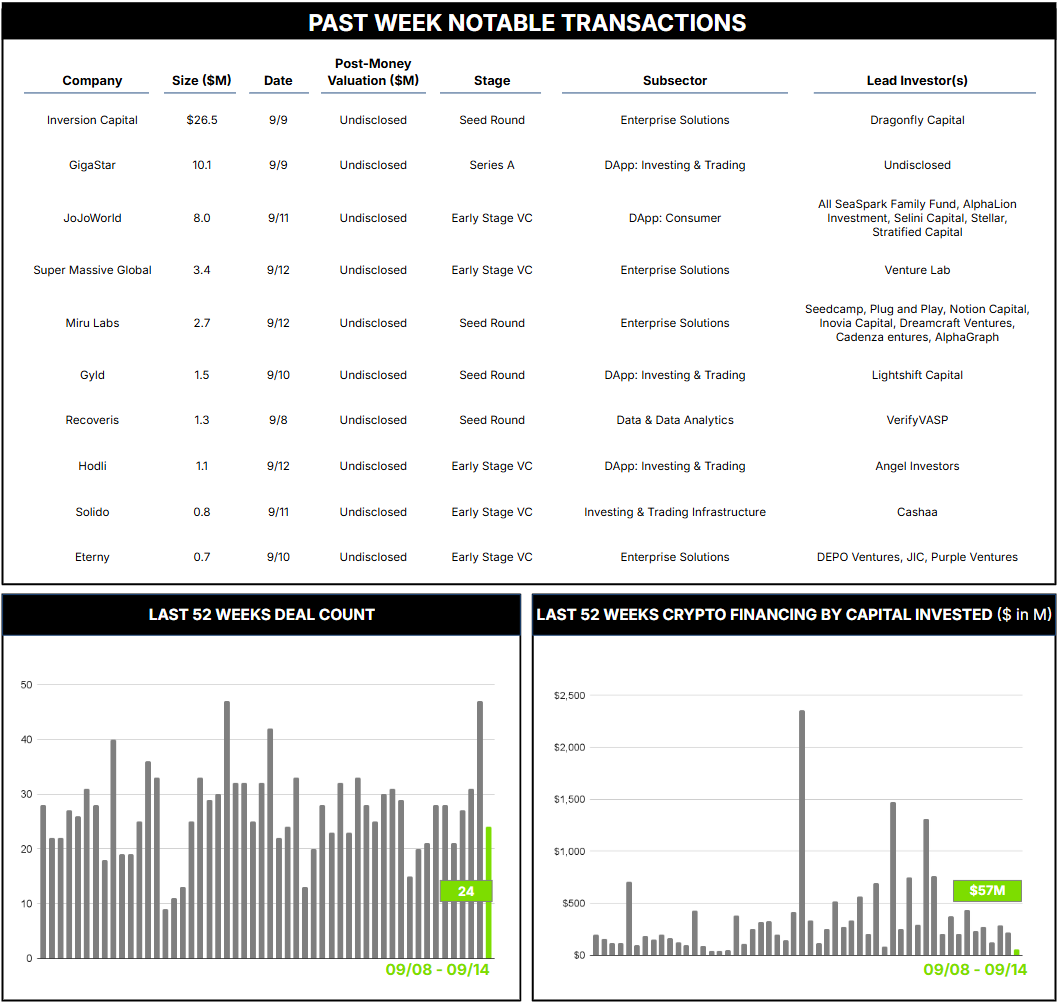

24 Crypto Private Financings Raised: $56.9M

Rolling 3-Month-Average: $373.3M

Rolling 52-Week Average: $347.2M

The integration of blockchain technology into traditional business has matured selectively, if underwhelmingly. The promise, dating back to Bitcoin’s origins in 2009, is for decentralized, transparent, and immutable systems to disrupt traditional industries like finance, supply chain, and healthcare. Current trends driven by real-world-asset (RWA) tokenization and regulatory clarity seem positive, but broad-scale adoption has remained hampered by technical, economic, and organizational hurdles.

There have been some notable successes. JPMorgan’s Kinexys (formerly Onyx) processes over $1 billion daily in tokenized deposits and cross-border payments via JPM Coin, reducing settlement times from days to seconds. RippleNet has enabled banks like Santander to cut international transfer costs by 40–70%. And the massive success in 2025 of crypto ETFs and tokenized money-market funds has attracted institutional capital, signaling mainstream RWA adoption.

Yet there have been many more failures. Some estimate that over 90% of all blockchain projects collapse, often from overhyped expectations and execution challenges. Common factors include lack of stakeholder buy-in, governance flaws, technological complexity, poor interoperability, and unsustainable business models.

Inversion Capital seeks to change this dynamic by combining seasoned crypto expertise with focused capital in a private equity strategy. Inversion was founded by Santiago Roel Santos, an experienced investor and former general partner at ParaFi Capital and founder of EON Capital, to acquire and transform traditional businesses by integrating blockchain infrastructure. Its core model involves strategic buyouts of underperforming companies in sectors such as financial services and telecommunications, followed by embedding crypto-enabled solutions (such as stablecoin payments and on-chain efficiencies) to unlock growth. Through its arm, Inversion Labs, the firm seeks to develop new revenue-generating products (e.g., blockchain-based remittances) and replace legacy cost centers with decentralized systems, aiming to make blockchain “invisible yet transformative” for mainstream adoption.

Inversion closed a $26.5 million seed round on September 8, 2025, led by Dragonfly Capital with participation from 35 backers including VanEck, Lightspeed Faction, ParaFi Capital, Portal Ventures, HashKey Capital, Volt Capital, Race Capital, and angels like Balaji Srinivasan and Bryan Pellegrino (LayerZero co-founder). Participating investors are predominantly crypto-native, comprising leading venture firms and high-profile angels who align with Inversion’s vision of mainstream blockchain adoption. The raise suggests conviction among the crypto cognoscenti that real-world utility beyond speculation is at hand, with an investor base capable of offering not just capital but strategic networks in DeFi and emerging markets.

We are encouraged to see a smart team attract smart capital to help promote and expand adoption. Future rounds may attract broader traditional interest once Inversion demonstrates success, but the current syndicate’s deep crypto focus seems an appropriate mix of capital, expertise, and connections to help pave the way.