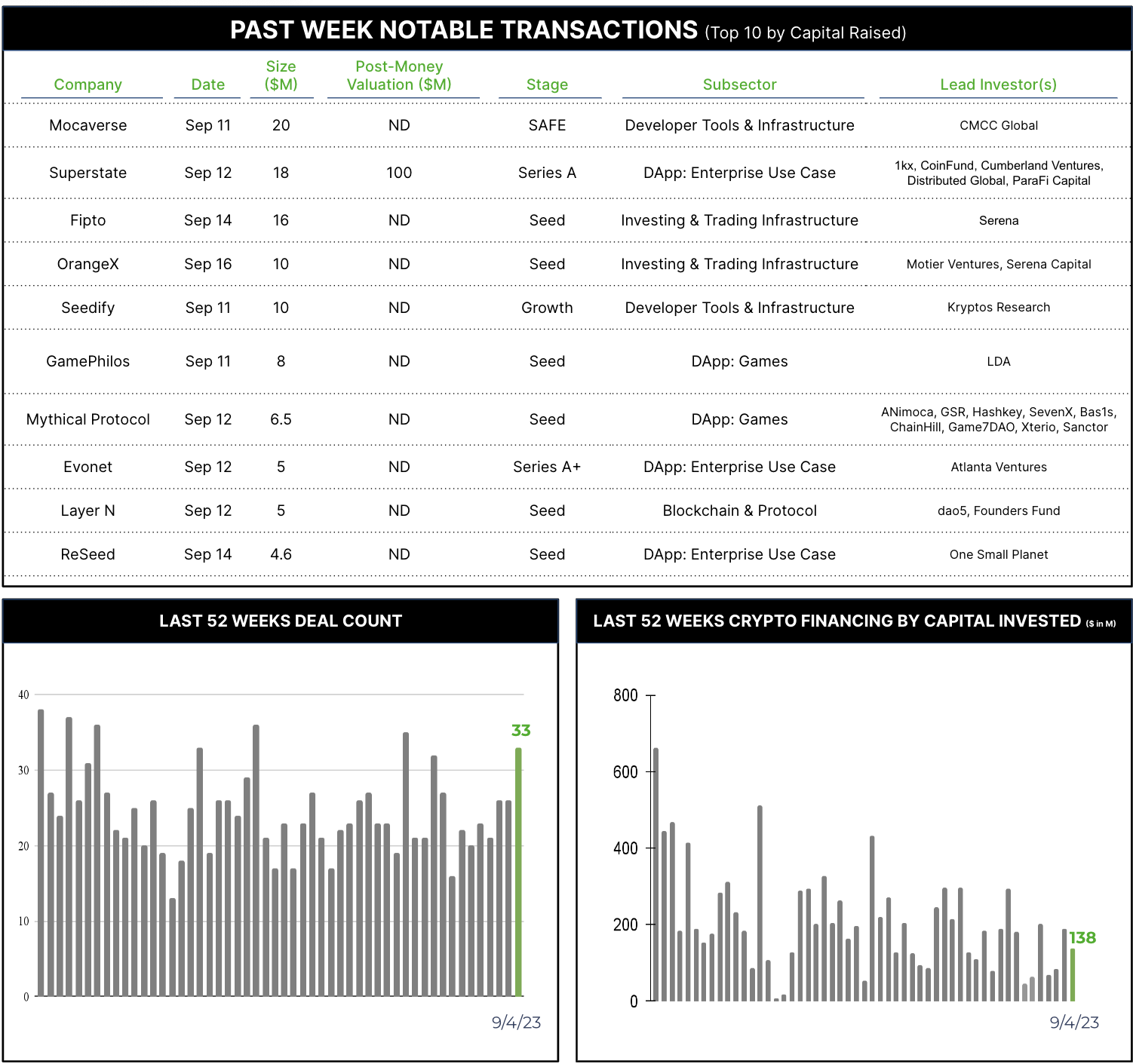

33 Crypto Private Financings Raised ~$138M

33 Crypto Private Financings Raised ~$138M

Rolling 3-Month-Average: $144M

Rolling 52-Week Average: $201M

Segment Overview

Deal count is up this week, although capital invested is down on a relative basis. There are about 10 raises that didn’t report amounts, but I suspect they are on the smaller size. This is a marker for earlier deals & smaller sizes overall. Large raises and later stage remain few and far between.

Selected Highlights

Mocaverse raised $20MM via SAFE notes, led by CMCC Global with six other investors tagging along. Mocaverse is a project under Animoca Brands, the sprawling gaming and metaverse firm, and is building identity based tools for Web3. It will combine identity with a loyalty program opening its use to the wider Animoca universe. It also has a DAO based structure.

Why Notable? Animoca Brands is an very active investor, with over 450 investments in various firms. Notable for bringing in other investors to further this project and striving for a network effect.

Fipto raised €15MM led by Serena. Fipto is a French fintech focused on payments, specifically using blockchain based digital assets for payments.

Why Notable? We continue to highlight real world use cases of blockchain beyond trading, and we’re seeing more activity in the payments space. Friend of Architect Partners, Orbital (getorbital.com), for example, has expanded their product a few years ago with digital asset payments, and has seen its use explode. All for the simple reason that it’s cheaper & less friction to move assets/monies globally.

OrangeX raised $10MM led by Kryptos Research with four other investors chipping in. OrangeX is a relatively new crypto exchange, launched in 2021.

Why Notable? OrangeX has specifically stated the funds will go towards regulation frameworks. Trust is paramount for exchanges, and embracing regulation is a key aspect. While there is a slow march to regulatory clarity, particularly outside of the US, it is not well defined despite 10 years of activity. As noted previously, an exchange attracting capital in this environment is a feat in itself.

Patterns

Broken record, but the catch-all “Infrastructure” remains the main segment. Gaming has been bubbling up lately as a sector, and in all forms.

Conferences

We will be at Mainnet (Sept. 20-23). If you will be there, let’s schedule time to connect.