September 15th – September 21th

PERSPECTIVES by Eric F. Risley

Traditional financial services continue to embrace crypto globally.

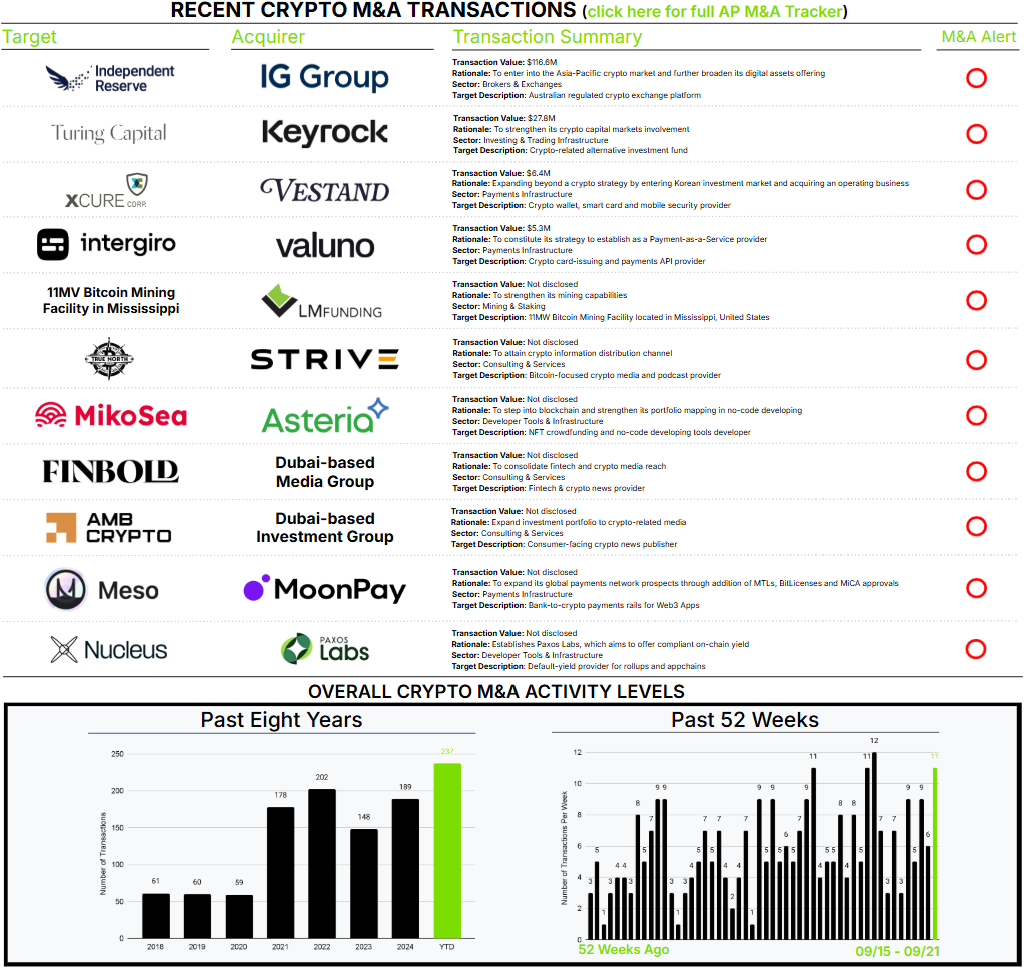

This week, UK-based IG Group acquired Independent Reserve for an implied total enterprise value of $117M as the headline. However, in M&A transactions, structure matters, which we’ll get to below.

IG Group offers active, retail trader-focused online equity, options, and futures trading products under the Tastytrade brand and, more recently, via the Freetrade brand through an acquisition earlier this year. IG Group began bolstering its nascent crypto-trading offering in May 2025 through a partnership with Uphold’s crypto-as-a-service product. The acquisition of Independent Reserve substantially augments IG Group’s crypto business with 129,000 funded accounts, $23M in last-twelve-months revenue, and clients in Australia and Singapore.

While headlines are great, the details matter more. In this case, IG Group is acquiring only 70% of Independent Reserve, and a portion of the closing consideration is being held back and is contingent upon performance in the fiscal year ending June 30, 2026. IG Group has the option to acquire the remaining 30% stake in the future, with the purchase price dependent on financial performance in fiscal years 2027 and 2028.

Bottom line: the actual consideration at closing is $72M for control of a business that generated $23M in revenue over the past twelve months, a modest 3.1× revenue multiple. Yes, the structure allows for future payments, the amount of which will depend on future performance. This may result in a higher valuation multiple in retrospect.

Why this structure? Almost certainly to bridge a gap between the valuation expectations of the acquirer and the seller. In M&A, there are many ways to create structures that can be win-win if certain future events unfold. In this case, IG Group can acquire the remaining 30% ownership stake at pre-negotiated values that vary with financial performance over the next three years. The shareholders of Independent Reserve are effectively putting that future consideration at risk because they believe they can perform well and “earn” an even better outcome. The nuances here are only partially disclosed, so it’s impossible for an outsider to assess the specifics. However, these types of structures, and the required leap of faith, can be an effective mechanism to align buyer and seller needs.