We are always on the lookout for real world use cases to demonstrate the “beyond asset value speculation” theme.

An excellent and proven example is CHAMP Titles. Earlier this year, CHAMP (an Architect Partners client) raised $18M in a Series C growth equity financing. CHAMP offers its Digital Title and Registration Suite to state motor vehicle departments, allowing auto title and registration records to be efficiently managed. West Virginia, New Jersey, Kentucky and Illinois are clients. The value proposition benefits the state DMVs but also the entire ecosystem of interested parties around automobiles including dealers, lenders and insurance carriers. Benefits include reducing title transfer time from weeks to hours, 5x productivity for DMV title clerks, elimination of 5M pieces of paper per year for each DMV and dramatically improved customer experience. Automobile titles and registrations are just the first use case. None of the value propositions mention crypto or blockchain, however, the enabling technology is exactly that.

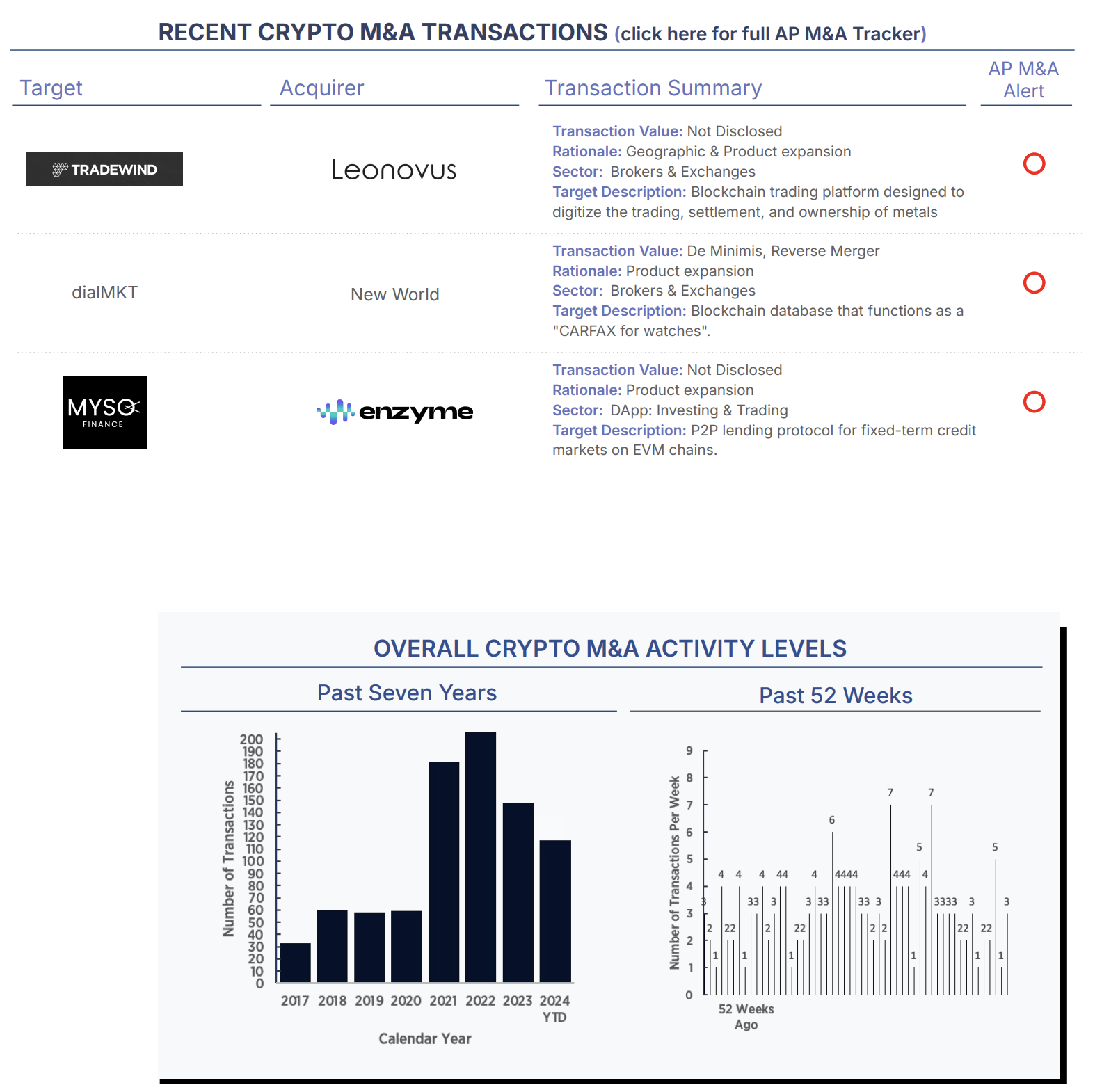

In a similar vein albeit more concept than reality, this week New World announced it was acquiring a controlling stake in dialMKT. dialMKT is focused on managing the provenance of pre-owned wristwatches, a $20B – $30B global market according to McKinsey & Company. Think of the solution as a CARFAX for watches. Who would have known! Now we have zero view on the veracity of either company or the state of development of the dailMKT solution but this is another example of an intuitive use case and what appears to be a large market opportunity.

We keep searching.