January 6 – January 12 (Published January 15th)

PERSPECTIVES by Todd White

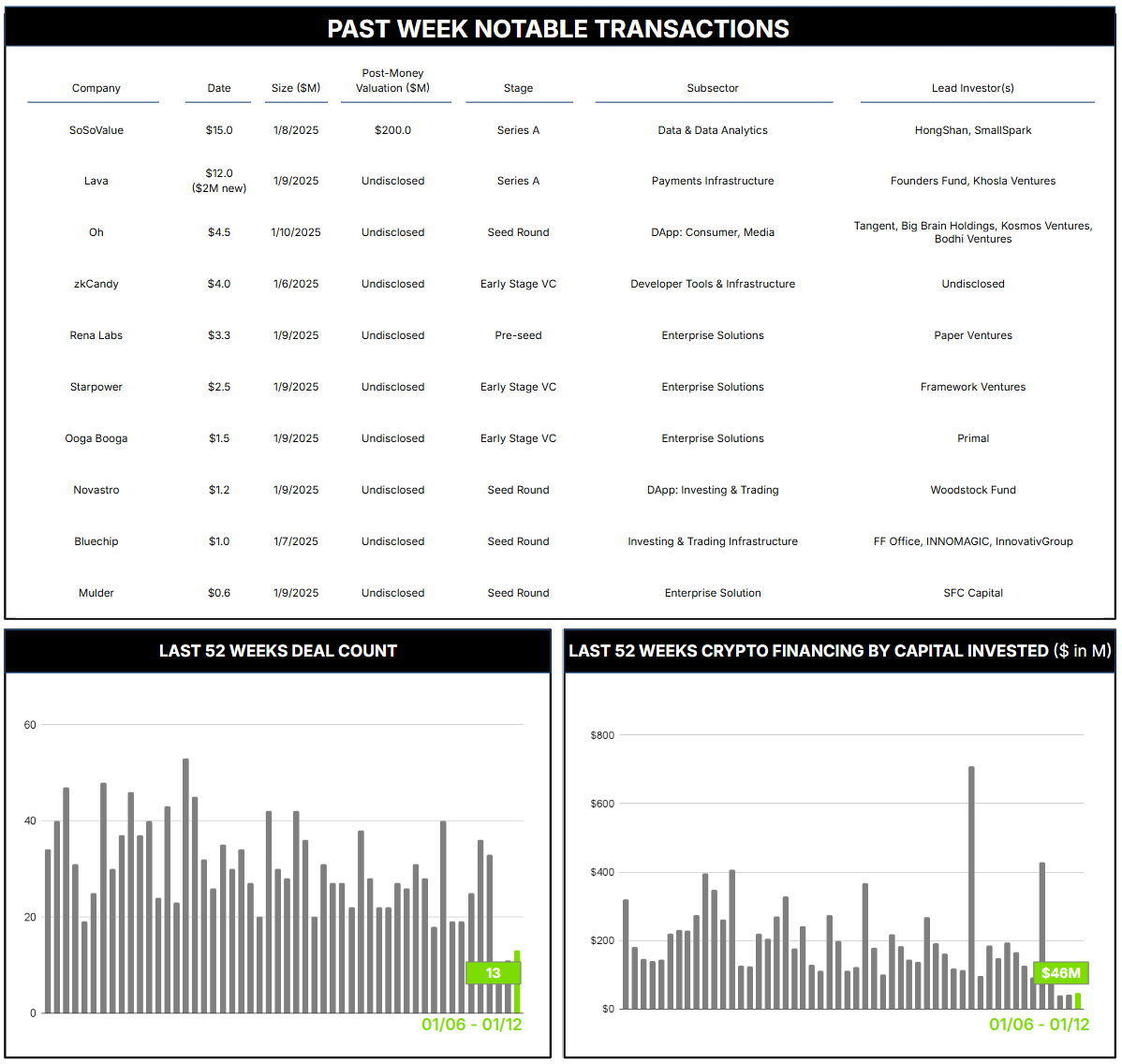

13 Crypto Private Financings Raised: $46.2M

Rolling 3-Month-Average: $137.5M

Rolling 52-Week Average: $201.1M

SoSoValue, an AI-driven crypto research platform, closed a $15 million Series A round at a $200 million post-money valuation this week. SoSoValue’s approach focuses on providing insights into crypto prices, on-chain data, and real-time news feeds through AI-enabled research. Their offerings include AI-powered market analytics for real-time data processing and trend analysis, ETF dashboards and portfolio tracking tools, market indicators for actionable insights, and automated data mining and AI-driven research reports.

The new funding will primarily support the launch of their Investible Spot Index Protocol (SSI), which leverages on-chain smart contracts to create wrapped tokens representing baskets of crypto assets. Their intent is to simplify crypto investments with passive index options that automatically rebalance.

As highlighted in our 2024 Year-End Report, the integration of AI, blockchain, and crypto has gained significant momentum and capital support recently. The increasing use of AI agents and AI-enabled analytics is playing a central role, particularly for complex processes that require both analysis and speed of execution, such as trading and portfolio management. While traditional bots will remain relevant for high-frequency and repetitive tasks requiring adherence to predefined rules, we expect AI-enabled solutions, with their ability to perform complex tasks, analyze data, and make more unique and informed decisions, to continue driving innovation and adoption across multiple areas of the industry.

Contact ryan@architectpartners.com to schedule a meeting.