March 24th – March 30th

PERSPECTIVES by Eric F. Risley

Crypto being left behind for the more attractive one

As we all know, blockchains require a large group of businesses and individuals to commit to “running the blockchain.” Perhaps in the early days of crypto, there were plenty of individuals willing to do so altruistically, simply for the benefits of supporting an innovative, disruptive approach and participating in a grand experiment—much like what motivates open-source software developers.

Those days are long past. Bitcoin mining, in particular, has become a landscape dominated by giants, all driven by the maximization of profits. It’s fair to say it has become a playground for fewer and fewer participants—those who have access to three key ingredients: First, large pools of capital to constantly upgrade the computers optimized for mining (mining rigs); second, physical sites and buildings to house these mining computers; and third, low-cost power, at scale, to run the equipment.

Today, the vast majority of returns from these investments come from the mining rewards built into the Bitcoin protocol, known as the block subsidy, paid in Bitcoin. The other component of return is transaction fees, which on average make up only 10% of the total. The fundamental challenge for Bitcoin miners is the variability of the fiat value of the block subsidy. This makes running their business difficult, as projecting revenue depends on forecasting the value of Bitcoin—not exactly a science.

Bringing this back to the opening sentence: Bitcoin mining is, at its core, a business running a data center. There’s nothing especially unique about it, aside from the specialized requirements tied to the purpose of the data center. In Bitcoin’s case, that means specialized computers.

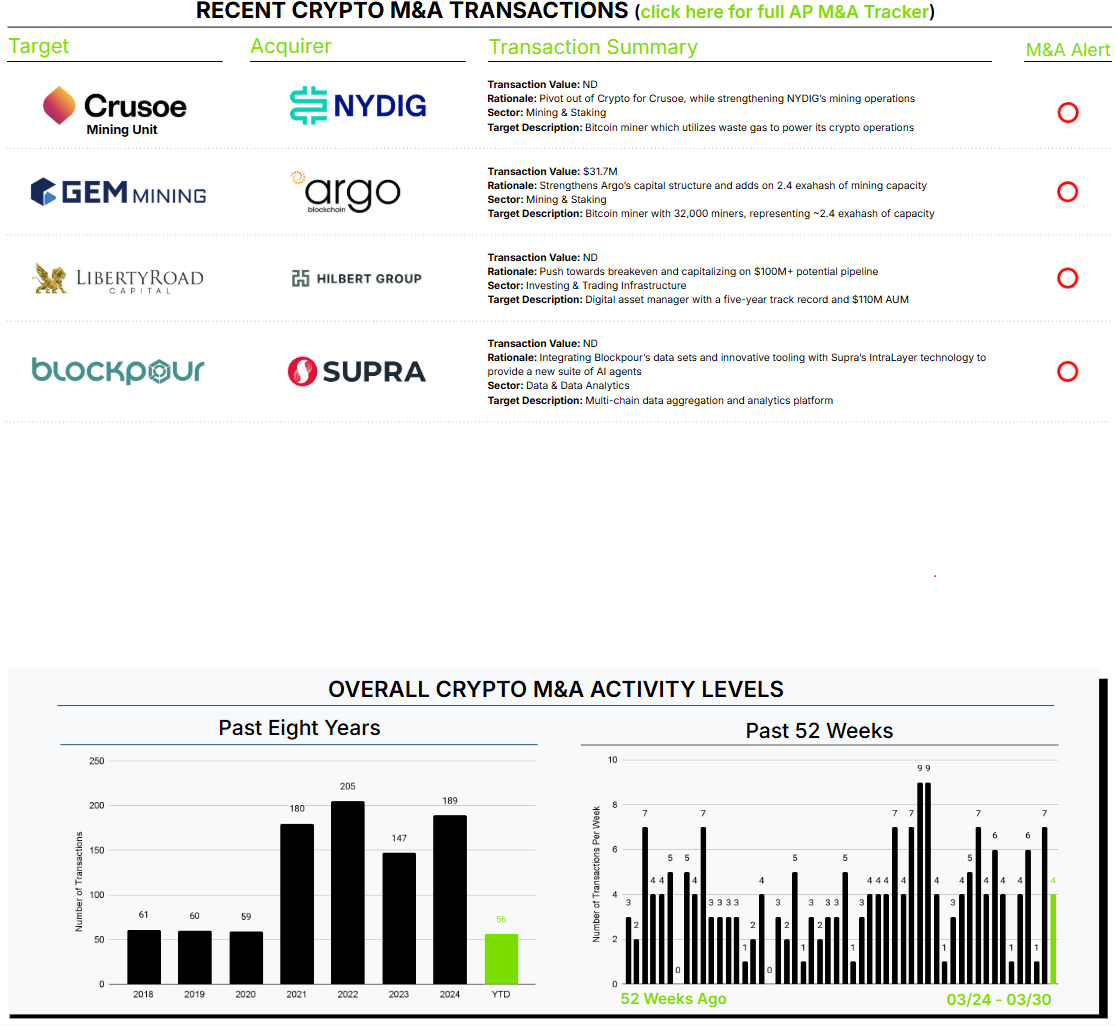

Given the inherent challenges of mining Bitcoin, some companies are simply choosing to abandon it and offer their capabilities to other, “higher-value” or perhaps more predictable use cases. Recently, that has meant pivoting to the latest phenomenon to capture interest: AI-related applications. We’ll set aside the many potential complexities of this shift in focus; nonetheless, many have chosen to switch allegiances. Most recently, this week’s cover story across many financial news outlets was the IPO of CoreWeave. Similarly, this week Crusoe elected to divest its Bitcoin mining business to NYDIG, in favor of AI.

Time will tell if this new, exciting focus was worthwhile in retrospect.