Yesterday, Coinbase released their highly anticipated Q4 earnings, and, as we all expected, they crushed it. For the full year, they hit $6.6B in revenue, up 112% from last year, and maintained a staggering 39% net income profit margin, generating $2.6B in net income for 2024, with half of that coming from Q4.

It wasn’t just financial metrics that they dominated in; their layer-two efforts with Base have also proved successful, with over $14B in assets on the platform and ~1M in daily active users as of February 2024, international expansion to Brazil, Canada, and Singapore, and a doubling of customer assets quarter over quarter.

But what happened as a result? Their stock fell 11% between yesterday’s closing and today’s. There are several key takeaways:

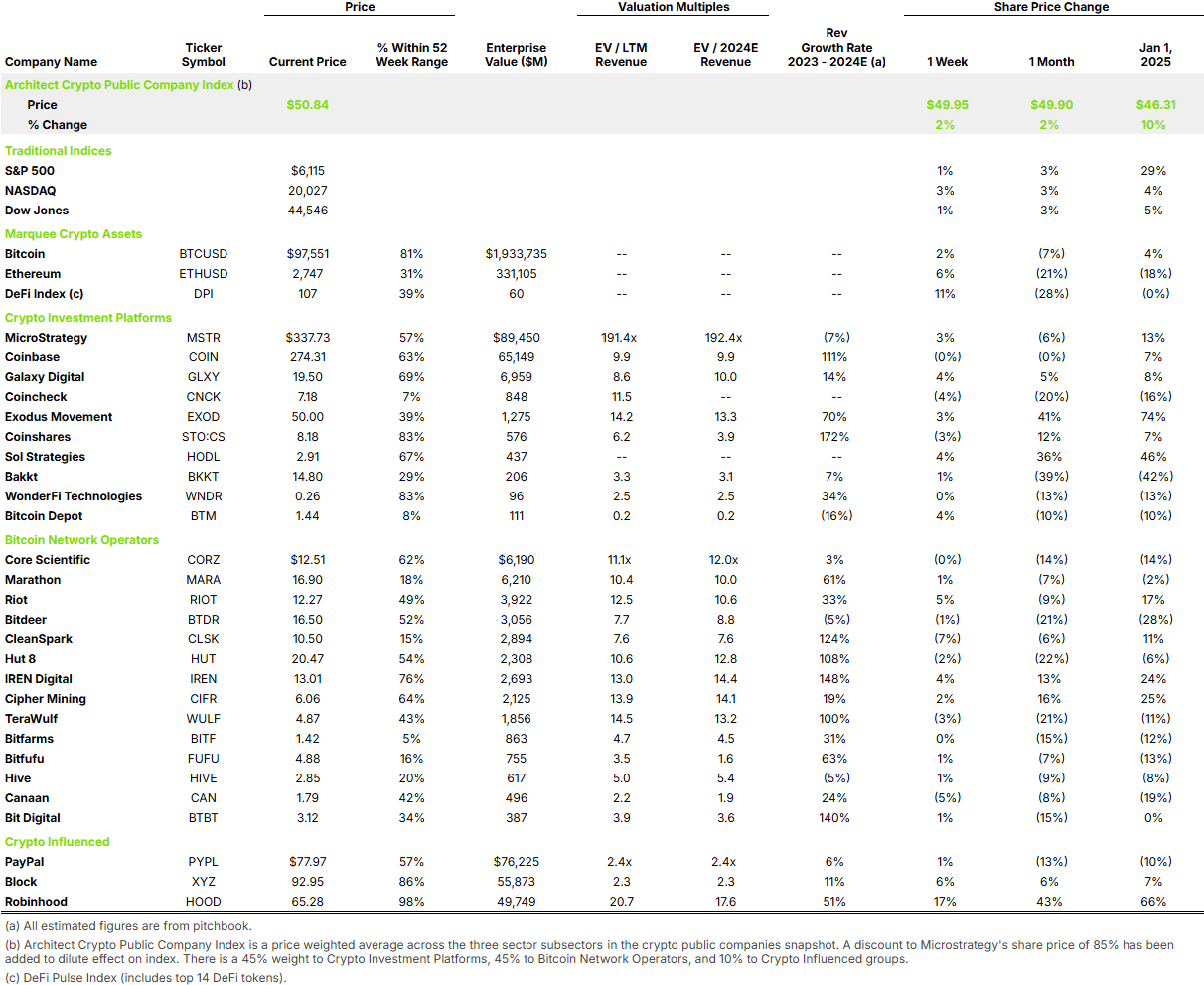

Exceptional is Expected: The market has priced in exceptional results in Q4 to the currently strong equity value of crypto public companies.

Financial Metrics are Not Enough: Even doubling of revenue has not satisfied the market. Companies must demonstrate they are doing more than increasing trading volume to generate higher fees.

Stock Price Increases Unlikely to Occur for Others: Many other crypto public companies likely expect big upticks in value after releasing Q4 results. Based on what we’re seeing from Coinbase, this is unlikely to play out.

We will continue to see what happens as others release earnings, but this is a very disappointing market outcome for Coinbase.