This week, the Trump administration impacted nearly every global market with its “Fair and Reciprocal Plan” Executive Order on tariffs. Global public capital markets reacted by selling off around 10% following the announcement.

While the implementation of this policy is fiercely debated, one of the stated objectives is to restore fair trade between the U.S. and its trading partners or, as I interpret it, move closer to free trade.

Much has been said—and will be said—about the reciprocal tariffs strategy, so let us see how this affects crypto.

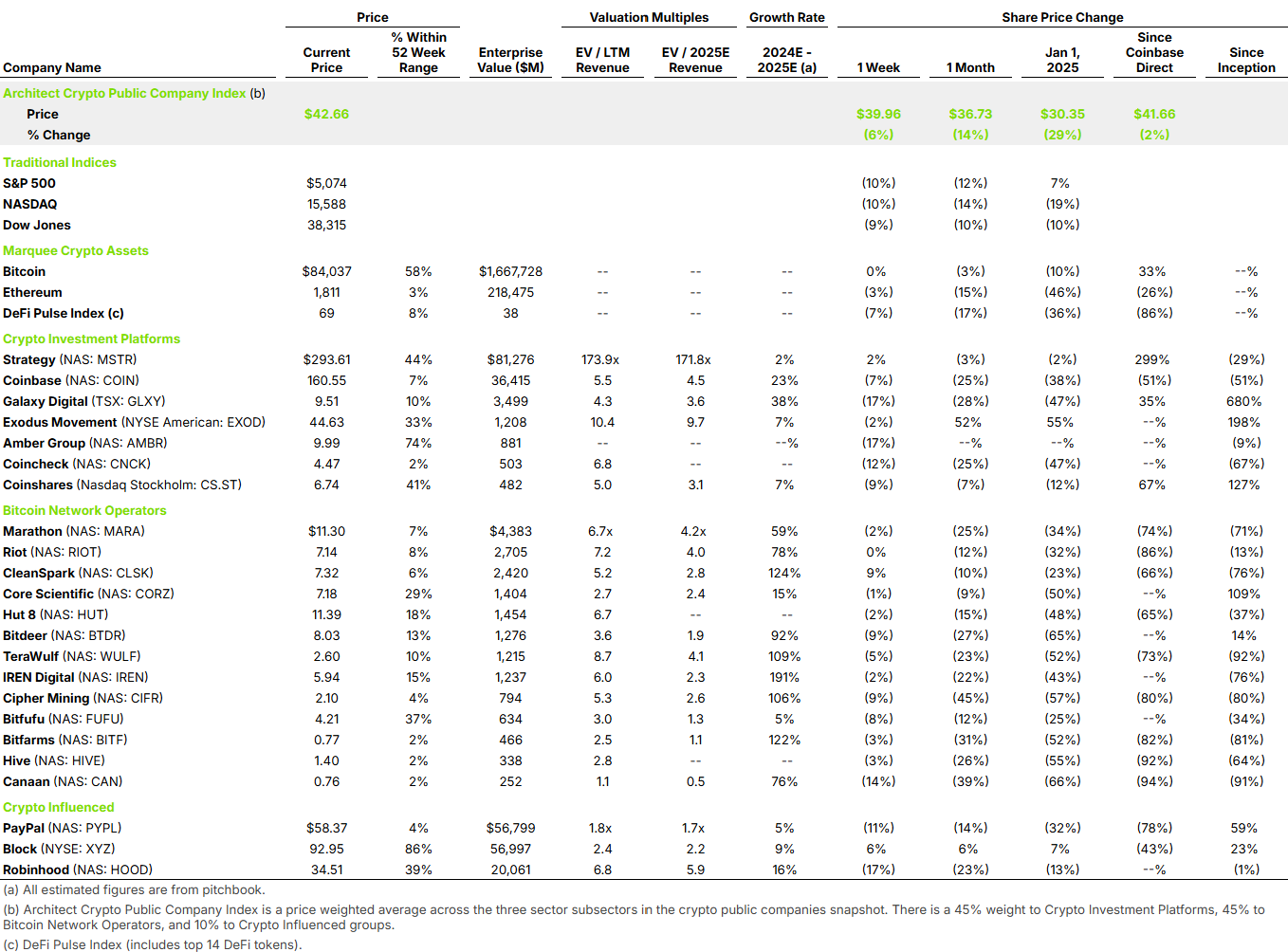

Our Crypto Public Company Index performed in line (-8%) despite BTC remaining essentially flat.

Tariffs will impact BTC miners, as most of the industry uses ASIC machines manufactured in China, and many miners rely on energy relationships between Canadian and the U.S.

The current impact of tariffs on capital markets is disrupting what had appeared to be a welcoming IPO environment, forcing Klarna and StubHub to pause their listing processes. Circle also seems close to making the same decision.

Beyond these two effects, what is the real impact on an industry built on digital distributed ledger technology?

The crypto industry’s core values are rooted in the principles inherent to Bitcoin. In relation to this global market event, the most relevant principles are decentralization, transparency, peer-to-peer exchange, and censorship resistance.

It’s also important to note that the crypto industry has largely been built on the thesis of Austrian economics—free markets, individual choice, and rejection of government intervention—as opposed to the currently dominant Keynesian economics, which holds that government intervention is essential to stabilize the economy.

The evolution of the crypto industry has always been rooted in free markets, where consumers choose which products they want to use and who they want to pay to use those products. Additionally, because the technology is globally accessible, consumer choices have not typically been based on where a product was made or manufactured. Consider Mt. Gox, which at one point accounted for an estimated 70% of BTC transactions. (Today, regulatory frameworks have become more prevalent—often for good reasons—but the industry’s founding principles were based on peer-to-peer exchange, i.e., no regulatory third parties.)

So, if our industry is based on globally accessible digital technology, rooted in free markets that reject government intervention and do not prioritize where a product is manufactured, will the Executive Order on tariffs meaningfully impact crypto?

If the answer is no—despite the immense current effect on global “traditional” markets—then is this an opportunity for the crypto industry to show the world an alternative vision for how the “global economic order” could operate? One where a true free market, with some necessary regulation, performs better than what currently exists?

We often say that the biggest opportunity in crypto today is the delta between the instant settlement of digital assets and the delayed settlement processes of the legacy system. This idea stems from the fact that today’s legacy system—“this is how it works just because”—exists largely due to government intervention. This week, the world is once again seeing the consequences of that intervention.

This week in his annual shareholder, Larry Fink wrote “If the U.S. doesn’t get its debt under control, if deficits keep ballooning, America risks losing the [world’s reserve currency] position to digital assets like Bitcoin.”

Could a “global economic order based on free markets with Bitcoin as the world’s reserve currency” exist in the future?

I am not saying the world will fully transition to crypto’s principles. I am saying there is an alternative path based on free markets and Bitcoin. And in 2025, each of us has access and the opportunity to choose which framework we believe and want to participate in.