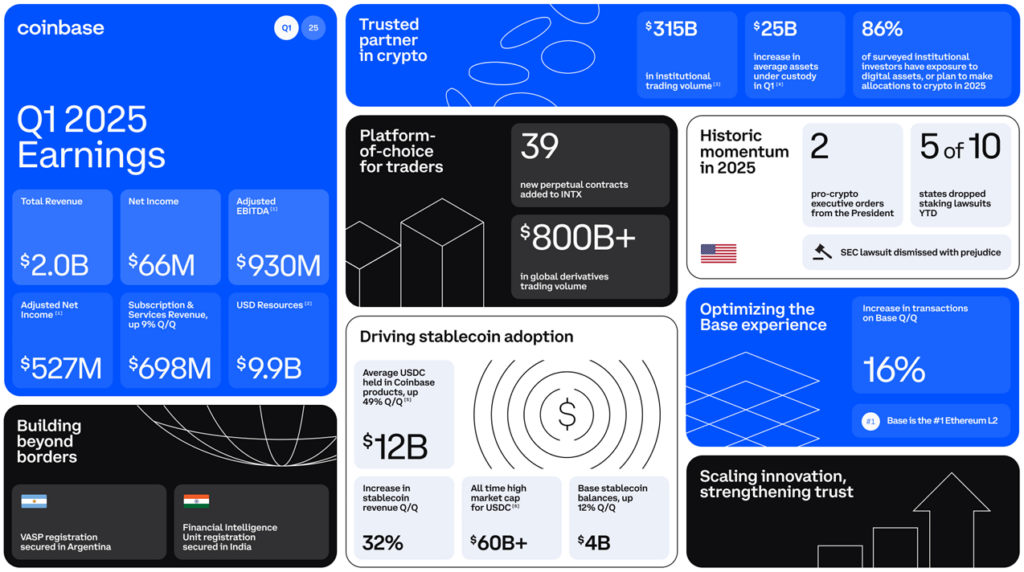

Despite blockchain technology’s inherently open and transparent design, the crypto industry has not always upheld these standards. As of May 2025, however, times have changed: groups like Coinbase now publish exceptionally detailed quarterly reports that clearly show what parts of the business are performing well, and which are not. This level of disclosure is exactly what the market needs, and other companies entering the public markets appear to be embracing the same ethos.

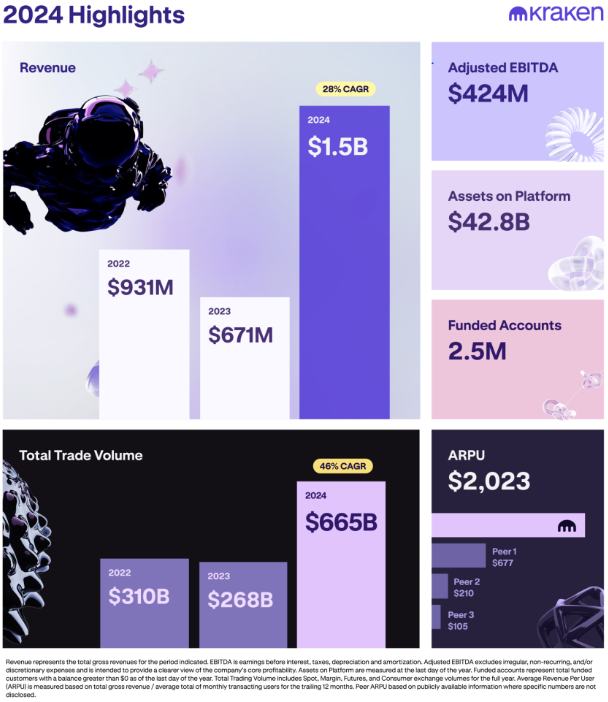

Kraken, for example, released detailed highlights of its 2024 financials to demonstrate transparency to prospective investors ahead of its planned listing.

Circle has also filed its draft S-1 publicly, providing exceptional detail, as one would expect from an S-1, including a thorough breakdown of risk factors, a clear description of Circle’s current business, and a review of its performance. This filing offers perhaps ten times more information than the “Super 8-K” disclosures common during the SPAC era, which contained far less detail yet still served as an S-1 equivalent for public-market investors.

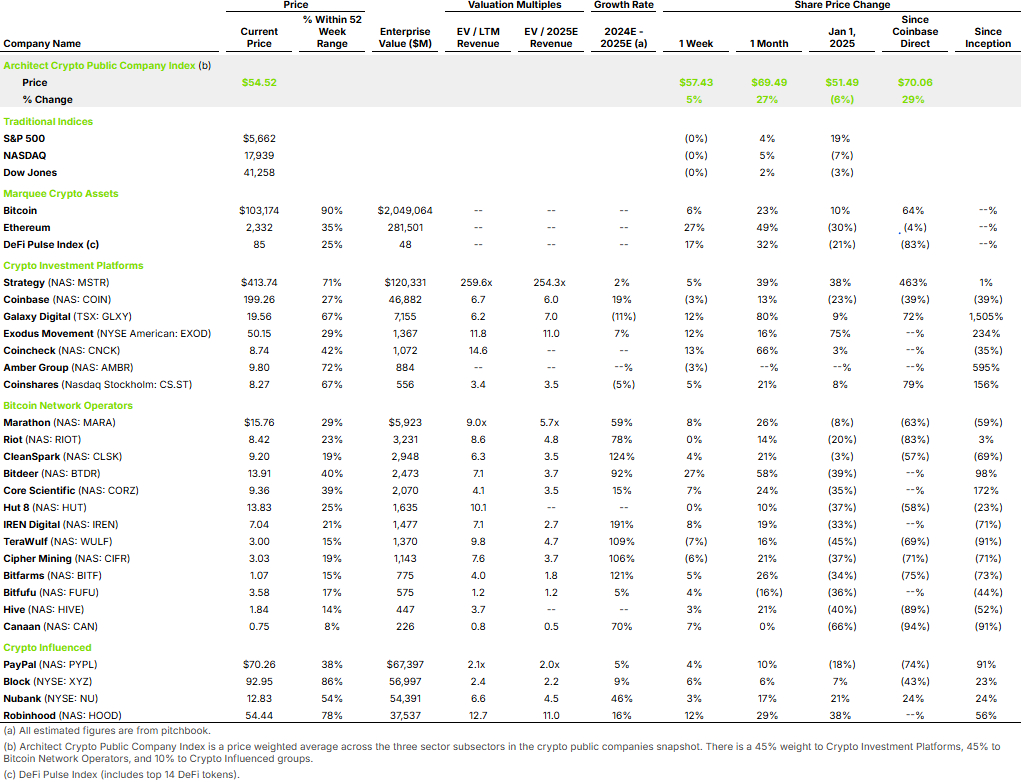

We expect an increasing number of companies in the sector to follow suit, entering the public markets via a traditional IPO, with clear, comprehensive disclosures and straightforward announcements.