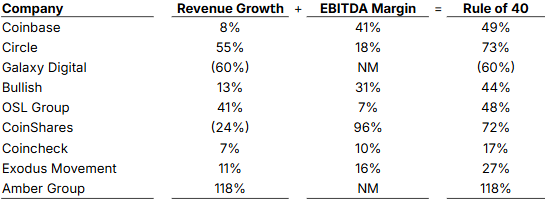

In 2015, the Rule of 40 emerged in venture capital as a quick diagnostic for software businesses where growth often suppresses near-term earnings. The test adds a company’s annual revenue growth and EBITDA margin; a score of 40% or more signals a healthy balance of expansion and profitability across cycles.

Applied to Architect Partners’ list of public crypto brokers and exchanges, the results point to a shift in operating model. These companies are relying less on bull-market trading spikes and more on cost controls and new revenue lines to drive profitability. Several large names exceed the 40% threshold, driven by either solid margins or still-strong top-line gains. Circle combines double-digit margins with rapid stablecoin adoption, Coinbase hovers near the cutoff even after growth slowed, and smaller platforms such as Bullish and OSL also clear the bar (albeit for different reasons).

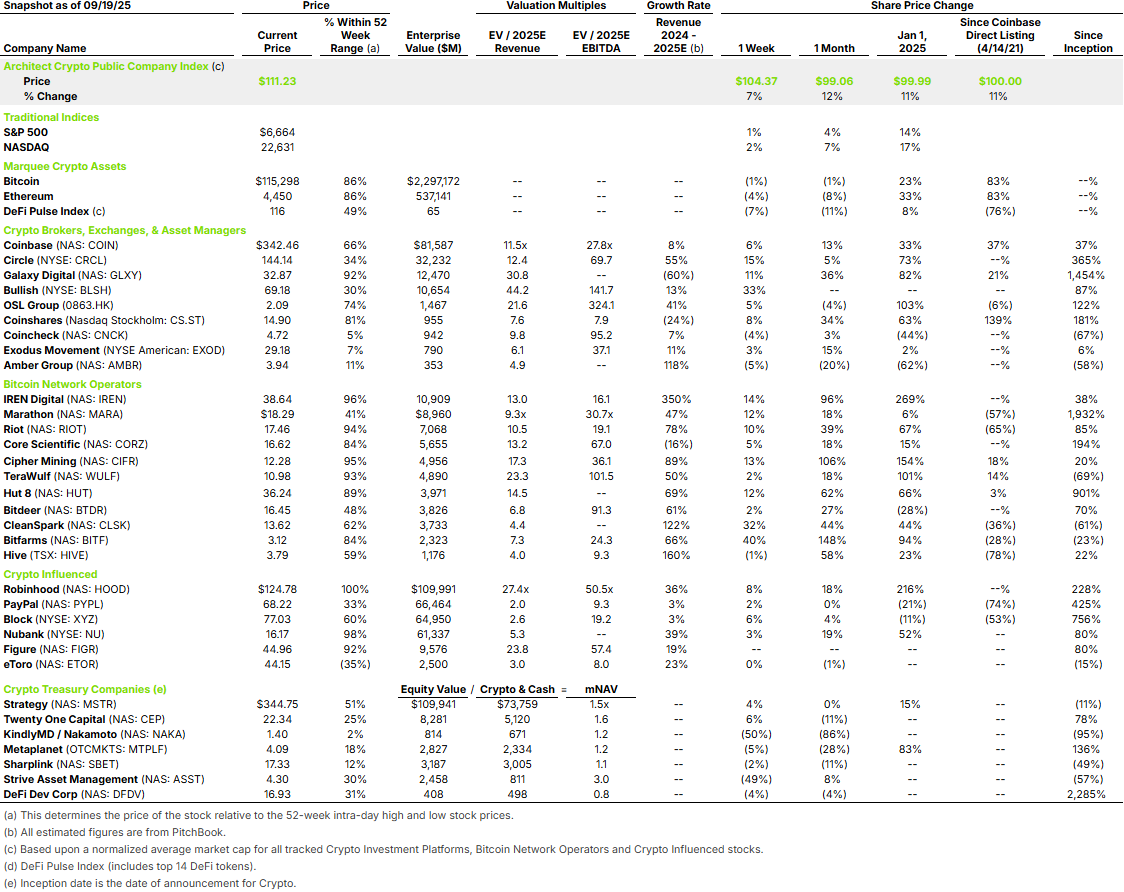

The transition to a profitability-driven industry is only half complete. Revenue growth has cooled to single or low double digits, yet enterprise values remain elevated relative to standard software norms in the mid-teens. The comp group trades at 69.7x forward EBITDA, with more mature platforms like Coinbase around 27.8x and smaller exchanges like OSL about 324.1x. This suggests either a temporary market inefficiency or that investors continue to price in optionality, new products, regulatory breakthroughs, and the next market rally more than today’s cash generation.