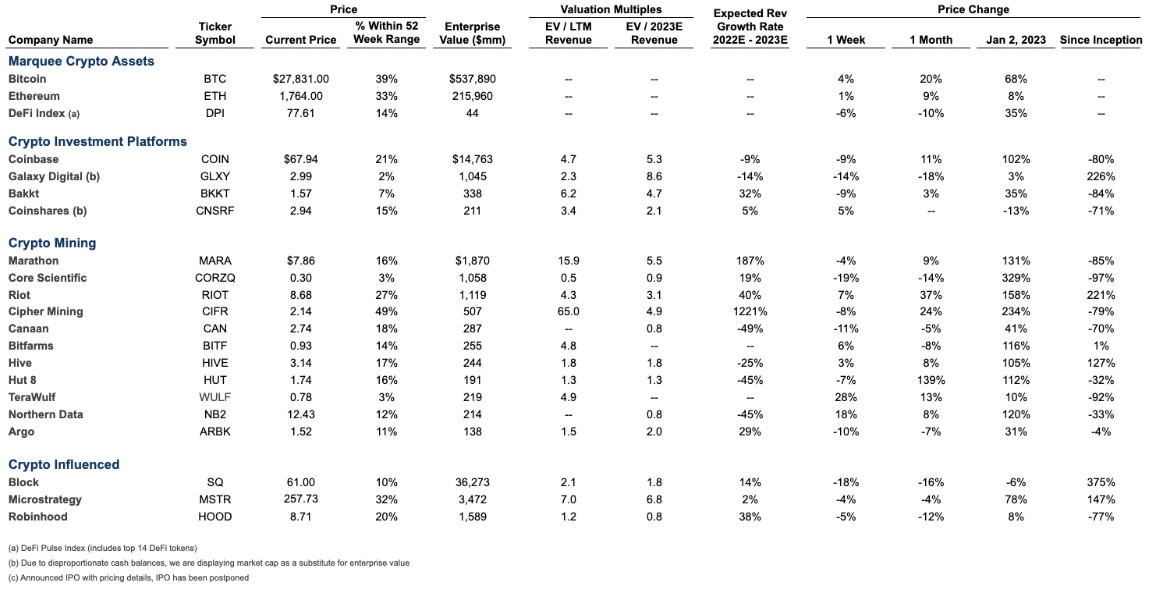

Historically the correlation between Bitcoin price and Bitcoin mining equity prices has been very strong. With Bitcoin up 4% and Bitcoin Miner stock prices down by a median of -4%, that correlation broke down.

Another week, another life lesson.

We always start with Bitcoin. Why? Currently, every public company in the sector is heavily influenced by Bitcoin’s price and trading volume. Bitcoin’s price is now facing the ebb and flow being driven by two major themes, emerging economic stress and regulation.

As highlighted last week, economic stress is showing itself via the banking crisis re dux, reminding us of the motivation driving the creation of Bitcoin, the grandfather of all crypto assets. This theme treats Bitcoin as a safe haven, driving demand and upward price momentum. However, offsetting the recent upward price movement has been active efforts by regulators, particularly in the United States, to enforce their view of the law of the land. This week, most notably, the SEC issued notice to Coinbase of an imminent enforcement action. The net result for the week was a seesaw of Bitcoin price, ending 4% higher overall.

With regard to digital asset public equities, a down week overall by a median of -6%.

Getting to this week’s lesson. Historically the correlation between Bitcoin price and Bitcoin mining equity prices has been very strong. With Bitcoin up 4% and Bitcoin Miner stock prices down by a median of -4%, that correlation broke down. Why and is this persistent? We’ll ask ChatGPT…