It’s time to change. Bitcoin Miners should be referred to as Bitcoin Network Operators.

Today the Bitcoin network is comprised of 16,866 reachable nodes, has been in existence for fourteen years, has validated and stored over 839 billion transactions, and has achieved an overall uptime of 99.9882659% since inception and a perfect 100% since 2013. Impressive indeed.

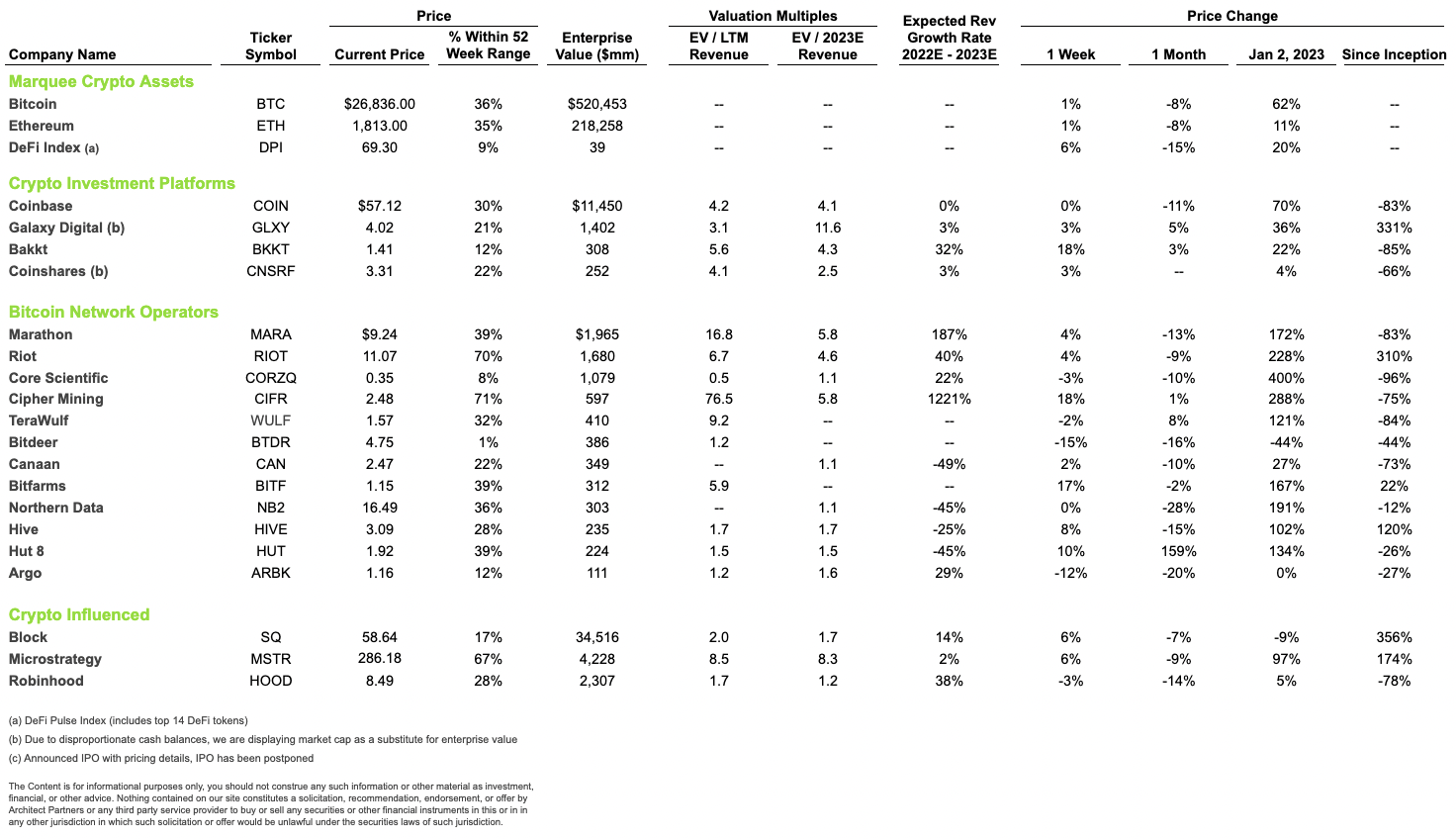

The issuance of Bitcoin, built into the protocol code as an economic reward, has created the necessary economic incentive for node operators to build today’s network. Architect Partners estimates that roughly $31 billion has been invested just in the necessary data centers and specialized computers. Additionally, the electricity expenditure today totals roughly $6 billion per year.

This is an extraordinary phenomenon where an incentive, created by an idea, and a collective buy-in to that idea, has translated into a physical manifestation costing $10s of billions. However, this Bitcoin incentive (commonly analogized as a mining reward) is declining and will eventually stop.

Transaction fees are also explicitly featured in the Bitcoin Whitepaper. “Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and (Bitcoin can) be completely inflation free”.

Historically, transaction fees have been a very small proportion of the total compensation received by operators of nodes. This has begun to change, particularly during periods of high demand for transaction validation. In fact, last week, transaction fees represented 36% of total rewards (in Q1 2023, the average was 7.9%) to node operators.

Our thesis is that transaction fees will become the dominant component of node operator compensation as the Bitcoin network matures. Why continue to call those that run this network “miners” when mining rewards are gradually declining and will eventually be eliminated?