October 13 – October 19 (Published October 25th)

PERSPECTIVES by Steve Payne

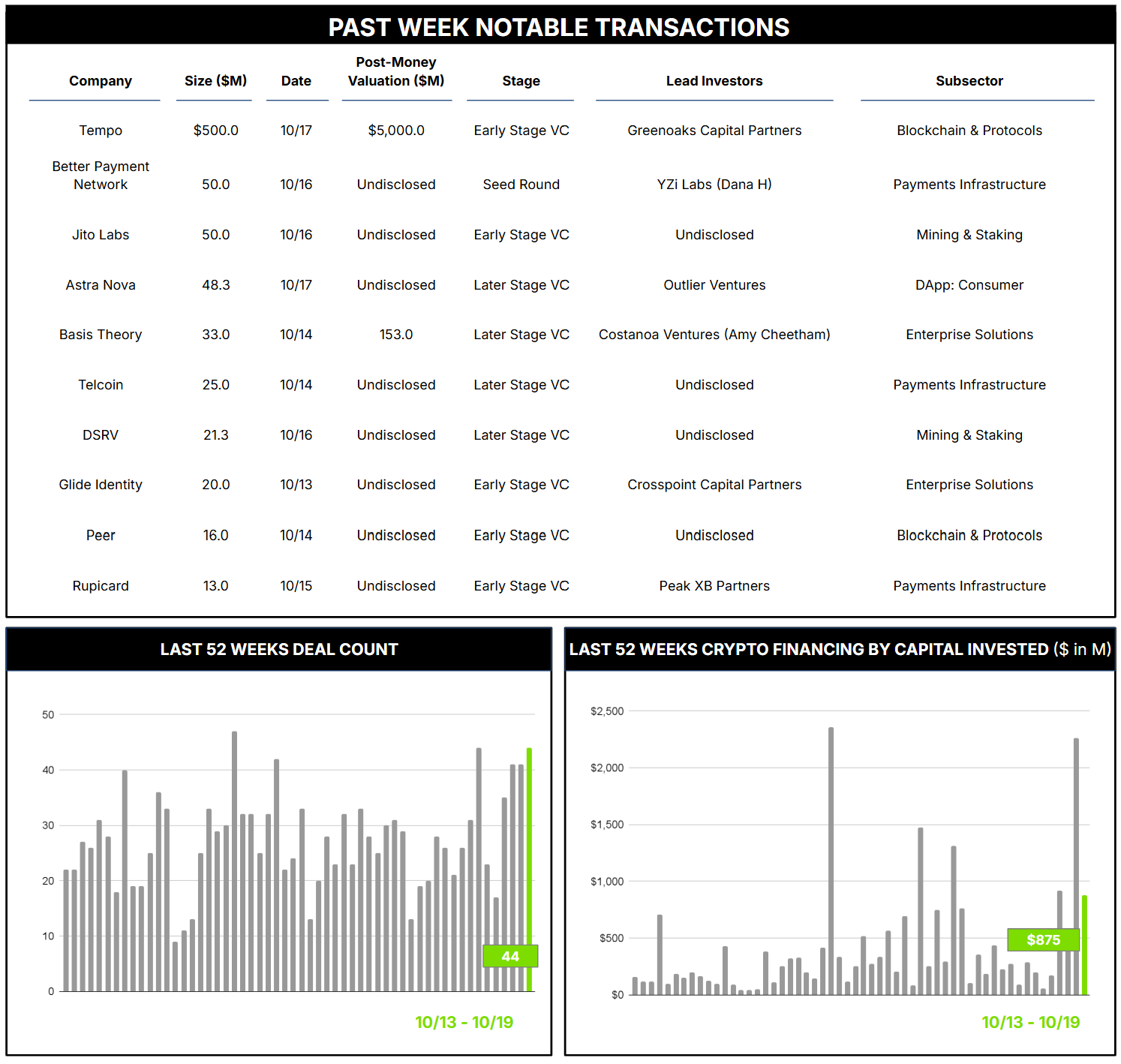

44 Crypto Private Financings Raised: $875.1M

Rolling 3-Month-Average: $473.5M

Rolling 52-Week Average: $397.7M

Another big week for crypto financings, with strong participation from “trad” investors, signaling maturation and a welcome shift beyond speculative use cases.

Two transactions are worth noting in particular this week:

First, Tempo raised $500M in a Series A at a $5B valuation to build next-gen payment infrastructure. Tempo’s website defines its objective well: “Why create a new blockchain? Stablecoins enable instant, borderless, programmable transactions, but current blockchain infrastructure isn’t designed for them: existing systems are either fully general or trading-focused. Tempo is a blockchain designed and built for real-world payments.” It also highlights a unique aspect: its backers — “Tempo was started by Stripe and Paradigm, with design input from Anthropic, Coupang, Deutsche Bank, DoorDash, Lead Bank, Mercury, Nubank, OpenAI, Revolut, Shopify, Standard Chartered, Visa, and more.” The round was led by Thrive Capital and Greenoaks, with participation from Sequoia Capital, Ribbit Capital, and Ron Conway’s SV Angel. Architect has discussed the massive opportunity for blockchain in payments in recent reports (Part I, Part II, Part III). Stablecoins are the rails here, and a half-billion-dollar raise for a new consortium-driven Layer-1 indicates the magnitude of what’s at stake.

Speaking of stake, the second notable financing was Jito Labs’ $50M raise led by Andreessen Horowitz (a16z crypto) for Jito’s native tokens. Jito is a Solana-based staking protocol that enables users to stake SOL and receive JitoSOL, a liquid staking token that earns both staking yield and additional MEV rewards. MEV (maximum extractable value) is a premium earned by validators for reordering or bundling transactions; in effect, it is a share of the value obtained by network users for putting certain transactions ahead of others (think of it as a toll for driving in the fast lane). This investment underscores continued support for Solana from top crypto investors and highlights a way to maximize yield from providing infrastructure services.