Download the full report above.

Crypto Mergers & Acquisitions

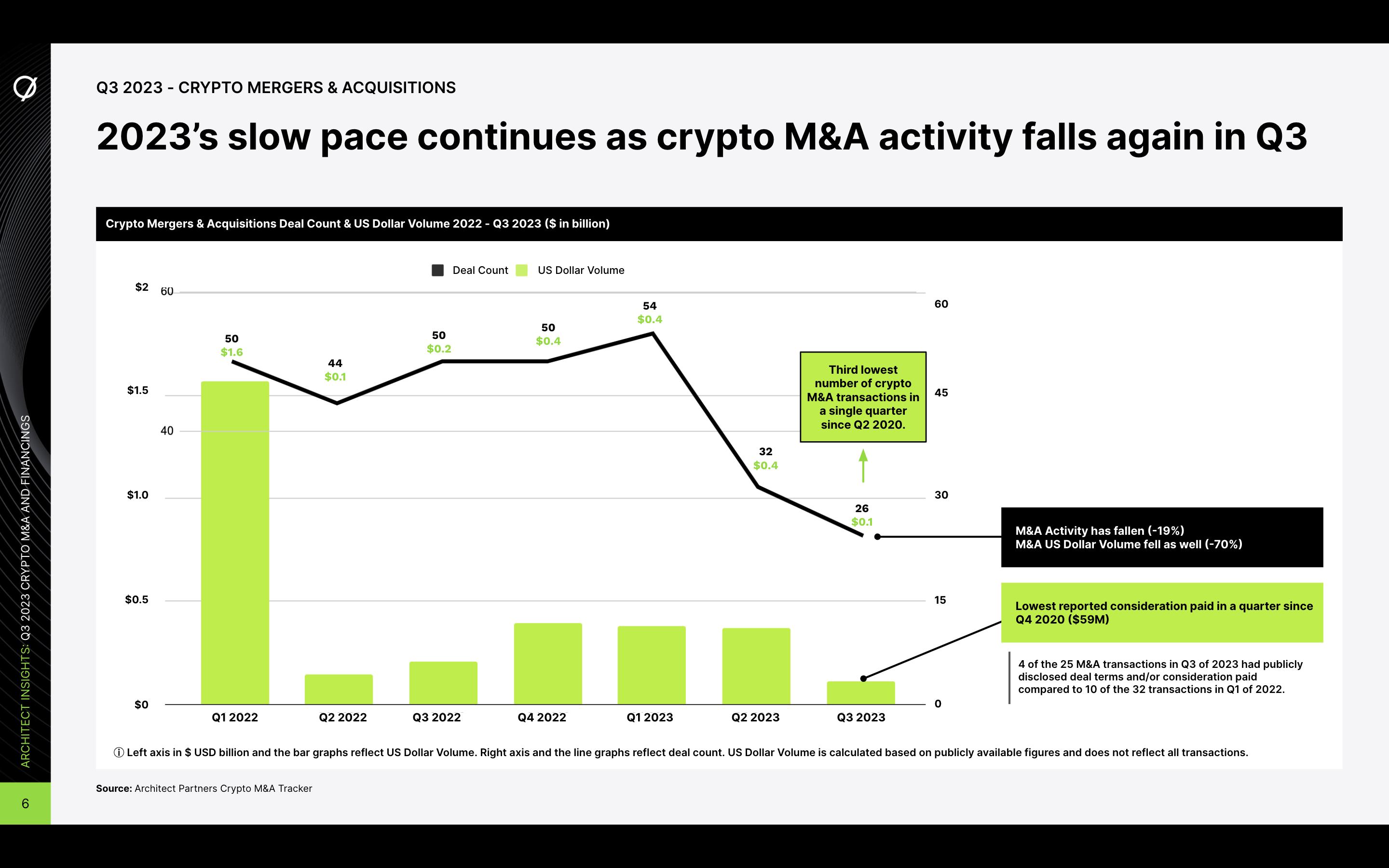

Crypto dealmakers must have taken the summer off as M&A deals declined again

M&A deals involving crypto companies were down 48% from 50 deals in Q3 ‘22 to 26 in Q3 ‘23, with only 112 total so far for the year.

Announced deal value was also down to $110M, although only 4 deals disclosed their value, meaning they were quite small.

The value would have been much higher, except for the cancellations of two custody deals: Bitgo/Prime Trust and Ripple/Fortress.

Q4 will have to be huge to equal the record pace of 2022 (204 deals).

To see an increase in crypto M&A activity we need to see increased real-world adoption, more regulatory certainty (particularly in the USA), greater institutional investment leading to higher prices/greater M&A currency, and new digital asset developments.