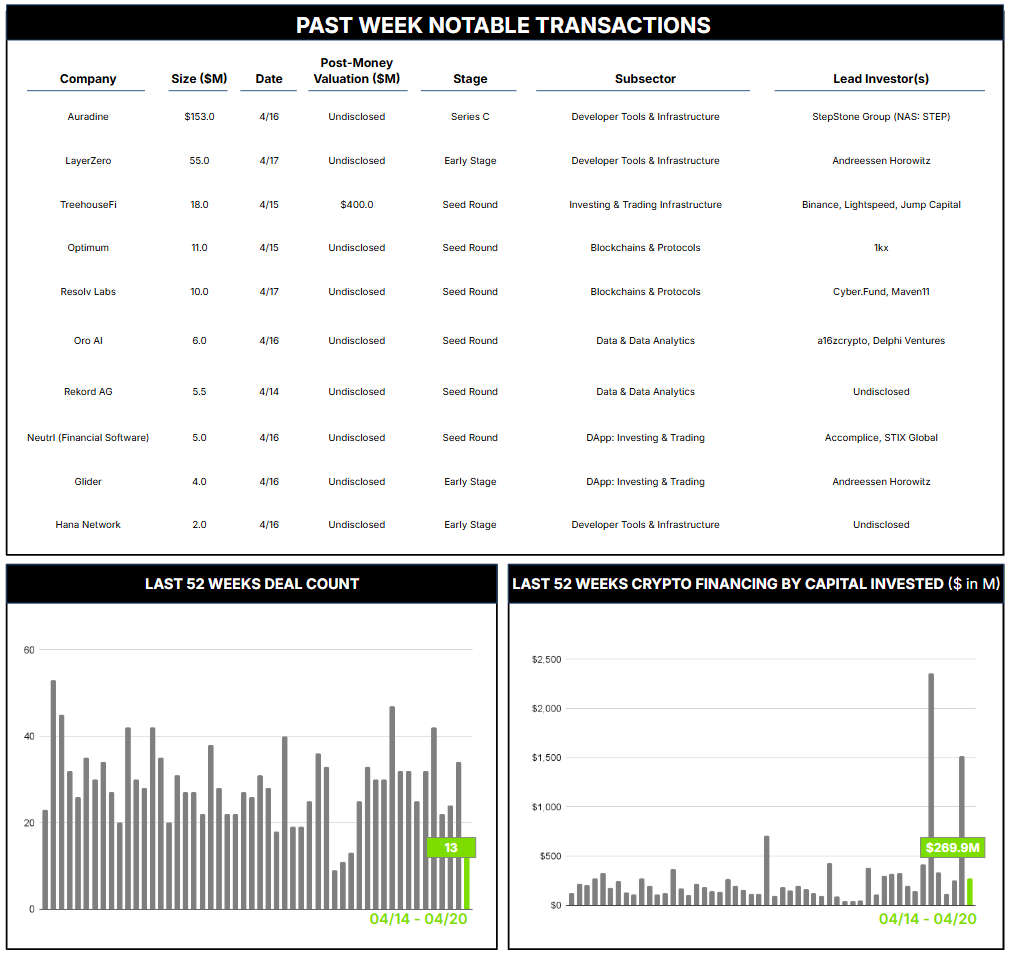

April 14 – April 20 (Published April 23rd)

PERSPECTIVES by Todd White

13 Crypto Private Financings Raised: $269.9M

Rolling 3-Month-Average: $545.2M

Rolling 52-Week Average: $270.6M

Bitcoin network operators (miners) have faced a number of headwinds of late. After receiving a major boost in 2021 when China banned all miners from the country, precipitating an estimated 42% drop in global hash rate capacity amid rapidly growing demand, the industry has faced several challenges. Once upon a time, mining rig operators offered an attractive way for investors to gain exposure to the asset without needing to hold BTC directly. But the advent of BTC accumulation companies, such as MicroStrategy, offered investors public alternatives without the energy and capex constraints of mining operations. And the subsequent approval and launch of multiple spot BTC ETFs offered an even simpler alternative. Then the rapid emergence of AI and high-performance computing into the investor spotlight drew capital attention even further.

Against this backdrop, the impact of the Trump administration’s tariff policies may feel particularly harsh. The vast majority of mining rigs are manufactured overseas, while a reported 40% of global hash rate is run from the U.S. The tariff policy, therefore, threatens to increase equipment costs dramatically and incentivize new facility construction overseas. This seems a strong deterrent to the President’s 2024 campaign goal of capturing the remaining BTC to be mined from the U.S., even if it does eventually lead to increased domestic rig manufacturing.

The fact is that Chinese firms dominate production of ASIC Bitcoin mining rigs, with Bitmain alone controlling 75% or more of the global market. In the wake of major supply chain disruptions, Bitmain and other leaders such as MicroBT and Canaan have moved some production capacity into the U.S., though this reportedly only covers about 15% of global monthly demand. The added turmoil and uncertainty were certainly not needed by an already beleaguered industry.

At least one company is well positioned to benefit from this dynamic. Auradine, a California-based producer of ASIC machines, launched its most recent model in March with a reported energy consumption of 14.5 joules per terahash (J/TH). This approaches the claimed 12 J/TH of Bitmain’s most efficient machine and presents a credible option for domestic miners without the burden of (uncertain) tariffs. Auradine has also launched a new AI infrastructure division, dubbed AuraLinks AI, positioning them to tap into investor zeitgeist. Investors have responded, with support for the company’s $153M Series C round announced last week. The round was reportedly oversubscribed and upsized from an original $125M target, and placed with a mix of $138M in equity with the balance in venture debt.

But the good news for Auradine may not translate too far afield. The demand for new and upgraded mining equipment is consistent, and Auradine’s capacity today only meets about 1% of global demand. Their trade war advantage may help, but it is not absolute—much of their supply chain will remain impacted, and it is uncertain how much of their production versus engineering is actually conducted domestically. Even with substantial capital to ramp production, Auradine alone cannot meet the demand, and the domestic mining sector is certain to feel the trade war squeeze.

Contact ryan@architectpartners.com to schedule a meeting.