April 21 – April 27 (Published April 30th)

PERSPECTIVES by Todd White

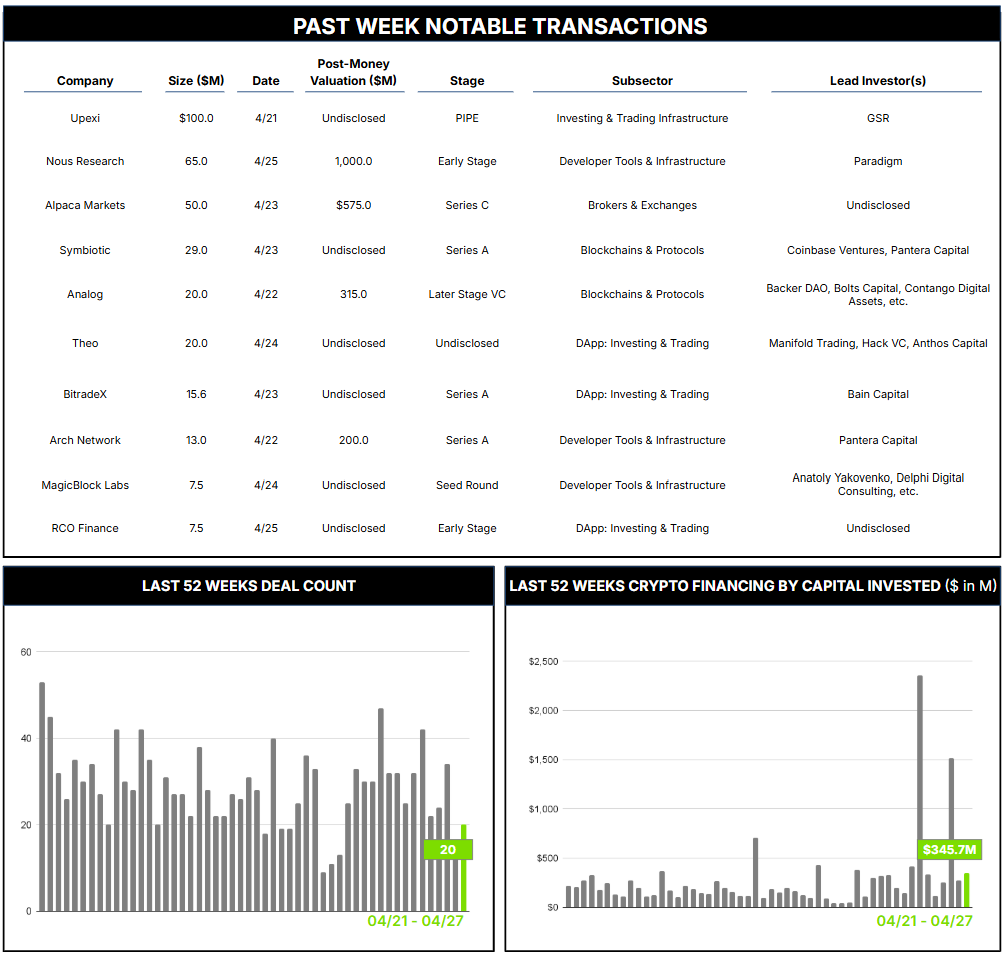

20 Crypto Private Financings Raised: $345.7M

Rolling 3-Month-Average: $549.0M

Rolling 52-Week Average: $274.8M

The convergence of artificial intelligence (AI), blockchain, and crypto (highlighted in our most recent sector report here) has the potential to transform the digital landscape. Blockchain can offer several potential benefits to the AI sector. An immutable ledger can ensure the authenticity and traceability of data used for AI training, reducing the risk of data tampering and bias, thereby building trust in AI outputs and model decisions. Storing AI model parameters, training data, and decision logs on the blockchain allows for transparent audit trails, making AI systems more accountable and explainable—addressing the so-called “black box” problem. Decentralized access using blockchain’s permissionless architecture can enable AI models to access diverse, high-quality datasets from multiple sources without centralized control, and facilitate federated learning and collaborative AI development. At the same time, blockchain enables secure, rule-based data sharing among stakeholders, ensuring compliance with privacy regulations and protection of sensitive information.

But challenges also exist, often as the inverse of potential benefits. For example, blockchain’s transparency can expose sensitive information if not managed properly, so balancing AI’s need for data with blockchain’s privacy and anonymity principles can prove tricky. AI and blockchains are also resource-intensive, demanding significant computational power and sufficient throughput capacity from consensus mechanisms. Their combination may create bottlenecks that inhibit the ability to scale and/or undermine performance. Both sectors are also highly innovative and currently fragmented without accepted standards, which may lead to interoperability issues and further market fragmentation. And while immutable blockchains can help verify data provenance, the quality and authenticity of data added to a blockchain are essential and hard to ensure, even within a decentralized environment.

Fortunately, these challenges are solvable, and there are numerous groups focused on doing so at the intersection of AI and blockchain. Established companies like IBM, Microsoft, Coinbase, Chainlink, and CertiK are driving adoption across supply chain, finance, healthcare, and cybersecurity. Numerous smaller innovators are paving the way for new business models and operational efficiencies with enhanced transparency, automation, and security. One such group, Nous Research, is using the Solana blockchain to pioneer a decentralized approach to AI development. Nous is an applied research group specializing in artificial intelligence and machine learning, but unlike traditional AI companies that rely on centralized data centers, Nous leverages the Solana network to coordinate and incentivize global participation in AI model training. This allows individuals worldwide to contribute idle computing power, earning rewards for doing so through a token-based system—contributors to the network (data, compute, expertise) are rewarded with NOUS tokens, which also serve as governance tools within the ecosystem. The goal is to align incentives and foster community-driven development.

This decentralized approach, distributing the training and operation of AI models across a global network of independent nodes, is distinct from typical organizations (like OpenAI, Google, and Microsoft) that own and control centralized data centers. Under Nous’s approach, anyone with suitable hardware can contribute computing power, coordinated and incentivized via blockchain, rather than relying on a single corporate-owned data center. Theoretically, a decentralized LLM can mitigate potential human bias and editorial distortion that can result from centralized selection of datasets used for training, and open the LLM to myriad data sources. While some risk of bias will remain even with distributed participation, decentralized governance at least takes this element of control away from the project developers.

Nous secured a $50 million Series A last week led by Paradigm, at a $1 billion token valuation, with an additional $15 million disclosed from Together AI, Distributed Global, North Island Ventures, Delphi Digital, and Solana co-founder Raj Gokal in a prior unannounced round. The capital will primarily be used to scale compute resources, expand the team, and accelerate research and development, including the training of large language models (such as the ongoing decentralized pre-training of a 15-billion-parameter LLM) and a broader suite of inference and orchestration products. The combined investment represents a solid bet on the intersection of blockchain and AI, and may signal institutional interest in decentralized AI as a viable alternative to centralized giants like OpenAI and DeepSeek. By issuing tokens that are central to both network participation and governance, Nous is testing the viability of token-based incentive models for open-source AI development.

Architect Partners will be at Consensus Toronto; if desired, please contact ryan@architectpartners.com to schedule a meeting.