April 28th – May 4th

PERSPECTIVES by Eric F. Risley

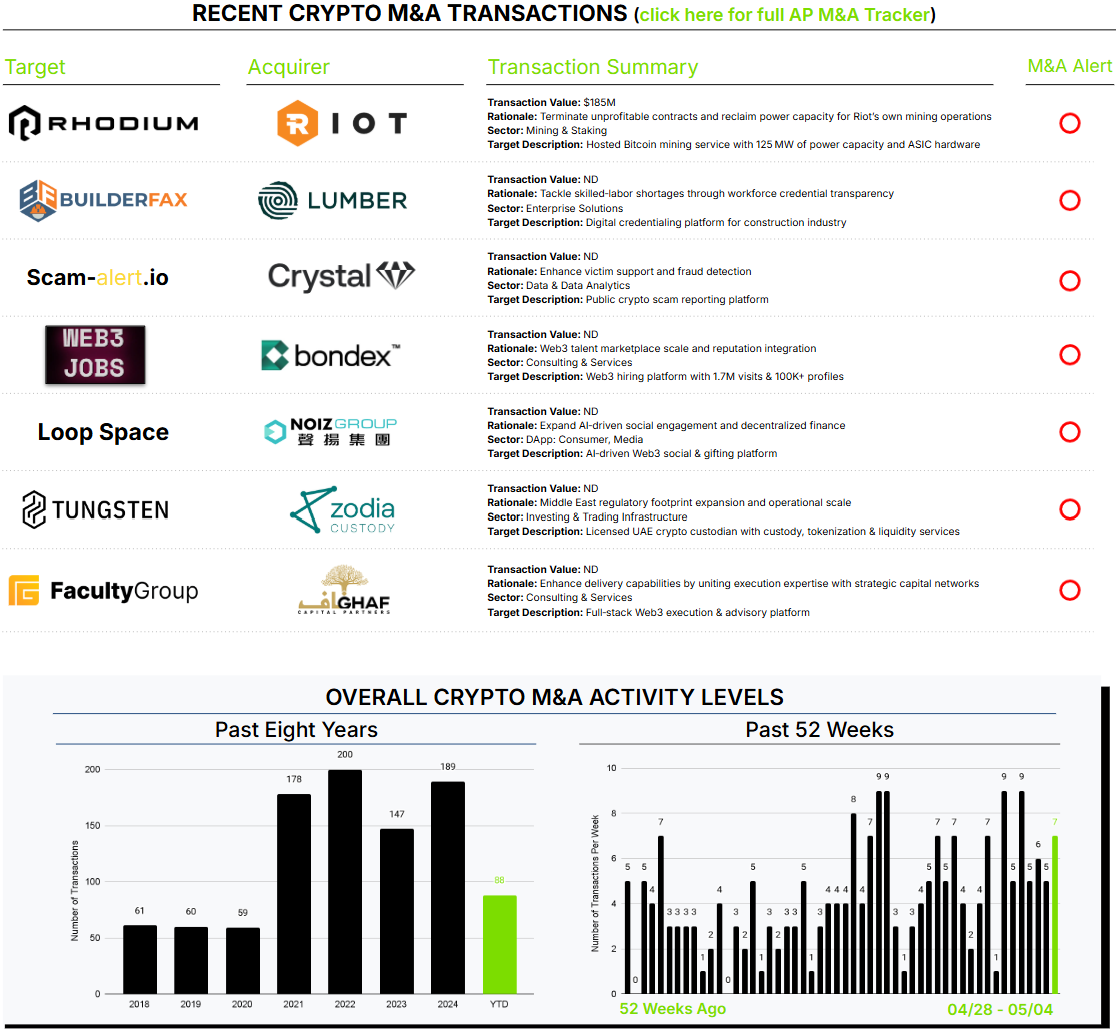

Despite potentially worrisome economic trends, crypto M&A remains strong, echoing the record‑setting pace that started in Q4 2024.

The week’s largest disclosed transaction shows how M&A can solve problems: Riot Platforms acquired all the tangible assets of Rhodium Encore to resolve an unprofitable hosting contract that Riot had inherited when it bought Whinstone from Northern Data in May 2021. The US $185 million transaction (a mix of cash, equity, and the return of a power‑security deposit) includes 125 MW of hosting capacity, hosting operations, and ASIC mining infrastructure controlled by Rhodium.

Also notable, Zodia Custody expanded its regulated‑custody footprint through the acquisition of Tungsten Custody Solutions, a UAE‑based provider regulated by ADGM and VARA. Zodia illustrates traditional financial institutions’ recognition of the importance of emerging crypto and digital‑asset markets. Founded to offer global “bank‑grade” custody, Zodia is backed by Standard Chartered, SBI, Northern Trust, Emirates, National Australia Bank, and Investcorp. The Tungsten deal further extends its global licensing and therefore its market coverage.

Security breaches and fraud remain an unacceptably large issue for the industry. We continue to see significant innovation and M&A activity to address these challenges. This week, Crystal announced the acquisition of Scam‑alert.io. Scam‑alert is a crowd‑sourced alert system: victims can report scams anonymously, and Scam‑alert organizes the data alongside similar reports. With Crystal’s analytics, links between separate incidents and broader fraudulent schemes can be identified. This proactive approach not only enables law‑enforcement agencies to react more quickly but also provides important warnings to users and virtual asset service providers (VASPs), potentially facilitating fund recovery.

Architect Partners will be at Consensus Toronto and Stablecon in NYC. Please contact ryan@architectpartners.com to schedule a meeting.