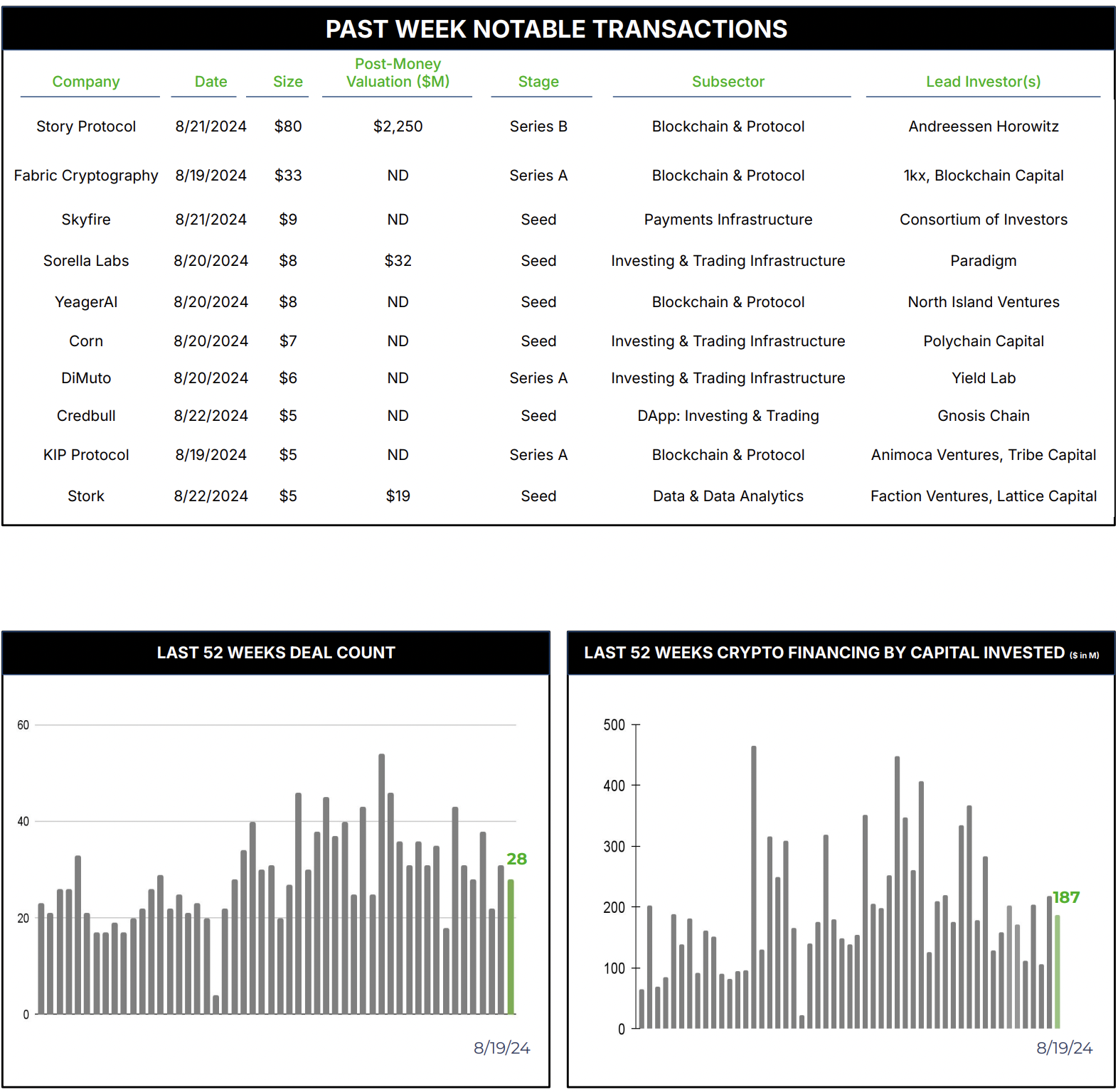

28 Crypto Private Financings Raised ~$187M

Rolling 3-Month-Average: $193M

Rolling 52-Week Average: $193M

The summer funding slow down continues. While a decent 28 companies were funded for a total of $187M, $113M was from two companies, Story Protocol and Fabric Cryptology. This means $74M funded 26 companies, or an average of $2.8M per company.

———————————————————————————

Story Protocol represents a significant advancement in protecting intellectual property (IP) in the digital age, particularly in the face of challenges posed by artificial intelligence and widespread content sharing. By leveraging blockchain technology, Story Protocol creates a decentralized and transparent system for registering, tracking, and managing IP rights.

One of the key strengths of Story Protocol is its ability to transform static IP into “programmable IP” through the use of smart contracts and blockchain-based data structures. This allows creators to set clear, enforceable rules for how their work can be used, remixed, or monetized. By making these rights machine-readable and automatically enforceable, Story Protocol reduces the need for complex legal negotiations and intermediaries, streamlining the process of licensing and collaboration.

The protocol’s approach to creating a “Universal Programmable IP Ledger” addresses the current fragmentation and opacity in IP rights management. By aggregating IP information in a standardized, easily accessible format, Story Protocol increases the legibility of rights and ownership. This transparency not only helps protect creators’ rights but also facilitates easier discovery and legitimate use of IP by potential licensees.

Furthermore, Story Protocol’s blockchain-based system provides a robust mechanism for attribution and fair compensation. In an era where AI models are trained on vast amounts of data, often without proper attribution or compensation to original creators, Story Protocol offers a solution to ensure that creators are recognized and rewarded for their contributions. By enabling automated royalty payments and creating new revenue streams for creators, the protocol incentivizes continued creative output while protecting against unauthorized use, potentially addressing the long-term sustainability concerns in content creation and AI development.

Story Protocol raised an $80M Series B led by Andreessen Horowitz (A16Z), and included Polychain Capital, and Brevan Howard. This funding round brought Story Protocol’s total raised capital to $140 million, with the company now valued at $2.25 billion according to anonymous sources cited by CNBC. It’s worth noting that a16z Crypto has led three rounds of investment in Story Protocol, including this Series B round, which is described as a rare “tripling down” by the venture capital firm.