December 30 – January 5 (Published January 8th)

PERSPECTIVES by Todd White

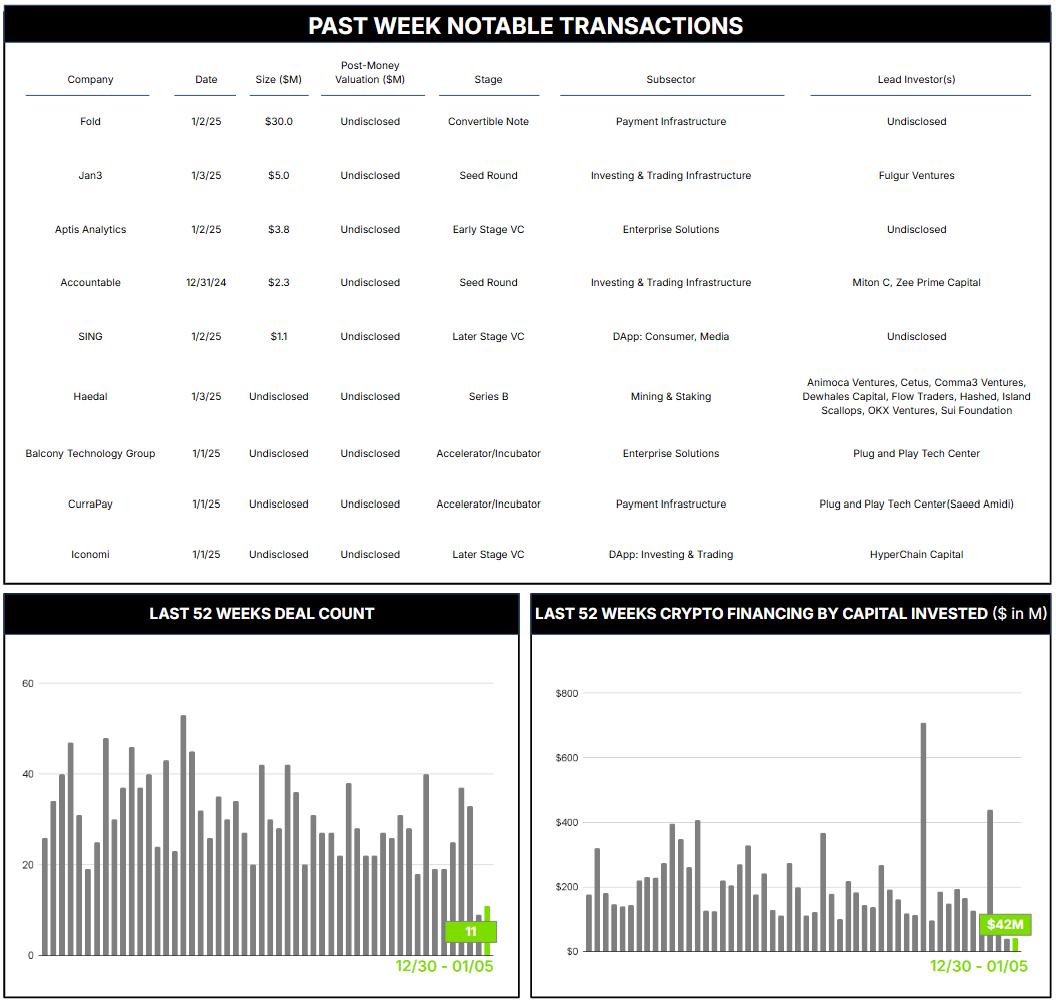

11 Crypto Private Financings Raised: $42.2M

Rolling 3-Month-Average: $194M

Rolling 52-Week Average: $204M

The convergence of crypto and digital assets into traditional finance has been gaining momentum for some time. Initially conceived as an alternative to traditional finance, the evolving story of digital assets now seems more likely to be one of integration rather than disruption or displacement. We’ve seen this play out in multiple areas, from brokerages such as Robinhood and Interactive Brokers offering crypto trading, to the growing momentum of BTC and ETH ETFs, the increasing tokenization of other real-world assets, and the potential integration of stablecoins into payment and remittance systems. As crypto gains acceptance as a legitimate asset class, we’ve even heard calls for allocations to bitcoin and crypto within sovereign reserves and individual investment portfolios.

Yet from a capital markets perspective, the paths to raising capital have remained somewhat distinct, with companies and entrepreneurs using either traditional instruments or token offerings to raise funds. Investor support for efforts to combine the two worlds through security token offerings has underwhelmed.

Fold, Inc., a bitcoin-focused financial services company, may be breaking that trend. Founded in 2019 as a place to exchange unwanted gift cards for bitcoin, Fold has now evolved to offer broader financial services, including a bitcoin cash-back debit card, merchant rewards, and consumer bill payment rewards, all coupled with insured custody and no-fee trading. In many ways, Fold’s business model demonstrates the convergence of crypto with the traditional.

On December 30, Fold announced a convertible bond financing that may be expanding the realm of that convergence. The deal includes a $20 million convertible bond from ATW Partners, with a potential $10 million increase pending Fold’s planned listing and entry into public capital markets through its announced combination with FTAC Emerald Acquisition Corp. The convertible notes are secured by Fold’s assets, including a portion of the company’s proprietary bitcoin holdings.

While other companies such as MicroStrategy and Marathon Digital Holdings have issued convertible notes to fund bitcoin purchases, Fold’s use of digital assets as collateral represents a novel approach in traditional debt financing structures. This kind of innovation to meet capital needs could prove fruitful for others holding significant amounts of digital assets on their balance sheets, as the lines between the traditional and the digital continue to blur.

Contact ryan@architectpartners.com to schedule a meeting.