February 24 – March 02 (Published March 5th)

PERSPECTIVES by Todd White

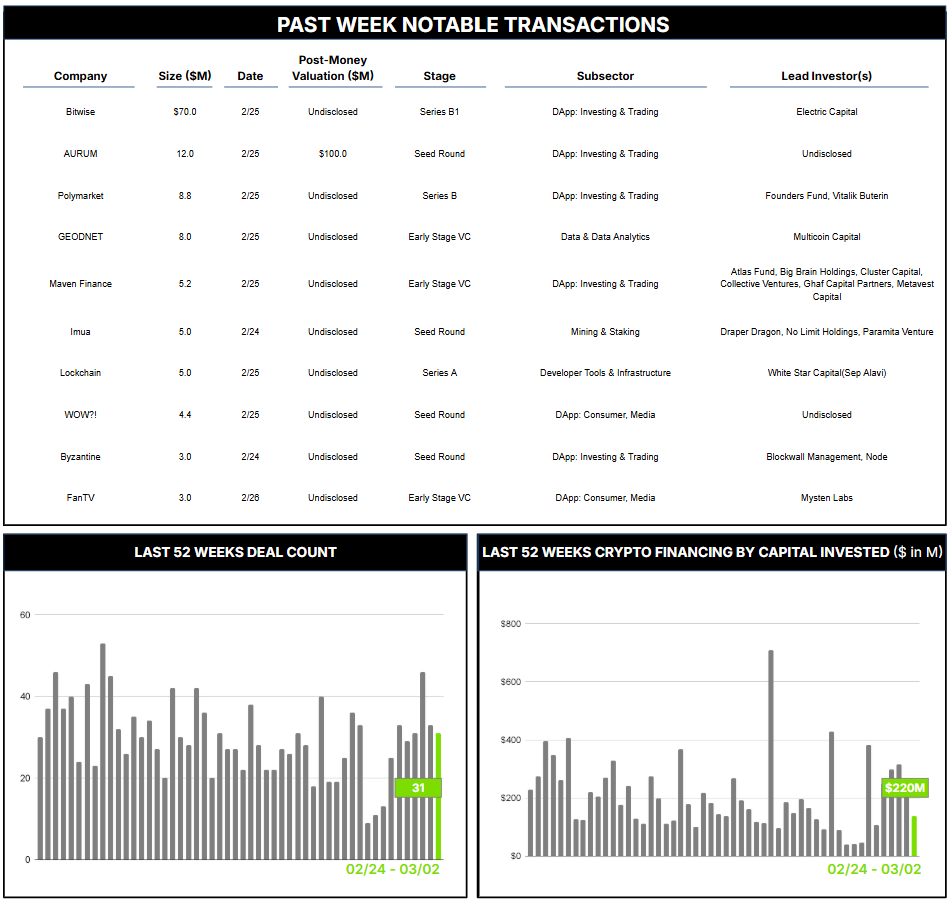

31 Crypto Private Financings Raised: $220.1M

Rolling 3-Month-Average: $203.6M

Rolling 52-Week Average: $209.2M

In many ways, 2024 was the year that institutional investors showed up in the crypto investment scene. Led by the much-publicized wave of Bitcoin ETFs, crypto AUM increased substantially with many institutional investors making significant allocations to the sector. BlackRock’s iShares Bitcoin Trust (IBIT) experienced the most significant increases to become one of the fastest-growing ETPs in history, reaching over $10 billion in AUM in just 51 days, growing nearly to $54 billion, making it the largest Bitcoin fund globally. Many others also achieved significant growth, including Bitwise Asset Management, a crypto-specialist manager that increased its AUM by more than tenfold during the year, and with over $12B in client assets by February 2025.

There are of course various niches where different asset managers play. So-called crypto hedge funds, such as Multicoin, Blocktower, and dChained, offer actively managed funds to seek returns through trading. Crypto venture funds focus on long-term growth potential by providing funding and support for early-stage blockchain and crypto projects. Examples include Blockchain Capital, Pantera and Andreessen Horowitz (a16z)’s crypto fund. Crypto exchange-traded funds (ETFs) provide indirect exposure to crypto through liquid vehicles traded on traditional stock exchanges. BlackRock’s IBIT is the largest, but the ETF class of 2024 includes notable offerings from Fidelity, ARK, VanEck and numerous others.

Index funds, on the other hand, offer a way to invest in a basket of positions by passively tracking cryptocurrency indices for diversified market exposure, generally with lower fees compared to actively managed products. Bitwise has established itself as one of the largest crypto index fund managers, as part of a broad suite of 32 investment solutions that include yield and alpha strategies, multi-strategy solutions, separately managed accounts, on-chain staking, and Bitcoin ETPs, in addition to its leading index funds.

Bitwise completed a $70 million equity raise at the end of February that was led by Electric Capital, with participation from notable investors such as MassMutual, Highland Capital, and MIT Investment Management Company. Proceeds from this funding round will be used to bolster their balance sheet for greater stability and growth potential, expanding investment capabilities to develop new products and solutions, strengthen research capabilities, investor education initiatives, and client service infrastructure, and to grow their team.

The industry and the managers that invest within it continue to evolve rapidly. Different firms are taking different approaches, from traditional finance giants entering the space to crypto-native firms expanding their offerings. BlackRock, for example, has leveraged its institutional reputation to quickly gain significant market share in Bitcoin ETFs. Bitwise on the other hand is a crypto-native manager that offers a broad range of 32 products. These include their core focus on “Beta Solutions” of crypto index funds, Bitcoin and ETH ETP’s (exchange traded products) and other passive vehicles that track assets or markets; “Alpha Solutions” that include actively managed yield strategies, and separately managed accounts with tailored mandates; and “trendwise” strategies that rotate between crypto and U.S. Treasuries based on market trends, and pure “on-chain” solutions such as staking services, onchain yield strategies and blockchain network indices.

The race is on for products and market share. If the crypto sector experiences the type of growth and adoption that we anticipate (and hope for!), there will be ample room for multiple managers with diverse strategies.

Contact ryan@architectpartners.com to schedule a meeting.