March 10 – March 16 (Published March 19th)

PERSPECTIVES by Todd White

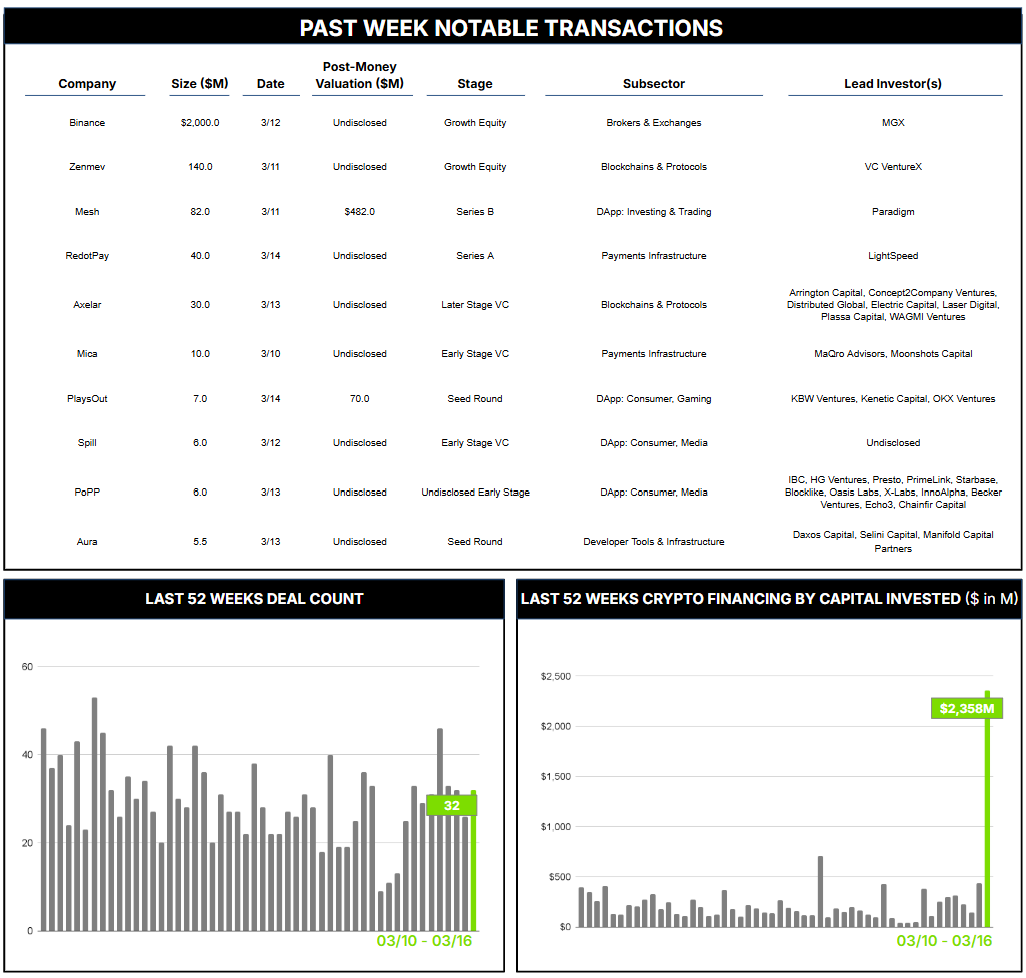

32 Crypto Private Financings Raised: $2,358.4M

Rolling 3-Month-Average: $386.8M

Rolling 52-Week Average: $251.8M

It’s no secret that the mood surrounding crypto has changed, dramatically and somewhat abruptly. In the past several weeks alone, the SEC has steadily disentangled itself from its highest-profile enforcement actions, including Coinbase, OpenSea, Robinhood, Uniswap, Gemini, and Yuga Labs. The Trump administration is moving toward a strategic crypto reserve. Prospects for regulatory clarity from the U.S. legislature seem favorable. And previously disinterested G-SIBs are suggesting moves at scale once such clarity emerges. Yes, the asset price volatility that characterizes our industry remains, but receptivity to digital assets across broad commercial and capital markets has been palpably transformed.

Against this backdrop, Binance, the largest crypto exchange globally by transaction volume and registered users, secured a $2 billion investment this week from Abu Dhabi’s MGX, a state-backed AI and advanced technology fund. This transaction is historic by numerous measures, including:

- It is the largest single investment in any crypto company, ever—2x the $1 billion raised by Luna Guard, NYDIG, and Figure in the pre-winter years of 2022, 2021, and 2019, respectively, and 8x the $250 million post-winter raise by eToro in March 2023.

- It was settled entirely in stablecoins, making it the largest crypto-denominated deal ever.

- It marks the first foray into the crypto space by MGX, a firm dedicated to accelerating AI adoption and chaired by UAE National Security Adviser Sheikh Tahnoon bin Zayed Al Nahyan.

But there are complex dynamics behind Binance’s move, and few underlying details about the deal are available. Much of the story seems untold, including the true strategic rationale and what Binance intends to do with its new mountain of cash, or rather, stablecoins.

This could be a story of regulatory redemption, as the investment comes as Binance seeks to rebuild trust after its 2023 $4.3 billion U.S. settlement over money laundering violations. MGX’s government-linked status, combined with CEO Richard Teng’s expertise as the former head of Abu Dhabi’s financial regulator, brings formidable regulatory credentials.

Or it may be a story of market consolidation, as with 260 million users and $100 trillion in cumulative trading volume, this capital injection reinforces Binance’s dominance against competitors like Coinbase, bolsters liquidity for trade support, and/or provides a formidable war chest to acquire smaller or regional exchanges, entrenching its leadership position and preparing for the entrance of TradFi behemoths into the crypto sector.

Or perhaps it is part of a UAE “gateway” strategy to strengthen its strategic base for Middle Eastern expansion, beyond the 20% of Binance’s global workforce already operating from the UAE.

Most likely, it is a combination of the above, with additional nuances to emerge over time.

Regardless of the underlying rationale, the potential market implications are significant. MGX’s entry as Binance’s first institutional capital may signal growing sovereign wealth interest in crypto infrastructure, potentially unlocking massive pools of institutional capital. The stablecoin settlement mechanism sets a precedent for large-scale crypto-native transactions. It may also highlight emerging opportunities for regulatory arbitrage, strengthening the UAE’s position as a crypto haven amid tightening EU and U.S. regulations.

Additionally, as MGX’s first crypto investment, this move suggests alignment with Abu Dhabi’s $54 billion AI infrastructure projects, and portends future integration of machine learning in crypto trading and compliance systems, a development that intrigues us greatly and led us to initiate “ABC” (AI, Blockchain, and Crypto) coverage in our 2024 year-end report (here).

Several of the largest players in the crypto exchange space have indicated a desire for headline deals. This bold move by market leader Binance sets a high bar and will be difficult to match. It should be exciting to see how their competitors react, and how this dynamic market unfolds.

Contact ryan@architectpartners.com to schedule a meeting.