March 17 – March 23 (Published March 26th)

PERSPECTIVES by Todd White

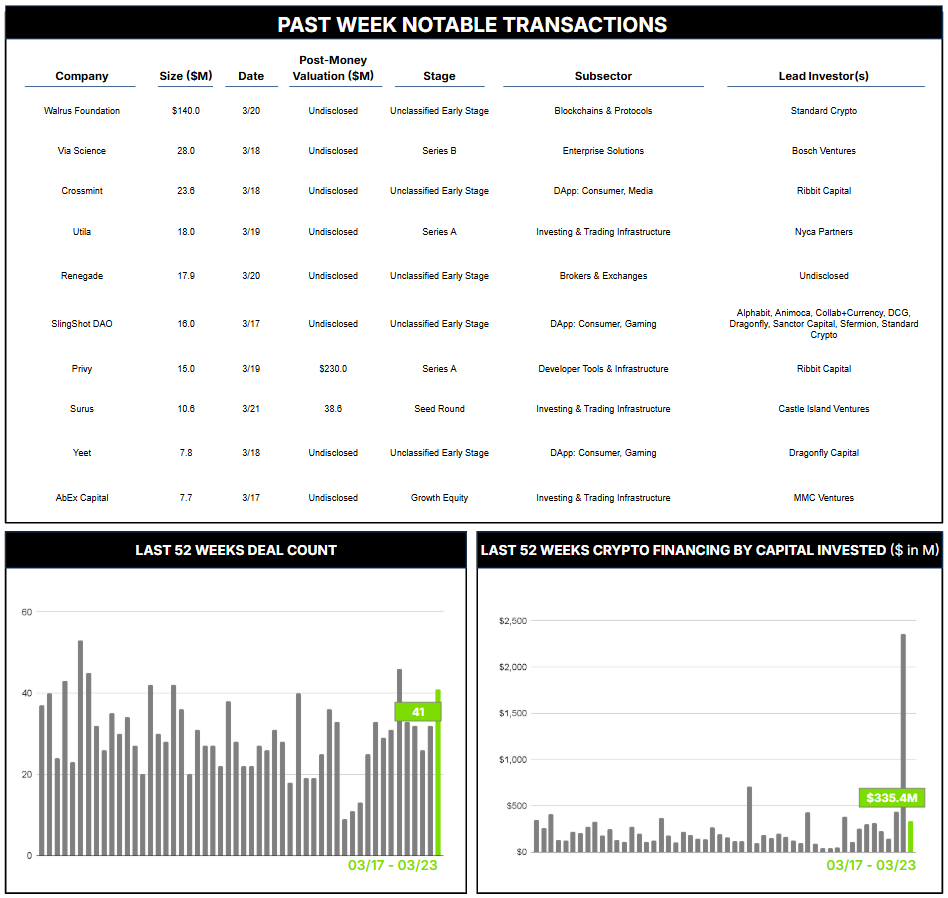

41 Crypto Private Financings Raised: $335.4M

Rolling 3-Month-Average: $411.5M

Rolling 52-Week Average: $250.6M

Remote data storage has evolved significantly over the decades. Conceptual green shoots in the early days of computing led to early movers such as CompuServe and AT&T’s PersonaLink in the 1990s that were mere glimpses of the future to come. Amazon Web Services’ (AWS) launch of Amazon S3 in 2006 began to revolutionize the industry with a scalable, low‑cost storage infrastructure. Companies like Dropbox, Google Drive, and Microsoft Azure expanded adoption in the 2010s with integrated productivity tools and enhanced user accessibility, helping “the cloud” gain acceptance as a household term. Cloud‑based services are now pivotal to commercial workflows and daily life for many.

But the convenience of centralized storage has also brought several challenges — most notably security risks from single points of control that are vulnerable to cyberattacks and data breaches, as well as simple mistakes that can lead to data leakage and unauthorized exposure of sensitive information. Other pain points include loss of data ownership and control and associated privacy risks that challenge compliance with regulations such as the GDPR and HIPAA. Centralized outages or disruptions can inflict collateral business damage on millions of users simultaneously. Users often experience commercial unpleasantness when locked in as vendors move from “attract” to “extract” mode, with increasing subscription and bandwidth costs coupled with contractual and technical barriers that prevent easy migration between providers.

Decentralized storage protocols claim to solve many of these concerns by offering greater security, control, and scalability while reducing reliance on centralized entities. Decentralized systems typically encrypt data before splitting and distributing it across multiple network nodes, ensuring that encrypted data remains inaccessible to unauthorized parties even if one or more nodes are breached. Unlike centralized solutions, they enable users to retain full ownership and control of their data via encryption keys and granular permission settings. They also eliminate single points of failure, making it significantly more difficult for cybercriminals to access entire datasets and providing resilience against outages. Advanced features such as onion routing and zero‑knowledge proofs can further protect user identities and usage patterns when storing and retrieving data.

Despite this potential, adoption has been hindered by limited user familiarity, inconsistent retrieval speeds and sometimes heightened latency, and a lack of seamless integration with existing enterprise infrastructure. Several projects are seeking to change this. Filecoin is one of the largest decentralized storage networks, leveraging a token‑based marketplace to connect storage providers and users with robust scalability and Web3 dApp support — though long‑term storage can be expensive. Arweave, on the other hand, targets permanent storage needs with a “pay‑once‑store‑forever” model popular for archiving blockchain data and NFT metadata, but it faces high replication costs. Storj provides enterprise‑grade decentralized storage focused on ease of use, competitive pricing, and high performance, though it has not yet achieved sufficient scale to rival centralized giants like AWS or Azure.

This week saw the Walrus Foundation raise $140 million in a private token sale. Proceeds will expand and maintain the Walrus protocol and support application development. The protocol offers a lower cost structure than some competitors and fault tolerance permitting up to one‑third malicious nodes. It was built on Sui, is interoperable with Ethereum and Solana, and integrates smart contracts for programmable, dynamic data management. The funding round was led by Standard Crypto and joined by Andreessen Horowitz (a16z), Electric Capital, and others; it coincides with the protocol’s public mainnet launch on March 27, 2025.

This is an exciting space with potential implications across Web3, AI, and beyond. The $140 million round reportedly values the $WAL token supply at $2 billion, signaling investor confidence in Walrus’s position relative to decentralized competitors and their potential to disrupt centralized cloud providers. Strong competition remains, and the potential for both success and failure persists as each project defines its niche and seeks critical market acceptance and scale.

Contact ryan@architectpartners.com to schedule a meeting.