November 18 – November 24 (Published November 27th)

PERSPECTIVES by Todd White

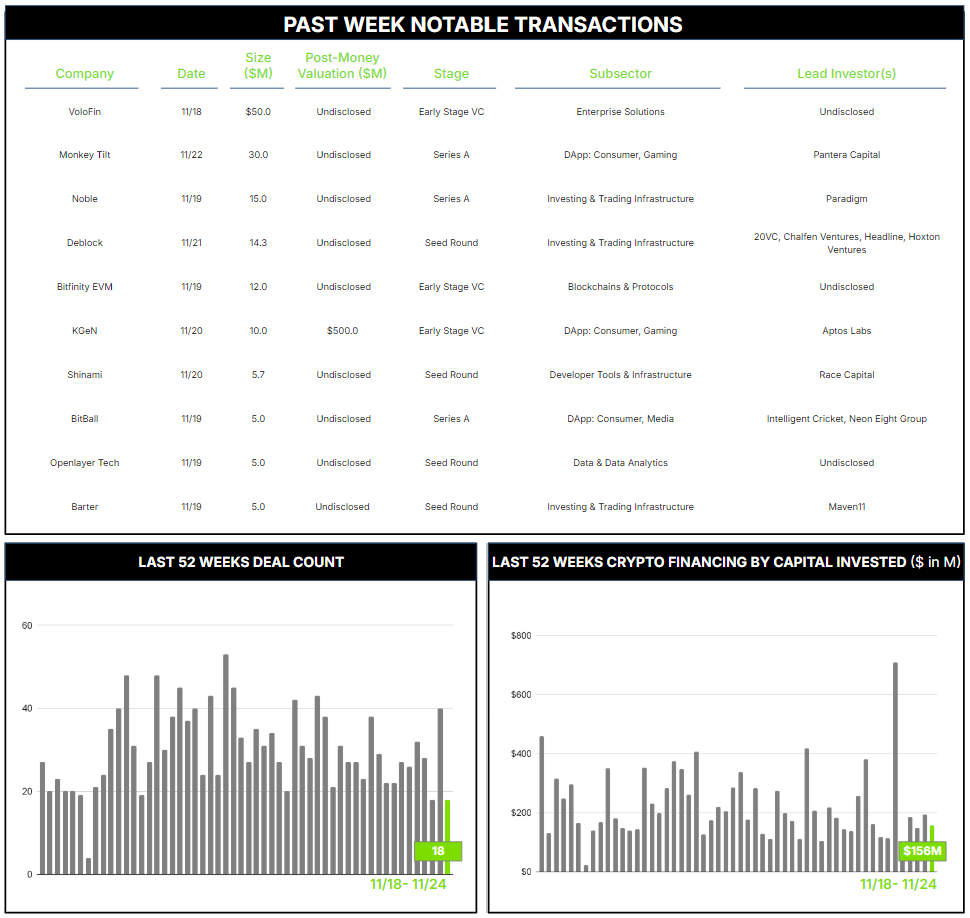

18 Crypto Private Financings Raised: $156M

Rolling 3-Month-Average: $221M

Rolling 52-Week Average: $221M

Supply chain management—broadly defined as a system to govern the flow of goods and services from their points of origin to distribution and consumption—is as old as trade itself and fraught with unavoidable complexity. The need to oversee the network of independent parties who touch, move, or enhance products along their commercial journey raises questions of security, visibility, tracking, and timing of these complex flows. Recent trends have added variables related to sustainable and ethical sourcing to the mix. These challenges present an intuitive fit for blockchain-enabled solutions, a match that has attracted both academic and commercial attention for at least a decade. These solutions promise vast potential improvements in transparency, traceability, and reductions in administrative costs—the hallmarks of effective enterprise blockchain systems.

Trade finance—the provision of credit to support the global exchange of goods—is also a centuries-old industry that relies on antiquated systems for contract creation, receivables financing (known as “factoring”), shipment and payment timing, mitigating disputed “facts,” AML and sanctions compliance, and the inevitable delays and disputes that erupt among counterparts who often distrust one another. Migrating to on-chain solutions has the potential to mitigate or entirely eliminate many of these frictions, resulting in faster, more cost-efficient, and easily auditable solutions.

VoloFin, a Singapore-based blockchain-powered trade and supply chain finance platform with operations in India and the US, announced a $50 million financing facility on November 11 from an unnamed US bank using a structured notes program issued through an SPV. According to Co-founder and CEO Rashan Shaw, VoloFin will use the new $50 million line to provide fintech-based lending in cross-border trade finance, focusing on Indian exporters to global buyers by financing receivables. The company anticipates expanding the capacity to $150 million over the next couple of years and expanding its “multi-lender” capacity to better serve client needs.

We’ve been intrigued by this potential for years. From systems to solve climate-related financial disclosure to tracing foodstuffs to financing the delivery of energy and oilfield services, this seems a compelling arena for distributed ledger technology to increase transparency, reduce risk, and ultimately facilitate the free flow of capital.

Contact ryan@architectpartners.com to schedule a meeting.