Who are you? Prove it.

It’s a simple question but surprisingly easy to deceive. According to Javelin, identity fraud resulted in $43B in financial losses in 2022.

Today’s traditional “prove it” consists of a government-issued ID, a social security number and an account name and password. That sensitive information resides within thousands of government and commercial institutions, sometimes well protected, oftentimes not. Breaches are commonplace.

Financial impacts are just the tip of the iceberg. Far more corrosive is the decline of social trust. Faking or obfuscating personal identity is a first step to corrosive behavior like election fraud, Social media platform meddling programs, anonymous doxing, proliferation of conspiracy theories, distribution of fake images, etc.

Trust is hanging by its fingernails.

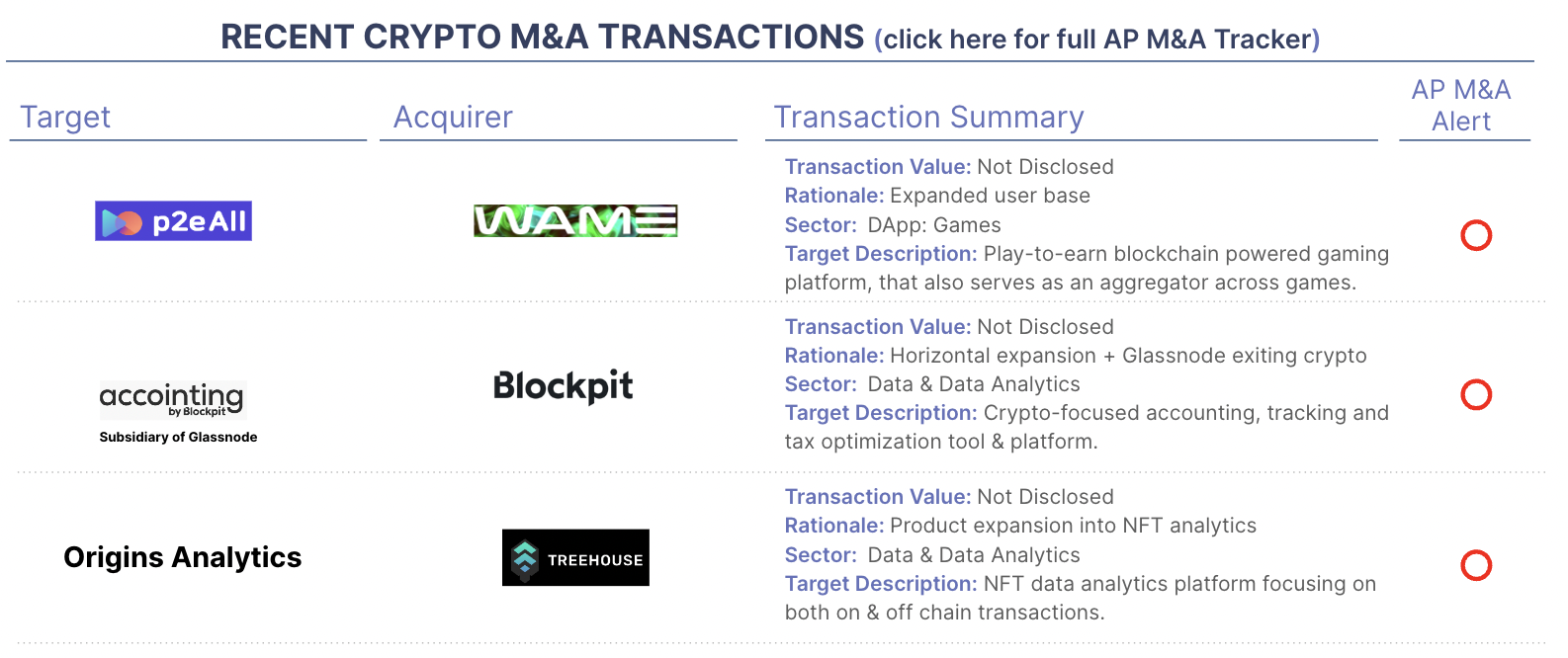

This week, the topic of identity and identity protection highlighted itself with WAME as an acquirer. WAME is one of many companies that are seeking to use blockchains and crypto assets to create “decentralized identity” systems, immune from the “my identity information is everywhere” problem highlighted above. Their approach is to assign a unique, non-transferable token to each person. That token records a set of facts about that individual, which can be validated without accessing the facts. While we have no viewpoint on WAME’s particular approach, we do have conviction that new approaches to protecting identity are essential.

Trust must reemerge or the path forward is dark.