September 22th – September 28th

PERSPECTIVES by Eric F. Risley

Digital Asset Treasury (DAT) company M&A? Decidedly yes, and essential.

We have been advising digital asset treasury companies (DATs) for the past few quarters as the phenomenon has arisen. In fact, Architect Partners’ data is the reference dataset for virtually all global news publishers that have published articles analyzing this unique phenomenon.

We have noted that the digital asset treasury strategy, pioneered by Michael Saylor at MicroStrategy, would appear effortless to copy, and indeed now we track over 200 public players. We have also noted that the extraordinarily large premiums to Net Asset Value (mNAV) many of these DATs have been valued at were almost certainly unsustainable. Well, the chickens have come home to roost, and these anomalous mNAV premium valuations have narrowed significantly over the past two months. As Matt Levine at Bloomberg has written, consolidation is logical and Architect Partners believes it inevitable.

DATs are simply asset managers. Asset managers are judged, and fundamentally valued, based on their ability to generate positive alpha. Alpha is a superior return on investment relative to peers, adjusted for risk. Each and every DAT must deliver positive alpha returns to its shareholders to justify itself.

How does one generate alpha returns in a DAT? Just like any other financial asset: via lending and trading strategies. In the case of DATs, some have the option of staking and perhaps making equity or token investments in the ecosystem supported by the asset they hold (BTC, ETH, SOL…).

The existential challenge is that each of these positive, alpha-generating capabilities is very difficult and requires skills, infrastructure, and experience far beyond the simplistic PR messaging and strategy of most DATs. Again, in fact, these capabilities are the domain of dedicated companies themselves and already exist as both independent companies and within larger crypto businesses.

It’s really quite simple: DATs need to build or acquire these alpha-generating capabilities, or will be acquired by those that have them. This is the next phase of this phenomenon.

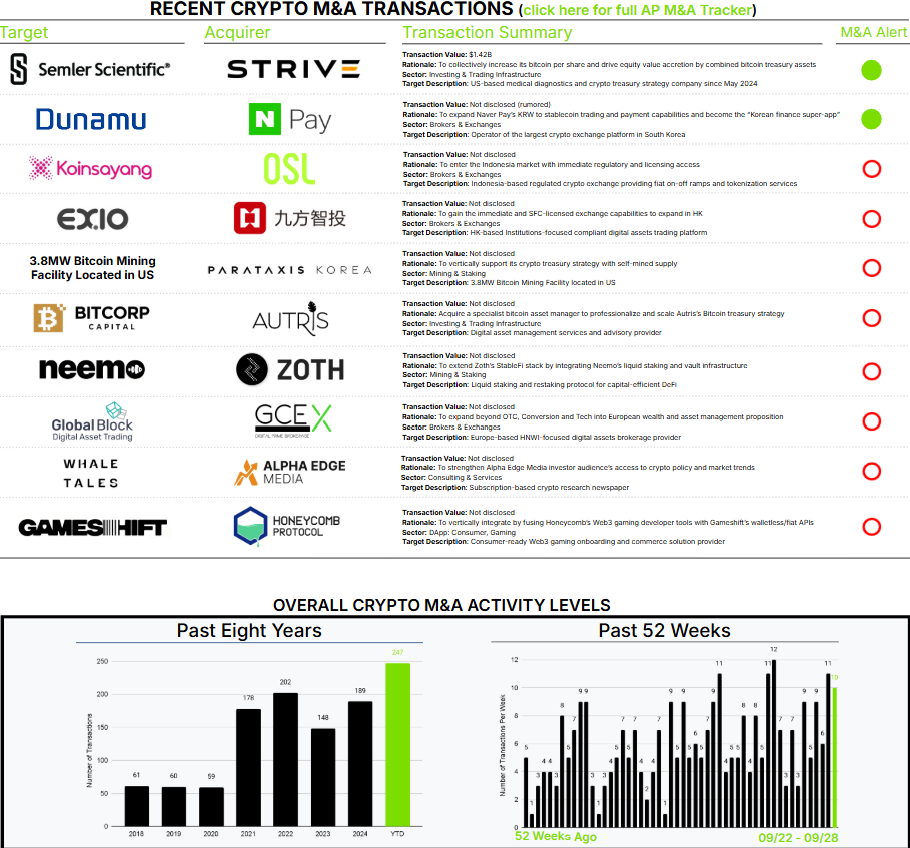

The first example of this coming consolidation is Strive’s acquisition of Semler Scientific. See our M&A Alert for a full assessment.

Architect Partners is pleased to discuss in more detail; please feel free to reach out for more detailed discussion.