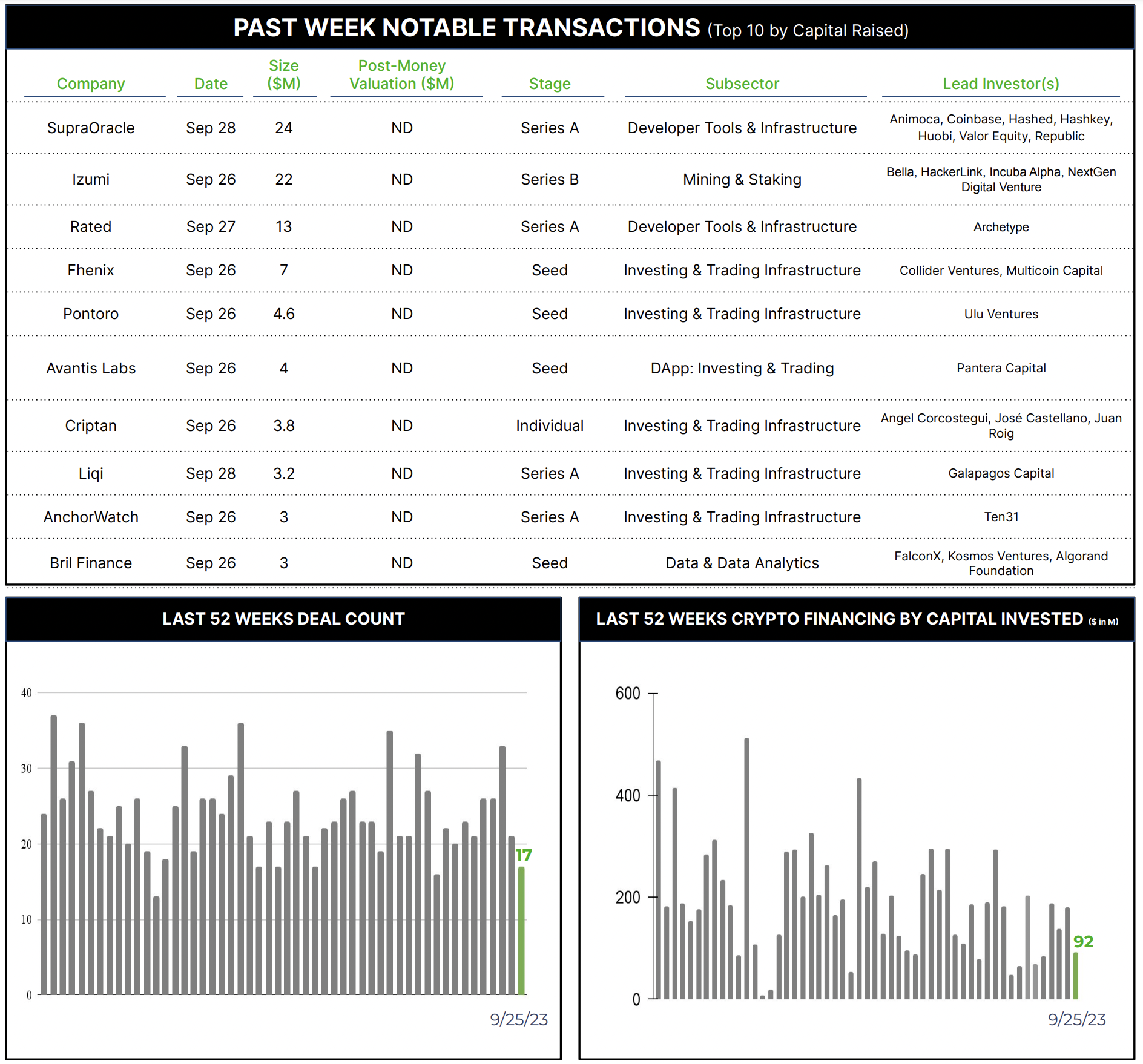

17 Crypto Private Financings Raised ~$92M

17 Crypto Private Financings Raised ~$92M

Rolling 3-Month-Average: $145M

Rolling 52-Week Average: $188M

Private financings continue their subdued pace, with both deal count and capital raised trending down this week from already muted volumes. Seven of our top 10 transactions were infrastructure deals, with half in early-stage investing and trading, showing continued investor appetite to build the plumbing during an extended sector down-cycle.

Selected Highlights

SupraOracle announced a total of $24M in private investments completed, including support from some of the largest digital asset investors such as Animoca Brands, Coinbase Ventures and Valor Equity Partners. Supra is a developer of low-latency infrastructure for cross-chain interoperability and security to enable migration of Web2 to Web3 with powerful oracles, cross-chain communication protocols and consensus mechanisms

Why Notable? Supra is building the critical interoperability infrastructure that is essential for the adoption and scaling of Web 3 initiatives. The large number of high-profile strategic investors providing private financing, co-developing white papers and collaborative R&D suggest that Supra’s “academic approach” to cross-chain oracles and bridgeless communication is resonating with key market players.

Rated Labs secured a $12.9M Series A round led by crypto venture investor Archetype, who also took a board seat. The UK-based oracle and dataset provider, which currently offers Ethereum-based node and node-operator ratings, data pipelines and comprehensive datasets, will use the new funds to extend into Layer 2 networks and additional blockchains including Polygon, Cosmos and Solana.

Why Notable? As we have seen in several infrastructure deals, simplifying access to Web3 continues to attract capital. This round is also notable for the sizeable participation from previous investors such as Placeholder, Cherry and Semantic who are showing continued financial support.

AnchorWatch secured $3M in funding led by Ten31 in order to meet the regulatory and capital requirements necessary to bring to market a regulated insurance product embedded in its secure custody vault, Trident Vault. The solution is an example of combined technical and financial infrastructure to meet the needs of commercial institutions as well as financial advisors with clients seeking secure and insured custody for Bitcoin.

Why Notable? We view appropriately scoped insurance solutions to be essential financial infrastructure for the Web3 and digital assets space in general. While not yet offering products in the market, AnchorWatch was formed to specifically fill a void identified by the founders, in this case commercial coverage for cold-storage Bitcoin. Investor support for their approach – combining secure technology with credentialed insurance – is encouraging as the broad insurance needs of the sector continue to be underserved.

Patterns

Infrastructure continues to dominate the private financing landscape, with cross-chain interoperability being a recurring theme. And we expect the often overlooked financial infrastructure – notably the underserved insurance and risk management needs of the sector – to attract increased investor interest as digital markets mature.