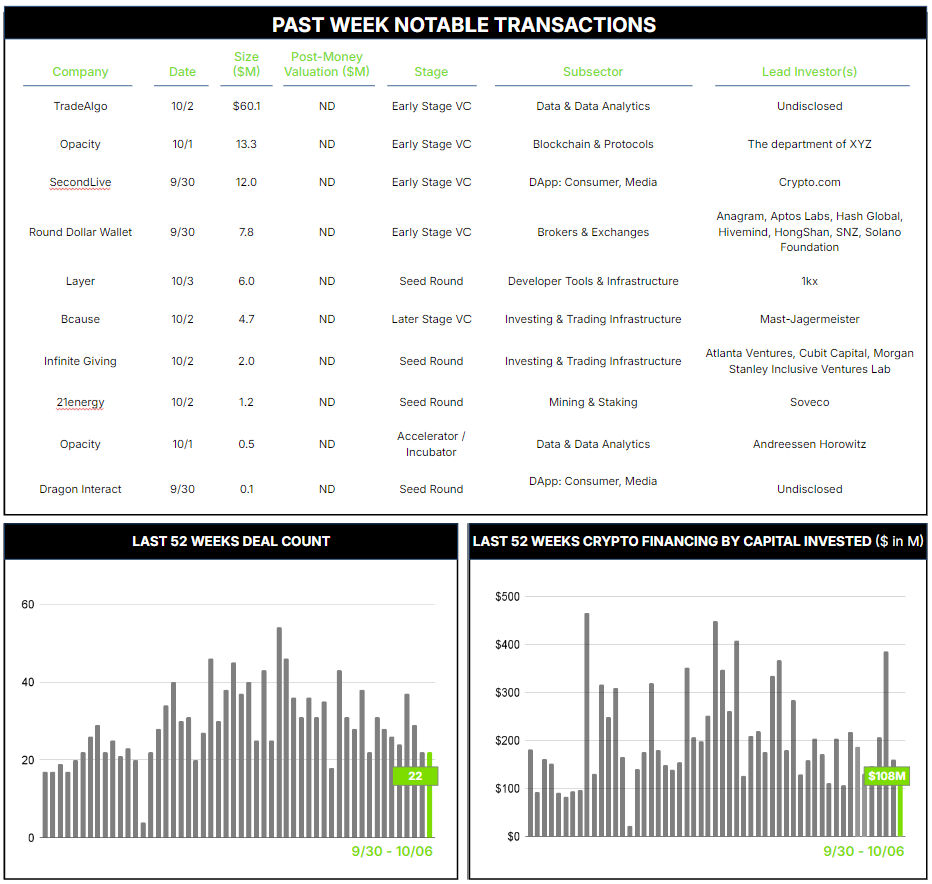

22 Crypto Private Financings Raised: ~$108M

Rolling 3-Month-Average: $178M

Rolling 52-Week Average: $205M

Web3 does not lack grandiose visions— reinventing money, banking the unbanked, democratizing finance, digitizing everything, and the list goes on. The potential for disruptive applications is impressive, but in reality, most projects continue to suffer from a distinct lack of users—that ever-elusive product-market fit. And lately, the sparkle of all things crypto seems to have fizzled, while other tech, notably AI, attracts much attention from the media and investor checkbooks alike.

Regardless of where this leads, a tremendous amount of human and financial capital has been invested in the blockchain space. All that investment has helped refine numerous adjacent technologies that may prevail in the end, even if pure “crypto” falters.

One such example is zero-knowledge or “zk” technology. A conceptual oxymoron that remains enigmatic to many, it was conceived in the 1980s by theoretical mathematicians as a way to establish the veracity of a statement without revealing sensitive or confidential underlying data. But “zk” remained largely theoretical until blockchain technology enabled its application. The result has been a flood of excitement, with myriad teams seeking to build more secure authentication tools, safeguard user privacy, improve encryption, and many other innovations. Some believe that zk’s privacy potential will enable global privacy regulations, such as Europe’s GDPR, to actually work—and even save us all from the deep fakes of AI.

One such project—the Opacity Network—claims to be “the Internet, verified.” If that sounds grandiose, it is—they seek to reimagine the internet so users can retake control of their information. It has proved appealing to some credible investors, with the developers at Opacity Labs this week securing a modest $500k from a16z’s incubation platform, coupled with a $13.3M early-stage round led by The Department of XYZ.

We don’t know whether zk will save us all from an AI-fueled post-truth apocalypse (as some portend), but the technology is intellectually fascinating and may yet become a financially fruitful offshoot of the crypto boom.

Meet Architect Partners at these upcoming events:

- Money2020 (Oct 27 – Oct 30)

Contact ryan@architectpartners.com to schedule a meeting.