November 18th – November 24th

PERSPECTIVES by Eric F. Risley

Regulatory compliance.

While anathema to the founding ethos of crypto, the evolution of regulatory acceptance of crypto and digital assets is now the latest in a long series of narratives driving investor enthusiasm and asset prices. Ironically, regulatory acceptance has also been both a major hindrance while simultaneously an important catalyst for mergers & acquisitions. In the former category, one must know what the regulations are before complying, the United States being the poster child for this conundrum. Other markets, like the European Union and its Markets in Crypto Assets (MiCA) regulations demonstrating the polar opposite — a clear roadmap.

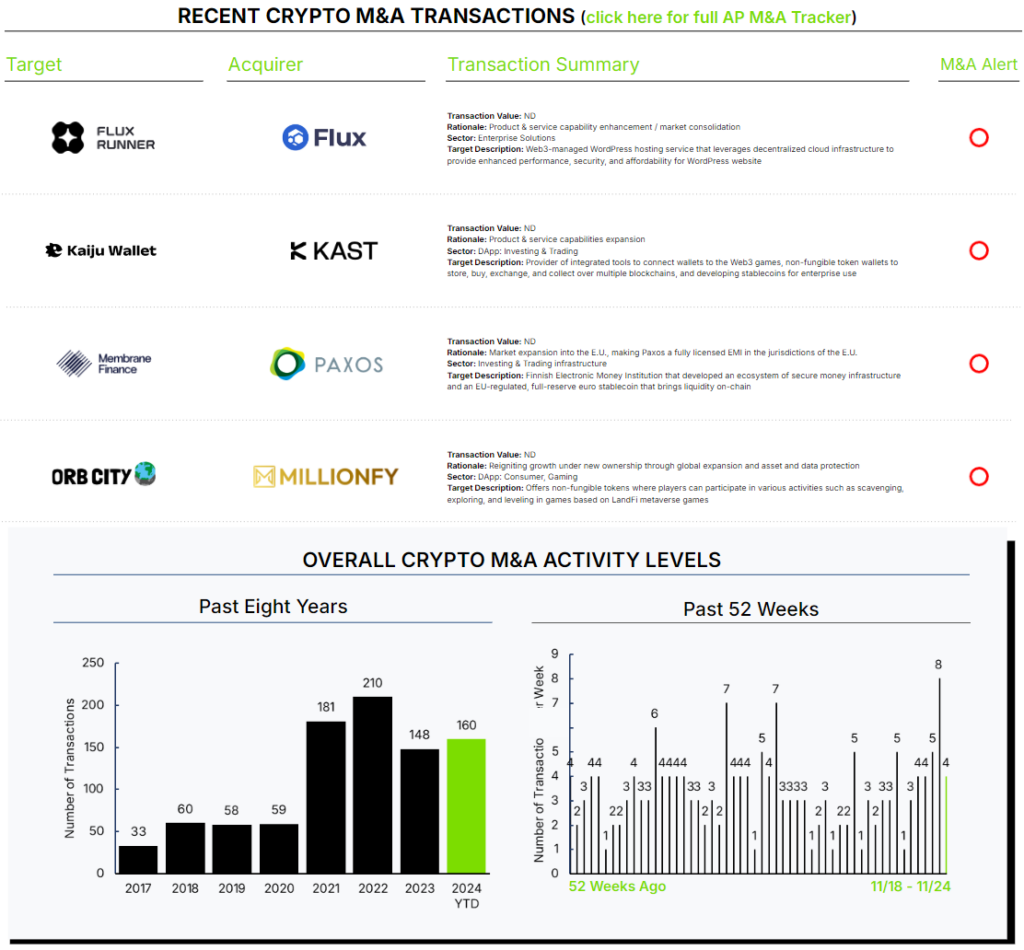

Since the MiCA legislation passed and was published in April-2023, we count 7 acquisitions which were, at least in part, strategically driven by positioning for compliance within the European Union. This is in addition to another 18 transactions which were oriented toward regulatory compliance in other regions including Australia (regulated by the Australian Securities and Investments Commission), Singapore (regulated by the Monetary Authority of Singapore), the UAE (regulated by Virtual Asset Regulatory Authority), and more.

This week, Paxos announced its first acquisition: Helsinki, Finland-based Membrane Finance. Like Paxos, Membrane Finance offers product and services supporting stablecoin issuance and is the issuer of EUROe, a euro-backed stablecoin, first announced in February 2023. As with other euro-backed stablecoins, EUROe has failed to attract meaningful use. In fact, according to Stablecoins: The Emerging Markets Story, recently published by Castle Island Ventures, Brevan Howard Digital and Visa Crypto, 98.8% of outstanding stablecoins are US Dollar-backed. Undoubtedly, this will change in the future, which is why Paxos is acquiring Membrane Finance, a Electronic Money Institution which will allow Paxos to offer a portfolio of assets and tokenization solutions compliant with MiCA.

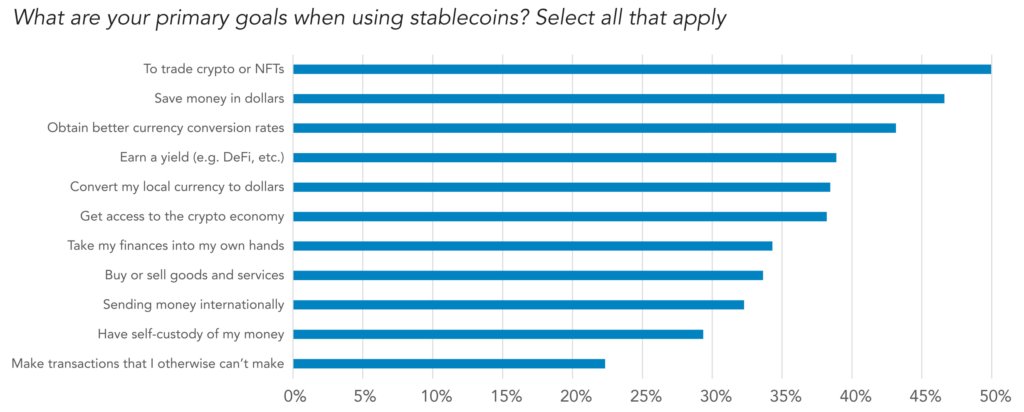

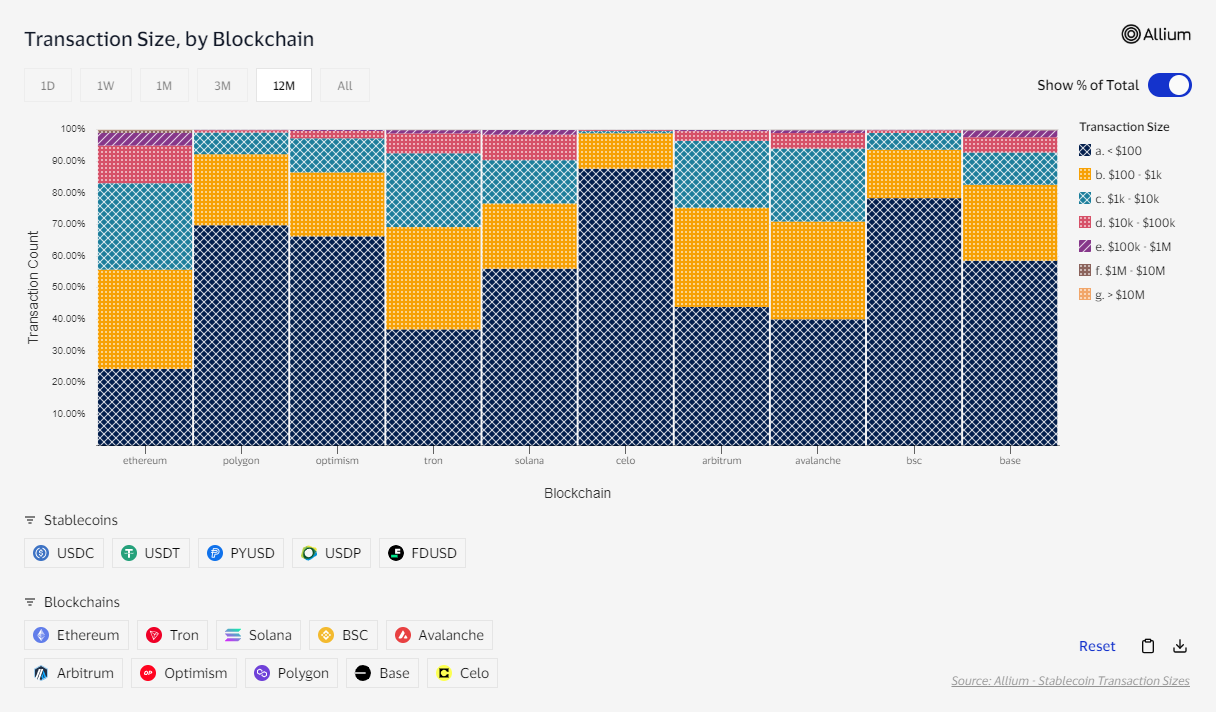

It’s important to note that stablecoins are rapidly transforming to become a very important asset for everyday people, particularly in developing countries, radically transitioning from simply a favorite of crypto traders. The report highlighted and linked above as well as Visa Crypto’s Onchain Analytics Dashboard are the most comprehensive and detailed analyses we have seen to-date. The two following charts demonstrate this trend nicely. Survey derived use cases in developing countries and data supporting small transaction sizes predominate.