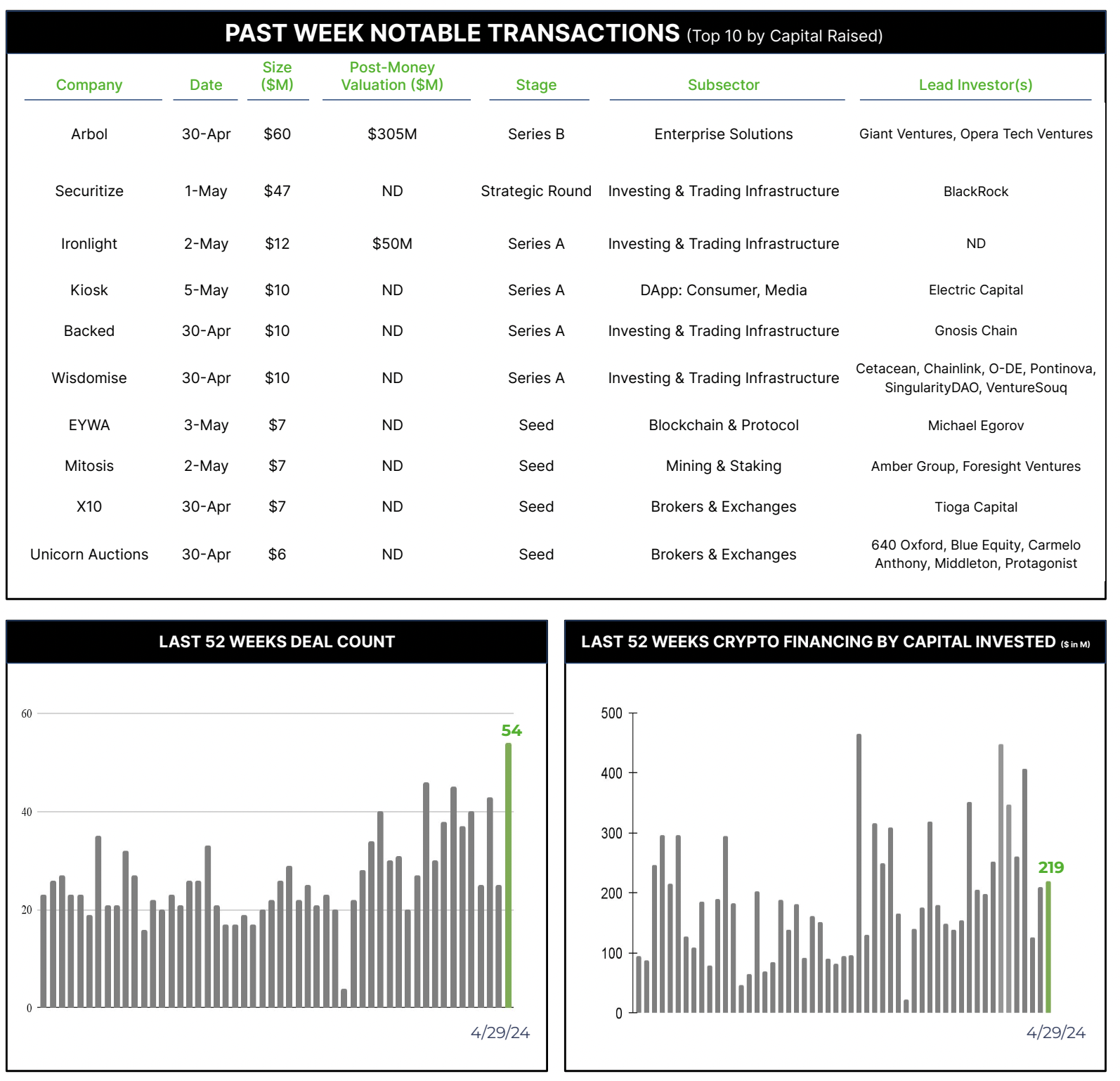

54 Crypto Private Financings Raised ~$219M

Rolling 3-Month-Average: $265M

Rolling 52-Week Average: $193M

Last week saw a spike in investment activity with 54 financings. It’s been quite a while since this level of activity has been seen! Perhaps funding activity is warming up with the weather. It’s important to note that 29 of those financings did not disclose the amount of capital raised, creating an artificially low value for capital invested.

Just a few weeks ago we wrote about the importance of tokenizing real-world assets when covering BlackRock’s introduction of their USD Institutional Digital Liquidity Fund. Last week, this important topic took center stage again with two significant fundings, underscoring the growing influence of this market disrupting technology.

By creating digital tokens on a blockchain that represent ownership rights in physical assets like real estate, art, and commodities, or with financial assets, tokenization unlocks new possibilities. Blockchain technology boasts enhanced security and transparency, streamlining processes, reducing friction in asset management, enabling around the clock trading, and significantly increasing liquidity and access across a wider range of assets.

Securitize – is a leader in digitizing financial assets through blockchain technology. Blackrock led a $47M funding, which also included Hamilton Lane, ParaFi Capital, and Tradeweb Markets. For their investors, Securitize currently enables access to Hamilton Lane’s Senior Credit Opportunities Fund and their Equity Opportunities Fund V, as well as is the transfer agent for Blackrock’s USD Institutional Digital Liquidity Fund, the first tokenized fund issued on Ethereum.

Ironlight – is a recently announced project by TradFi veterans, including the former trading heads of Schroders, with a former CEO of TD Bank as an advisor. They aim to create a regulated marketplace for trading tokenized real-world assets. They will focus on tokenizing private securities with existing value, and which are typically illiquid. Ironlight did not disclose the investors in their $12M round beyond noting that a significant portion came from investors with Wall Street backgrounds.

The rapid advancement in this investing infrastructure is exciting, and will surely disrupt the status quo.