October 20th – October 26th

PERSPECTIVES by Eric F. Risley

Capital access remains in the dark ages; however, a roadmap for evolution has emerged.

Even today, the process of requesting money (raising capital) and providing money (investing capital) for businesses, both small and large, is horribly inefficient and disjointed. Yes, we read the headlines about the latest darling business raising hundreds of millions daily; however, that is the extreme anomaly.

From the company’s perspective, the norm is investor identification, outreach, and conversation, repeated again and again. Success means cobbling together a set of investors over months and thousands of hours of senior executive time.

From an investor’s perspective, it is much the same: hit-or-miss opportunity identification, outreach, and conversation. Success requires teams of people and access to significant capital, which is why venture capital and growth capital firms exist.

The phenomenon of tokens and token markets has demonstrated the potential for a different model, with the ability to operate at massive global scale already proven. This is a more direct way for both companies (or “projects,” in crypto parlance) to raise capital and for investors to invest. Perhaps most importantly, it is open to all and global. Neither really exists today in traditional capital markets.

While promising, a few ingredients remain immature or missing: regulation, disclosure, best practices, and the emergence of leaders dedicated to doing it right and building trust, an absolute first-principles requirement. Trust requires more than code.

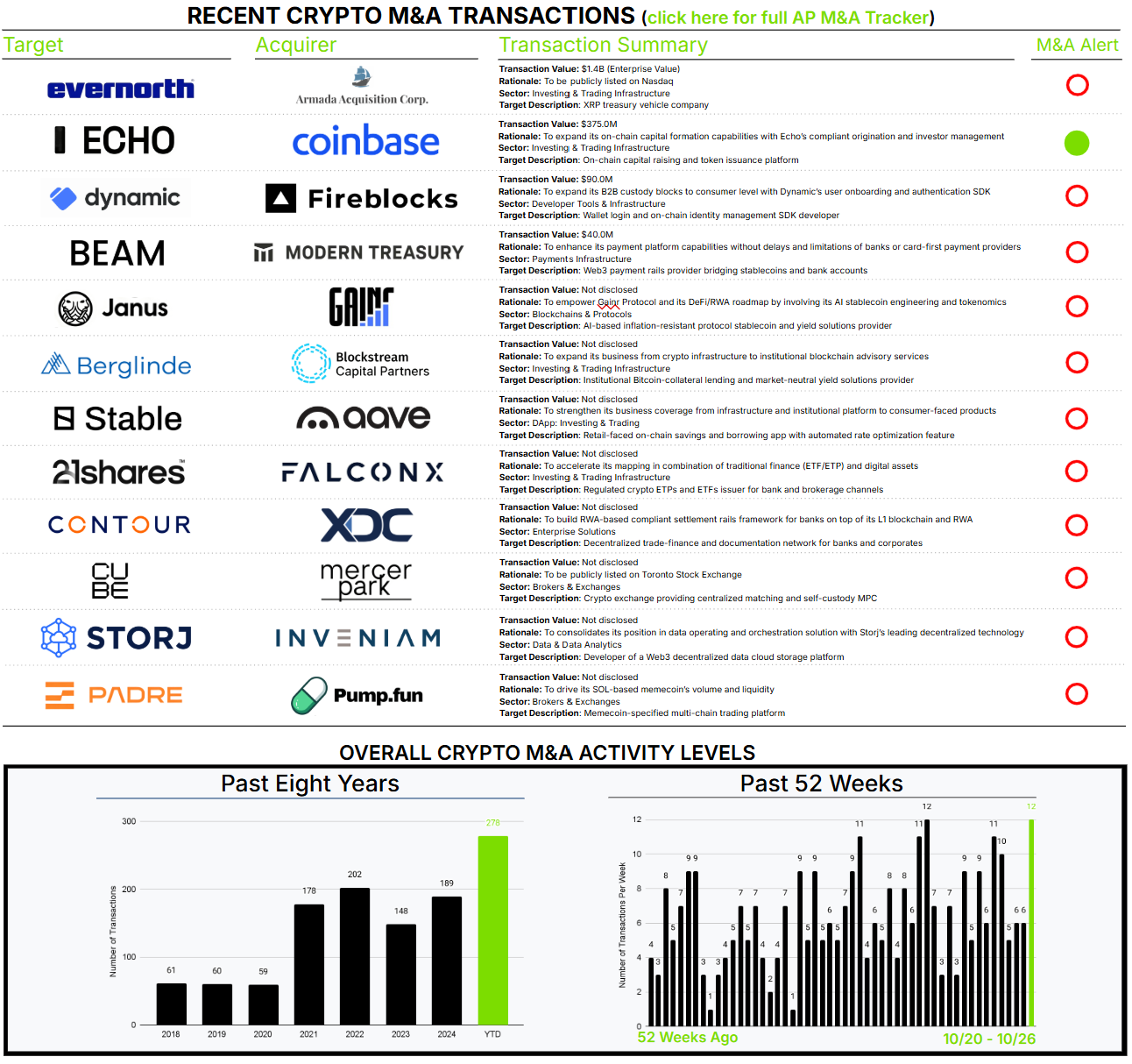

Coinbase is exceptionally well positioned to lead this evolution. This week, it announced the acquisition of Echo for $375M. Coinbase often uses the term “democratizing investing.” This focuses on the investor side, allowing anyone to invest without barriers. As described above, the value proposition is similarly profound for the company (or project) raising the capital.

See our M&A Alert for more information.

EFR