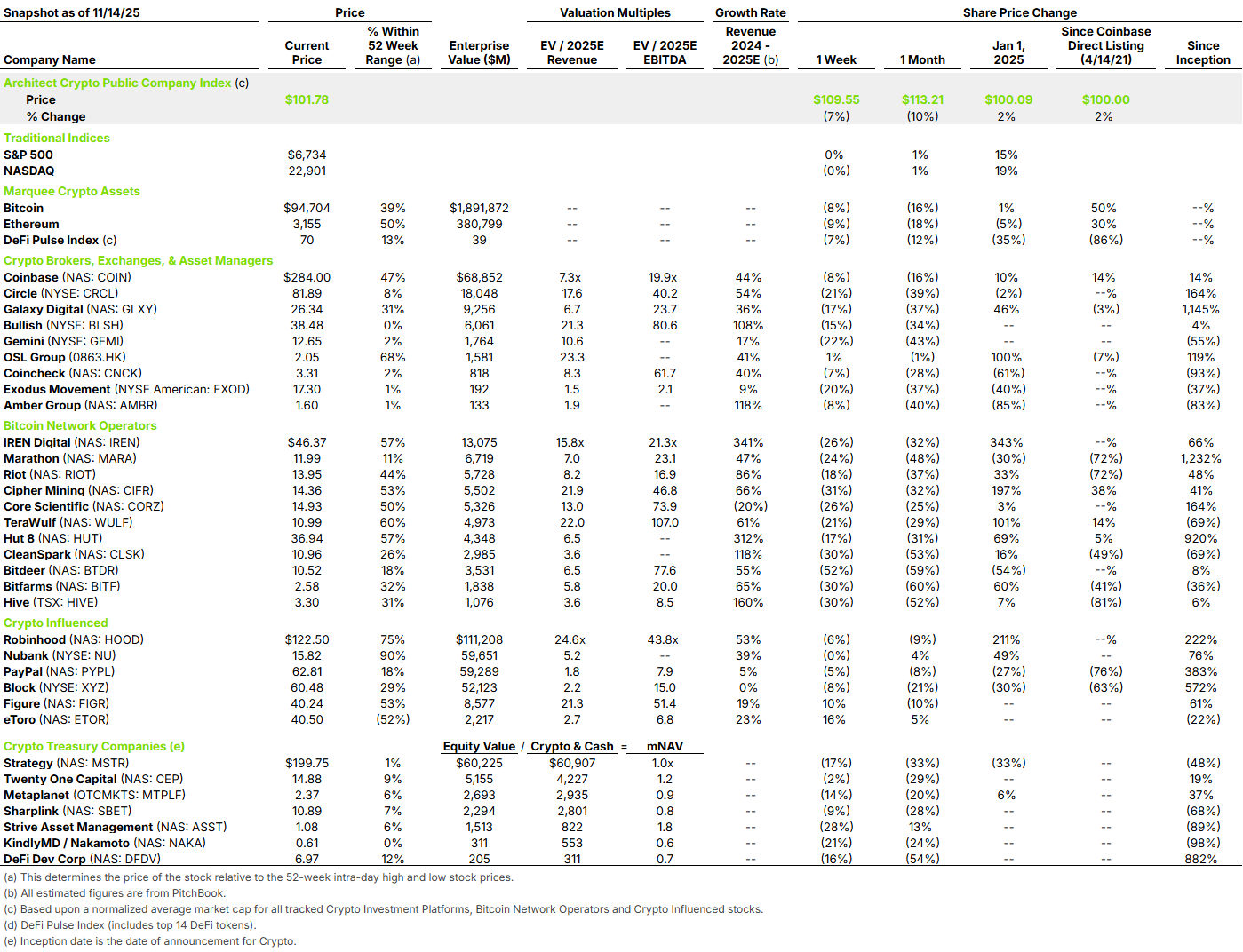

Over the last week and month, BTC has declined by 8% and 16%. At the same time, several companies announced that they outperformed expectations and grew at significant rates, including Coinbase and 14 other companies in our tracker, which grew revenue by 20% or more quarter-over-quarter. Despite that, our Crypto Brokers, Exchanges & Asset Managers declining 31% and 13% in the last month and week, and the miners declined 42% and 28% respectively.

We have previously argued that there may have been a decoupling of BTC and crypto stocks, however, this latest downturn suggests that the historic relationship still holds, with equity moving roughly 2 – 2.5x the magnitude of BTC’s decline (we historically have thought about beta closer to 2x).

What drives the correlation is straightforward. First, the fundamental link: miner revenues are paid in BTC, exchanges and brokers’ P&Ls are tied to trading volume and asset-based revenue, and growth is driven by adoption, which tends to slow in periods of market stress. Second, BTC and crypto stocks are often treated as a single thematic basket, so a pullback in one market is closely associated with a pullback in the other as investors de-risk at the theme level. Finally, companies in this ecosystem typically have meaningful operating leverage, meaning that a 20% decline in BTC and the related slowdown in activity can translate into a much larger percentage drop in net income, and therefore in perceived shareholder value.

To be fair to the bitcoin miners, the stock reaction has not been tied solely to BTC’s decline. Over the last year, many of these companies have attempted to pivot into AI infrastructure in order to re-rate their multiples and capture some of the enthusiasm around AI-driven growth. However, weak earnings in the AI sector and a growing acceptance of an AI-bubble have undermined that effort. The failed re-rating, combined with softer BTC economics, has contributed to miners selling off more sharply than the broader crypto equity index.

Taken together, the last month is a reminder that even when fundamentals are historically strong, listed crypto-stocks are still levered BTC-bets still, with theme-level de-risking and operating leverage amplifying moves in the underlying asset. Furthermore, it’s a reminder equity markets are driven by future performance expectations not quarterly beats.