News on Macro Economic Data

Overall the markets remain cautious, even though Q4 historically provides positive returns. Global instability hasn’t significantly affected the market yet, as there is an argument the broader market is already oversold with 1,000 new yearly lows hit this week alone. Inflation remains elevated with both the PPI and CPI numbers coming in hotter than expected (0.5% MoM and 0.4% MoM respectively). With higher long rates, consumer debt skyrocketing, concern over higher energy costs, and inflation stabilized to some degree, multiple Fed governors have hinted at an extended pause.

On a positive note, JPM, Citi, and Wells Fargo announced earnings that were better than expected, and more importantly showed that credit quality was also better than expected. Credit quality is a key metric to watch as the full effects of the interest rate increases have still yet to be felt, consumer credit card debt has reached over $1T for the first time, and corporate bankruptcies continue to rise.

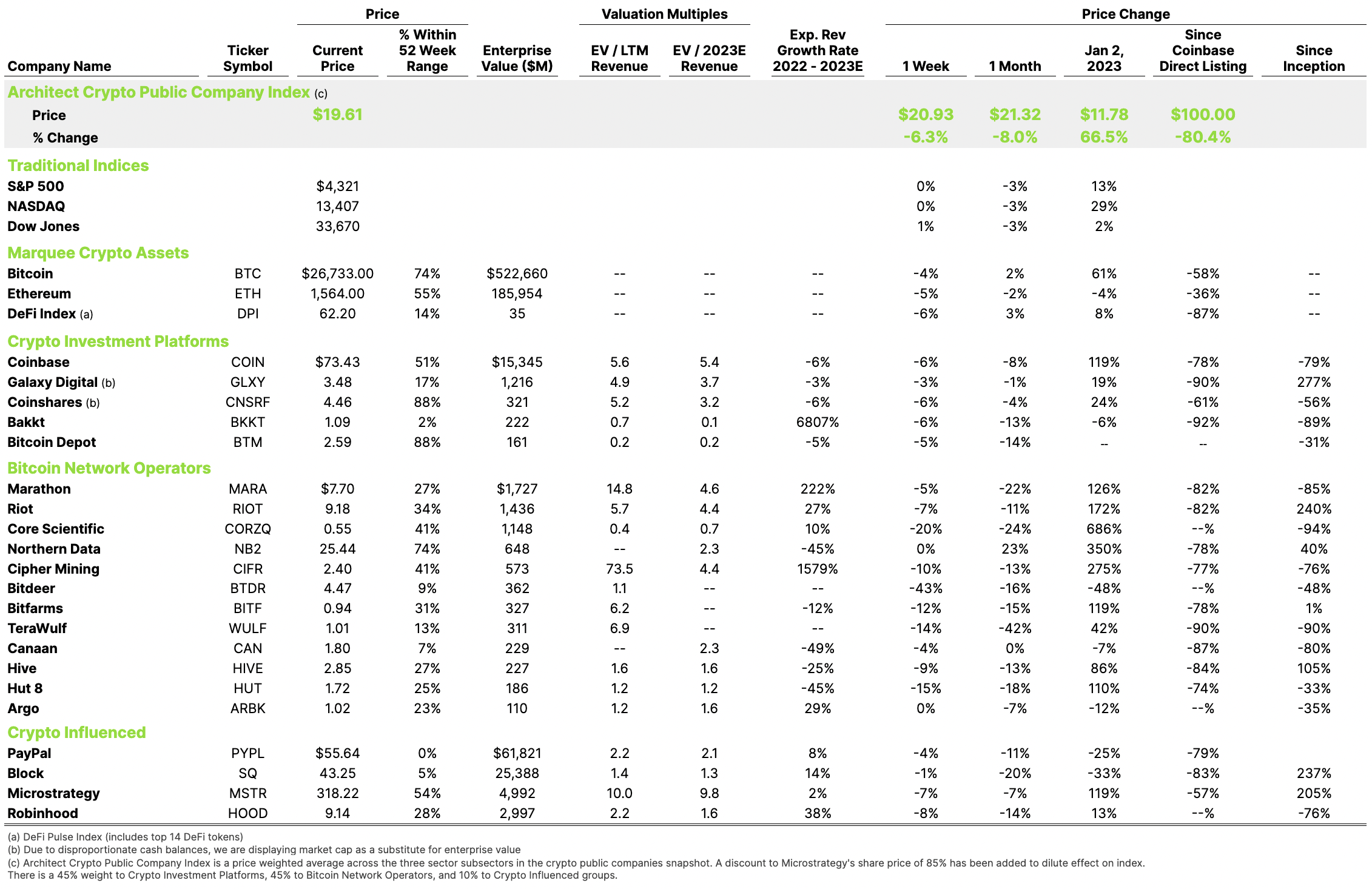

Crypto Public Company Activity

The Architect Partners’ Crypto Public Company Index was down by 6.3% this week due to a number of issues.

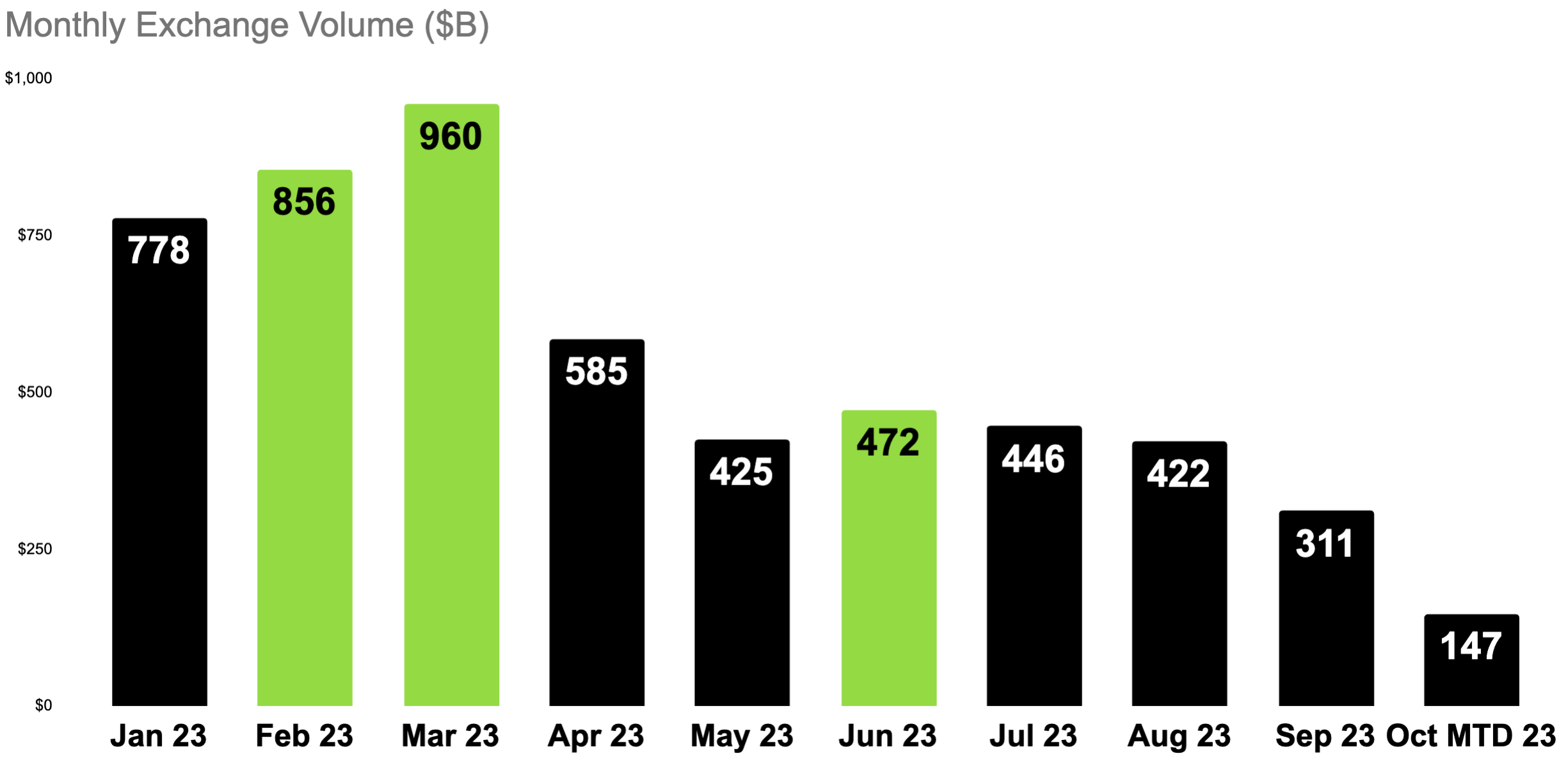

- Trading Volume: there continues to be a significant drop-off in crypto trading, reducing revenue for exchanges, miners, and other ecosystem participants

- Macroeconomic Conditions: Inflation and heightened yields on risk-free assets, especially as the Fed continues its “higher for longer” stance, have impacted all markets, including the notoriously volatile crypto market

- Sentiment: Overall negative to neutral market sentiment combined with continued regulatory concerns

Watch Architect Partners’ Elliot Chun interviewed on Nasdaq Trade Talks