News on Macro Economic Data

The current economic environment continues to provide many mixed signals, and thus, we remain cautious.

Given the combination of global geopolitical instability, elevated interest rates, and the fact that the effects of most of the Fed rate hikes have yet to be felt, the Fed kept rates steady. Public markets are experiencing a bump due to the Fed pause. “Looking under the hood” shows the macro environment may be eroding.

Inflation has come down from its high but remains elevated. September CPI was up 3.7% annualized in September, yet key staples – food and energy – were up 6.6%. The economy continues to be driven by consumer spending, up 0.7% from August to September, but real incomes were up only 0.4% questioning the ability for the consumer to continue to drive economic growth, especially given record credit card balances, and the highest credit card and auto loan defaults in 10 years.

With CBO estimates of GDP growth averaging 1.2% through 2025, there is fear that Treasury yields will necessarily have to go much higher as $1.6T (11% of GDP) will be coming to market over the next 6 months with a less-than-welcoming- market.

Crypto Public Company Activity

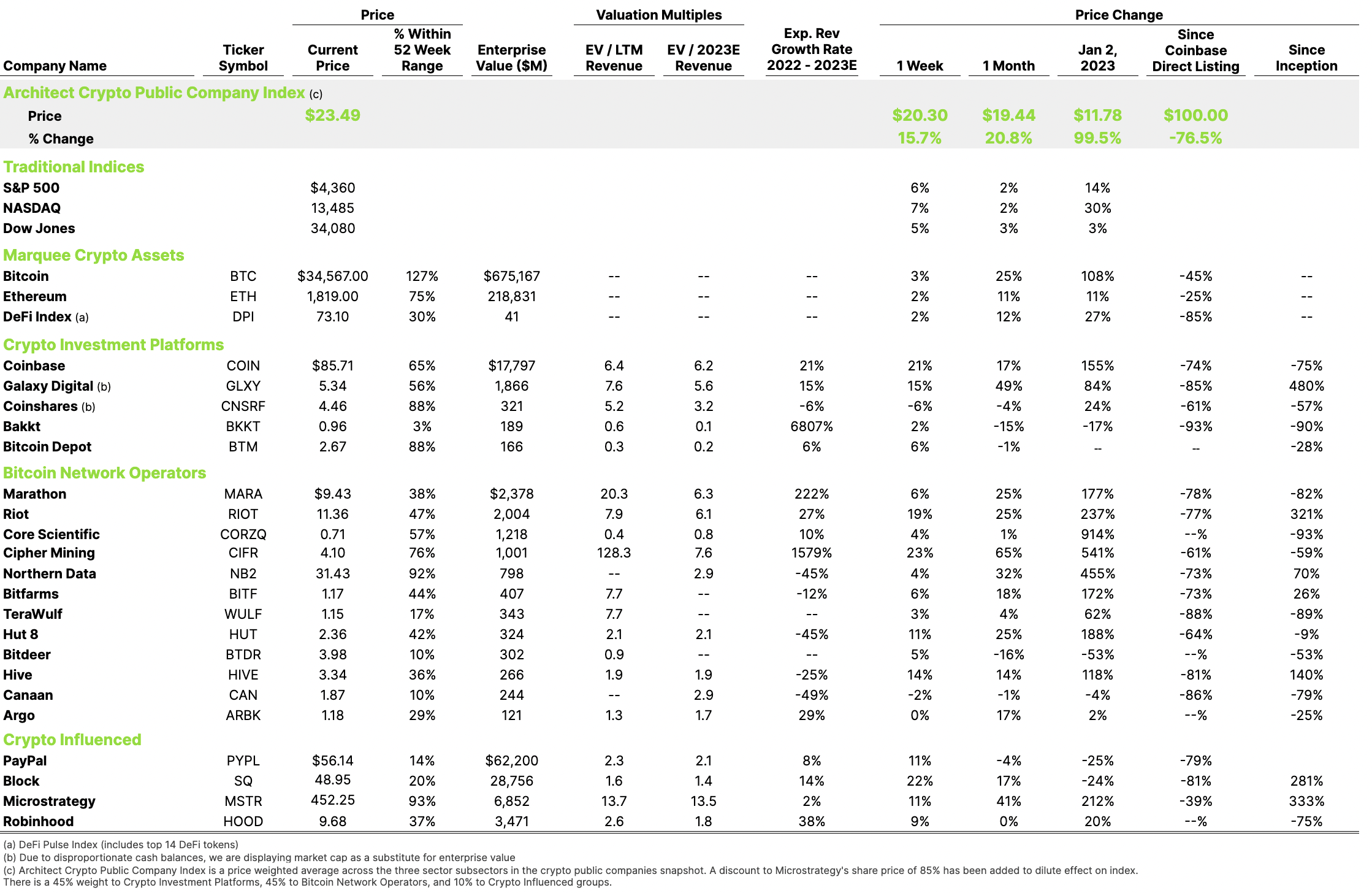

Coinbase posted mixed third-quarter results beating revenue ($674M actual vs $651M estimate) and profitability estimates (-$0.01 EPS actual vs -$0.54 EPS estimate). However, revenue was down 6% from Q2, and the company posted its seventh consecutive quarterly loss as trading volumes and number of people trading on the platform fell.

Retail trading volume fell 21% QoQ and Institutional trading volume fell 17% QoQ leading to overall trading revenue falling 11.8% QoQ, and 21.1% YoY. Coinbase made up much of their reduction in trading revenue with substantial increases in subscription and services revenues which rose 59% YoY.

Guidance for Q4 expects subscription and services revenue to be flat, but looking for positive EBITDA.

This week, Coinbase also announced that eligible customers in the US now can trade futures contracts tied to Bitcoin and Ethereum.

Coinbase stock is up close to 150% so far in 2023.