News on Macro Economic Data

Fed Chairman Jay Powell asked Fed governors to think outside the box in thinking about the economy and their continued analysis and approach. To that end, perhaps the Fed chairman would take the same bold approach former Fed Chairman Alan Greenspan did and speak up loudly about the threat posed by the US government’s excessive spending and the nation’s unsustainable and growing debt.

The upcoming CPI number is expected to show a decrease in inflation mostly due to a decrease in energy costs of greater than 10%.

Indicators continue to forecast an economic slowdown in 2024. One indicator that the Fed is watching is unemployment. Unemployment is up 15% over the last six months, and the majority of new jobs in the last few jobs reports are government jobs (which add nothing to GDP and only add to the tax burden) and lower paying part-time jobs. The reports also point to multiple job holders being at an all-time high. Additionally, Warren notices were very high in August and were recently raised for September suggesting further rises in unemployment.

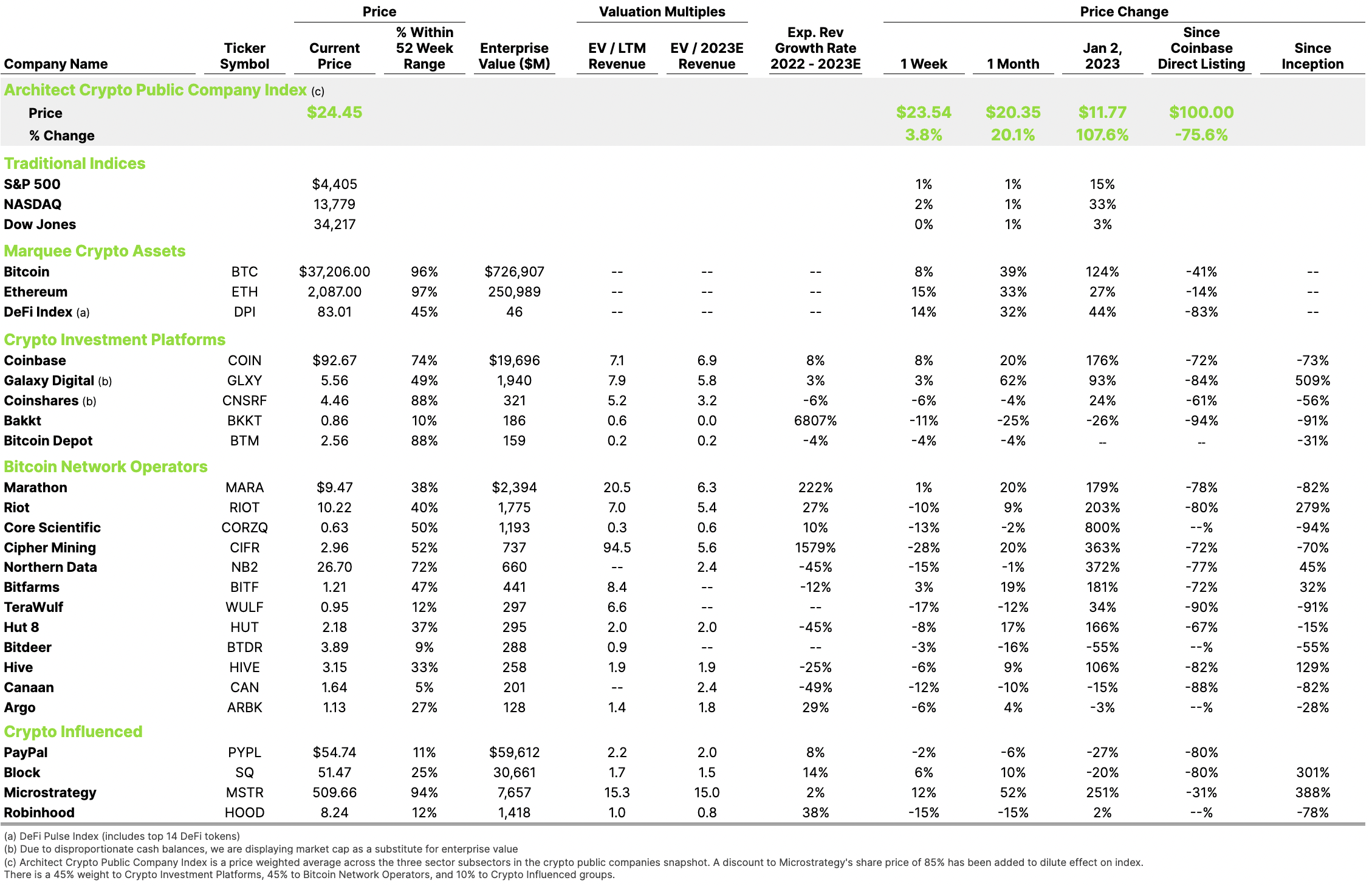

Crypto Public Company Activity

Stablecoins promise many benefits, including yield, easy movement of funds from crypto to an underlying currency, inexpensive peer-to-peer transfer of funds, and payment for goods. However, as many investors learned recently, “stable” only refers to their price and not its value. Value is ensured by the issuer’s reserves as well as the value of the underlying asset to which it’s pegged. The issue of value based on reserves affected Circle in March of this year, when they revealed that $3.3B of its $40B in reserves was with failed Silicon Valley Bank, and the value of USDC immediately fell 12%. There have been other well-publicised issues with stablecoins, such as Tether’s past unreported shortfall in reserves (since rectified).

However, properly capitalized and regulated stablecoins represent an opportunity to utilize all the benefits of digital currency without the volatility of cryptocurrencies. To this end, as the regulatory environment is solidified, many large and trusted financial institutions are planning stablecoin-based offerings.

Against this backdrop, the news this week is that Circle is considering an IPO in 2024. Circle had a much publicized $9B SPAC deal fail in 2022. Circle is backed by Goldman Sachs, Blackrock, and Fidelity, and is the second-largest stablecoin issuer with USDC having a $24B market cap. Circle is a key component of what will be a growing and important market. Thus, going public makes sense to fund the company’s growth as well as provide liquidity to early investors.