News on Macro Economic Data

The economy received good news this week, as both CPI and PPI numbers came in better than expected. CPI was up year over year by 3.2% and down 0.5% month over month. The majority of the reduction can be attributed to the reduction in energy costs. Core inflation (CPI less food and energy) fell to 4% year over year, and just 0.2% month over month. In addition, housing starts surprised to the upside of 1.9% month over month instead of the expected decline. Housing permits were also better than expected at 1.1%.

There is still caution as major retailers provided cautious guidance for Q4, and major banks are projecting a slowdown in 2024. Data suggesting a slowdown continues to include: total inflation since January 21, 2021, is slightly above 17% while real wages have declined 4% over the same period, consumer debt defaults are rising, and the full effects of the Fed raises have yet to be felt.

Crypto Public Company Activity

“The Future Will Be Tokenized” – Forbes

Many believe that tokenization is the future, and this digital future will revolutionize financial markets, along with substantial positive effects in other markets. The integration of tokenization and blockchain will lead to innovative financial solutions, marketplaces, and drive efficiency and liquidity for markets. There are still many technical and regulatory hurdles, but innovative companies are partnering with large financial institutions to aggressively drive this future forward. Two exciting announcements from this week include:

- JPM and Apollo announced a POC to tokenize Apollo’s funds in collaboration with Axelar, Oasis Pro, and Provenance Blockchain. The goal is to manage large-scale client portfolios, execute trades, and provide automated portfolio management of tokenized assets.

- Monetary Authority of Singapore (MAS) announced multiple financial industry partners to develop comprehensive infrastructure and capabilities to expand and scale the opportunities for tokenization and digital assets across networks and borders. The partners have created five POCs representing the entire value chain for capital markets– listing, distribution, trading, settlement, and servicing. MAS’ announced partners include Citi, T Rowe Price, Fidelity, BNY Mellon, OCBC, Ant International, Franklin Templeton, JP Morgan, and Apollo.

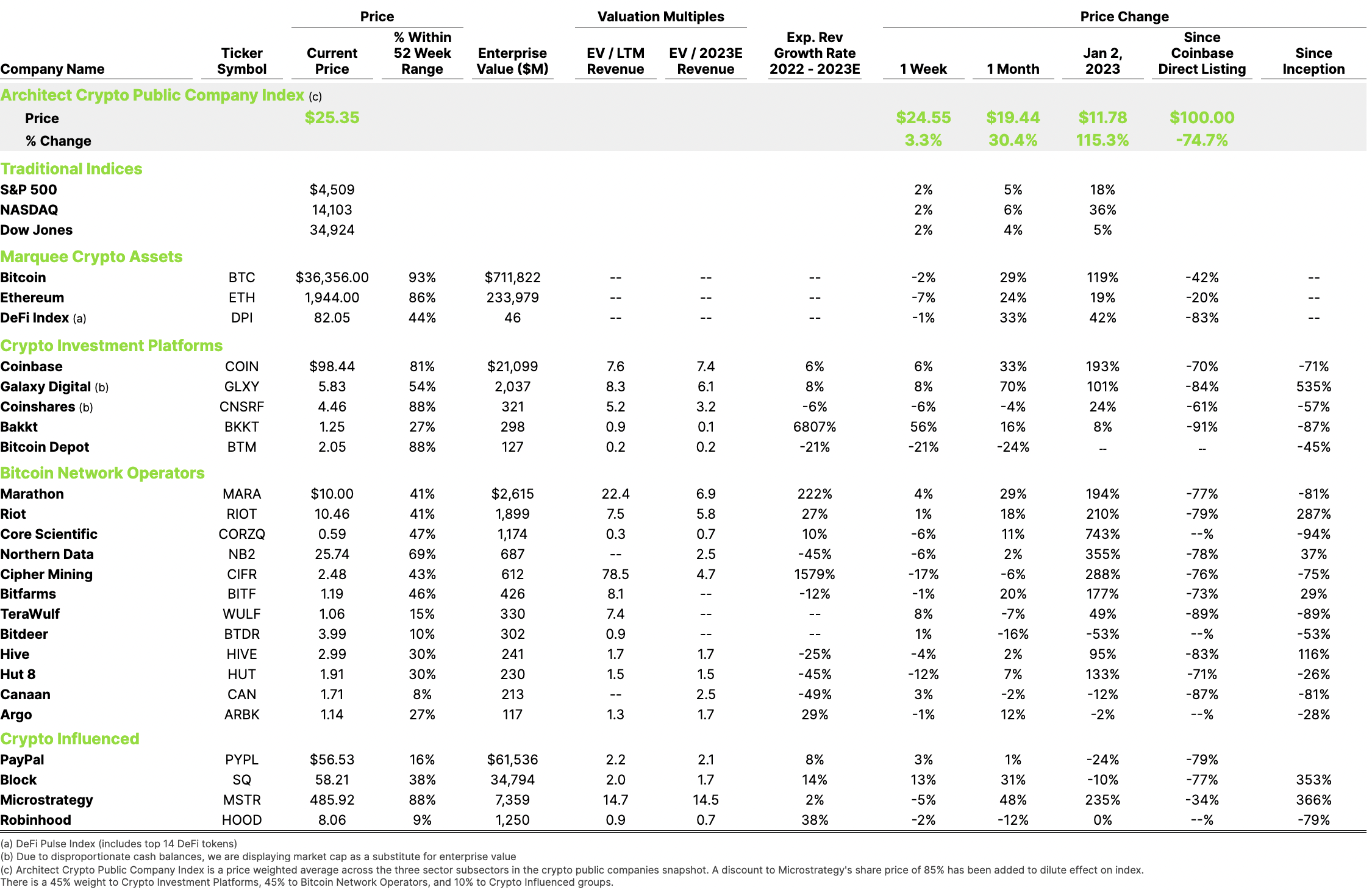

Recent weeks have been positive for public markets, especially given the positive economic news over the past couple of weeks. As a result, BTC has been up 27% over the past month providing a positive influence on public crypto companies, with the Architect Partners’ index up 30% over the same period.