News on Macro Economic Data

Unlike almost any other time, Fed watching is driving market activity. To that end, Fed Chair Powell said that any rate cuts will come later this year, and are “not likely” to occur in March as the market expected. Richmond Fed President Thomas Barkin, a voting member, said the Fed has time to be patient regarding rate cuts. The market was expecting six cuts this year, but with these comments, the prospects of that are fading rapidly. The Fed signaled three rate cuts this year. However, any occurring late this year could be seen as political in this election year.

Despite some concerns about the economy, there is still a lot of liquidity, mostly due to government spending. Some economists feel this spending is buoying the economy and markets right now, but also can help maintain stubborn inflation.

Next week the CPI and PPI numbers come out, which will provide greater insight into trends.

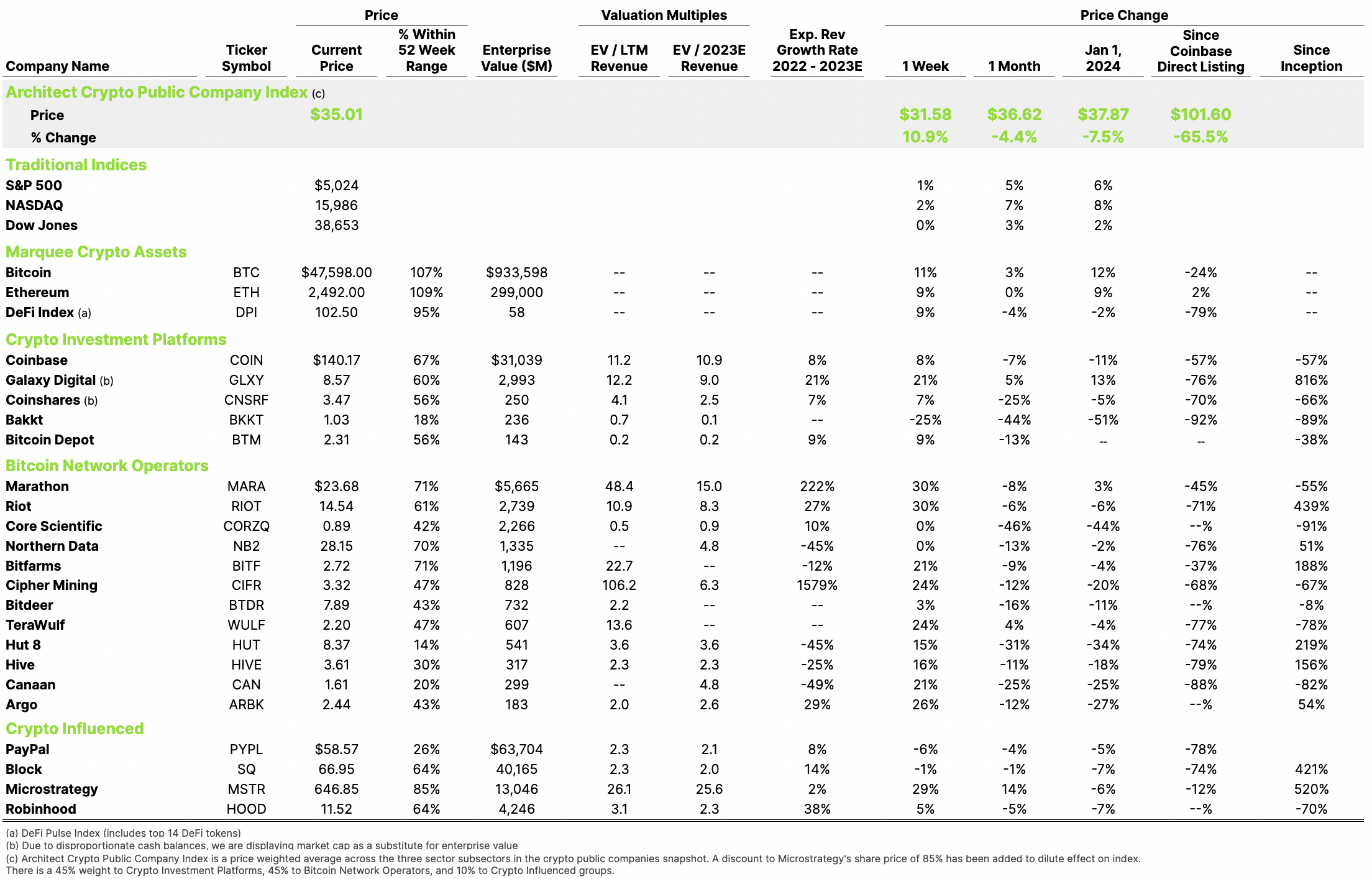

Crypto Public Company Activity

Snapshots from this past week:

Blackrock or MicroStrategy?: MicroStrategy acquired another 850 BTC for $37.2M in January, raising its holdings to 190,000 BTC. Michael Saylor believes BTC is the safest long-term investment and inflation hedge. MicroStrategy has an astounding 312 PE Ratio, with the 190,000 BTC representing about 80% of MicroStrategy’s market cap. BlackRock iShares Bitcoin Trust is now a top 5 ETF based on 2024 inflows of $3.2B.

NBA Voyager Lawsuit: Voyager investors filed a lawsuit against the NBA alleging it acted in a “grossly negligent” fashion by approving a marketing deal between Voyager and Mark Cuban, owner of the Dallas Mavericks. The lawsuit alleges the NBA promoted Voyager’s “unregistered securities”, as well as promoting multiple crypto companies through sponsorships and naming rights despite the risks associated with crypto.

Baakt: On February 7, Bakkt filed an amendment to its Q3 2023 10Q that raised questions about Bakkt being a going concern. In a press release on Feb 8, Bakkt wrote, “In response to questions, management remains confident about our business and will continue to focus on delivering for our clients, making progress on our primary business objectives, and working efficiently to scale our business and move toward profitability. We plan to share more during our earnings announcement later this quarter”.