News on Macro Economic Data

Nvidia provided excitement with its earnings announcement. With revenue up 265% YoY, the company added an astounding $277B to its market cap in one day. As it relates to financial markets, the processing power Nvidia’s GPUs provide is closely tied to the federal government’s push for immediate settlement, a topic the crypto community has been touting for some time. This push is estimated to positively impact GDP by 2-3%. The two major programs driving this change are:

FedNow – Launched by the Federal Reserve on July 20, 2023, FedNow aims to modernize the U.S. payment system by providing a safe and efficient instant payment infrastructure. As of October 2023, 107 financial institutions were offering FedNow services to their customers. FedNow program’s introduction is likely to enhance liquidity, streamline payments, and contribute to a more dynamic macroeconomic environment in the United States.

Shortening Equities Settlement Time: On May 28th, the U.S. securities markets is set to adopt next-day settlement for stock trades. This move from T+2 to T+1 will reduce systemic risk and increase efficiency in the equities market. SEC Chair Gary Gensler has emphasized the importance of this move during recent discussions with the European financial community. The objective is to move to immediate settlement within the next few years.

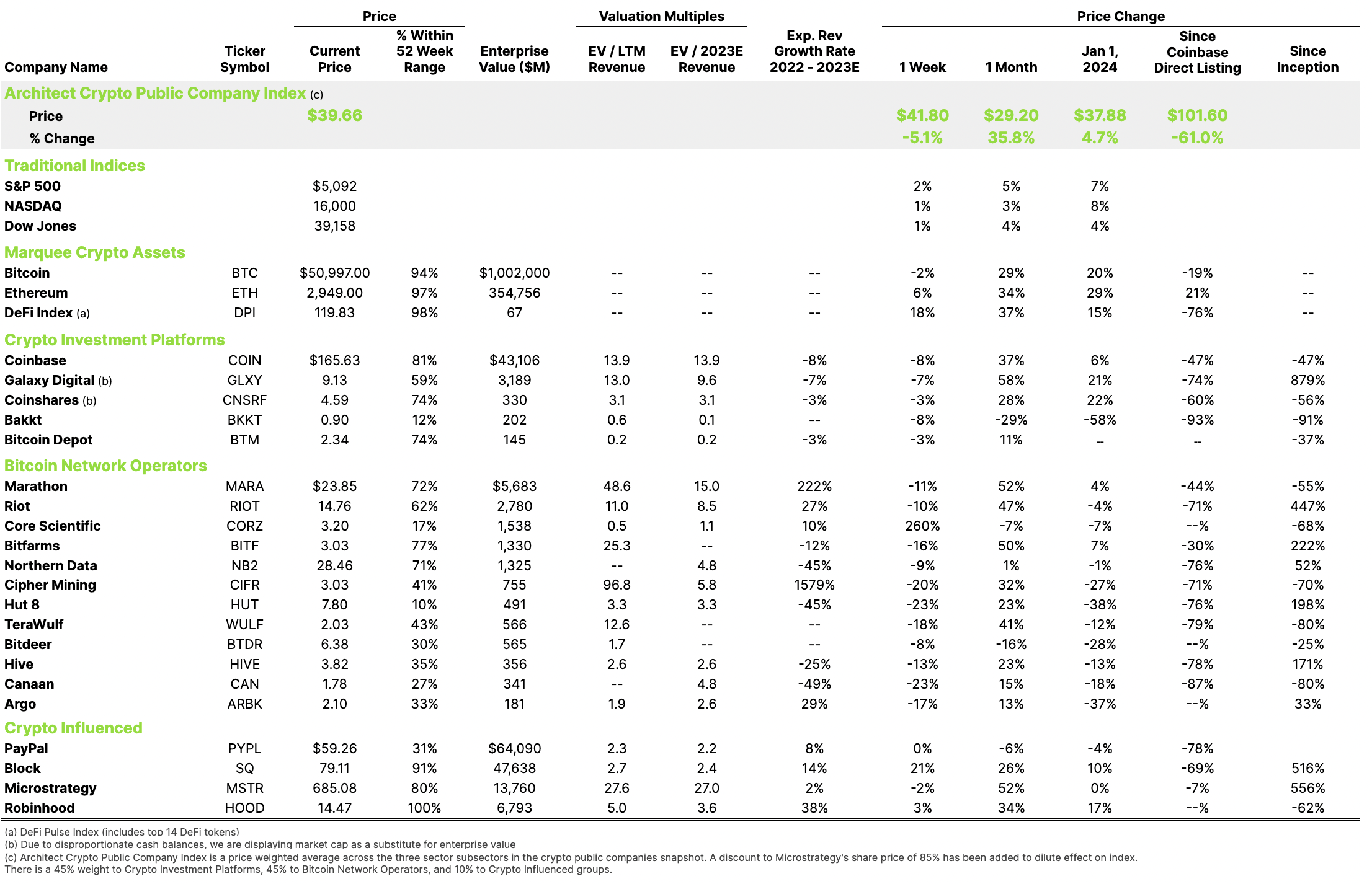

Crypto Public Company Activity

Nvidia’s impact is unlike any in recent memory, and their earnings announcement prompts us to reflect on the company’s influence and the AI-driven growth it fuels as it relates to the blockchain and crypto markets. Rather than delving into specific details of AI-blockchain integration, below are some broad topics of opportunities that Nvidia enables through its advancement of more powerful AI:

Virtual Worlds: Exceptional rendering, combined with AI will enable more immersible and intelligent 3D Metaverse experiences.

Data trustworthiness: AI opens up exciting possibilities for content creation. Blockchain provides a secure foundation for establishing authenticity, ownership, and data source trustworthiness.

Fraud prevention and security: AI aids in detecting suspicious transactions and patterns bolstering overall system security.

Smart Contract and DeFi: AI can enhance smart contract processing, ensuring compliance with agreement terms and complex regulatory frameworks.

DEPIN: Companies like Fetch.AI and Ocean Protocol integrate “AI tokens” into ecosystems, enabling access to AI/ML resources, data monetization, and governance.

Nvidia’s technological breakthroughs reverberate across nearly every technological ecosystem, making it a company worth closely monitoring, including within the Crypto community.