News on Macro Economic Data

This week’s data confirmed that the economy is still facing challenges, with core PCE, the Fed’s favored inflation measurement, rising 0,4% (2.8% annualized) which is the fastest rate of increase in four months. Coupled with the latest core CPI report of 3.9% annual inflation rate, it’s clear that sticky inflation remains. It also represents the second report in a row in which inflation has accelerated.

In addition to rising inflation, the expected 1.5% increase in pending home sales report came in with a sharp decline of 4.9%, the manufacturing index fell for the sixteenth month in a row to 47.8, the manufacturing workweek continues to contract, and consumer sentiment came in at a recessionary level of 76.9.

Views from Fed governors who have spoken this week didn’t provide much clarity, as opinions ranged from suggesting further hikes, to unsure about cuts, to suggesting cuts beginning this summer.

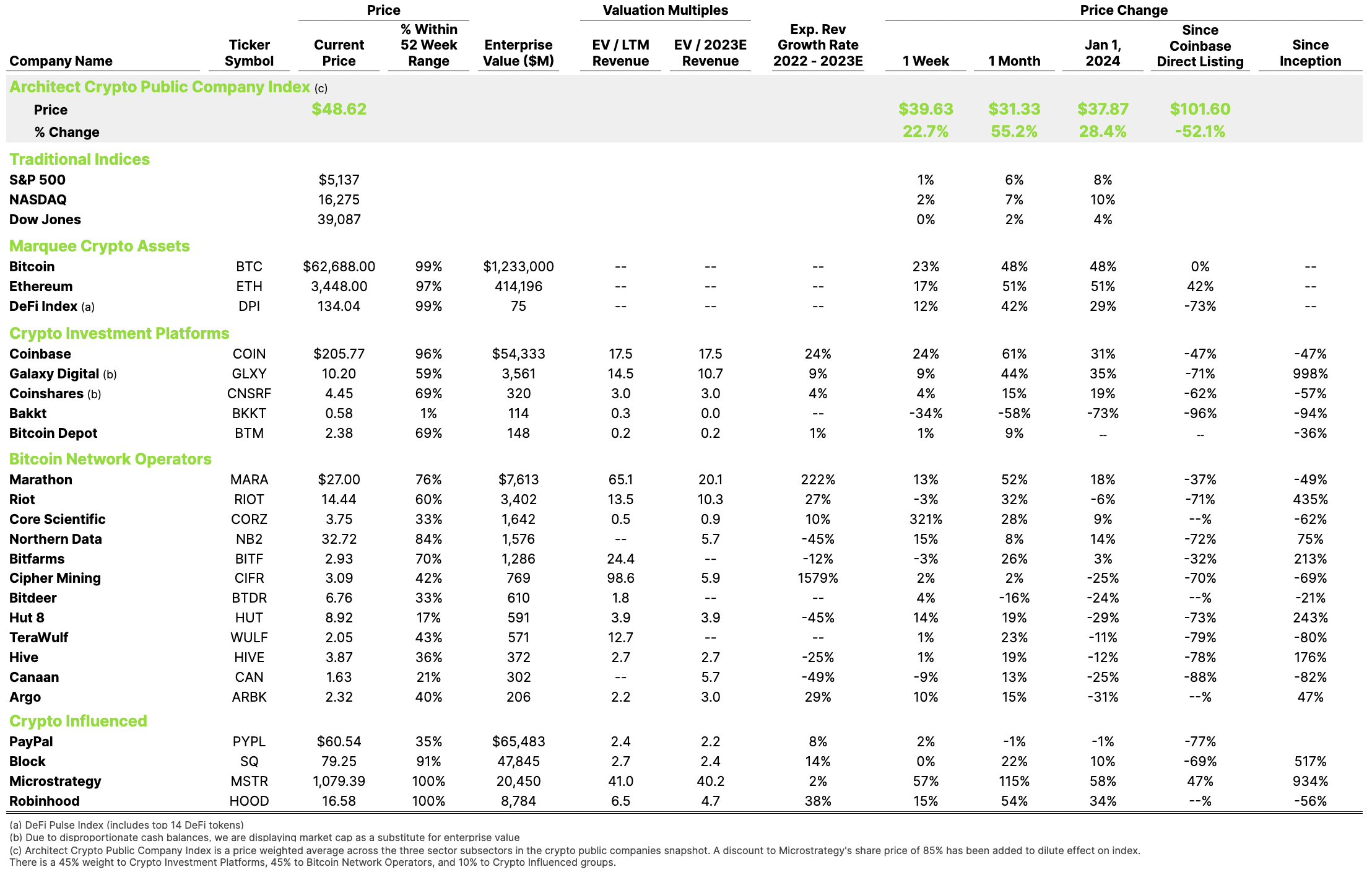

Crypto Public Company Activity

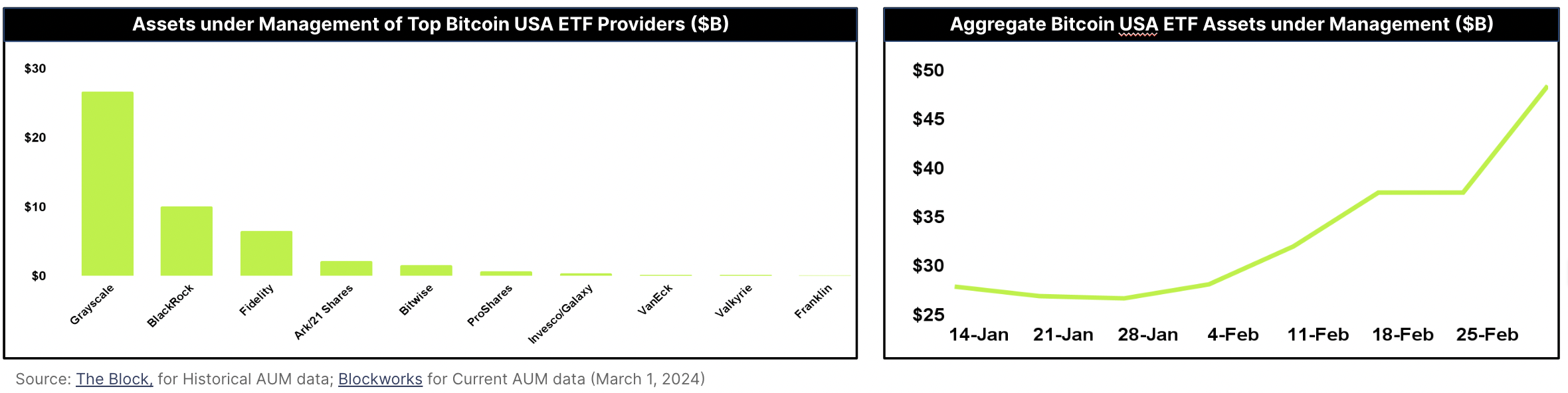

One week after bitcoin ETF approvals, bitcoin lost an amazing $80B in market cap. Since then, bitcoin has been on a tear, up more than 48% year to date. The question is, what is causing such a large move in such a relatively short period?

Much of the activity has to do with continued investment in the ETFs. This institutional support enables bitcoin to be a portion of portfolio management planning. According to an interview with TheStreetCrypto, analyst Scott Melker, “The ETFs’ demand is 10x that of new bitcoin being mined on a daily basis. We know that roughly 75% of all bitcoin buying right now is for the ETFs, and we also know that yet another bitcoin halving is coming in April.” Bitcoin halvings have historically led to price increases.

Another factor is increased industry optimism. ETF approval was a watershed event after the crypto winter given the numerous bankruptcies and legal issues that occurred. While regulatory uncertainty still exists, ETF approval added stability, and changes to the industry seem to have limited near-term exposure to serious and impactful negative news.