News on Macro Economic Data

Multiple reports came out this week supporting the view that the US economy continues to slow.

The ISM index was down 3.6% continuing the greater than expected downturn in factory orders.

The jobs report showed an increase of 257K new jobs. Digging into the details reveals that the majority of the jobs were government related – government, health care, and social assistance, with the next largest areas of employment being transportation and warehouse. Given these segments, hiring seems focused on lower paying jobs. Other reports show that layoffs hit their highest level for the month since the 2009 financial crisis, and Temp hiring was down for the 25th straight month.

The headline jobs number continues to be challenging to believe on an ongoing basis, as since Dec 2022 the headline number has been revised significantly downward and now diverges significantly from the household survey which has been showing a contraction of full time employment.

Credit card delinquencies have risen above 3% for the first time since 2012.

Fed Chair Powell’s testimony to Congress suggested Fed cut(s) would be coming this year if the economy continues to weaken.

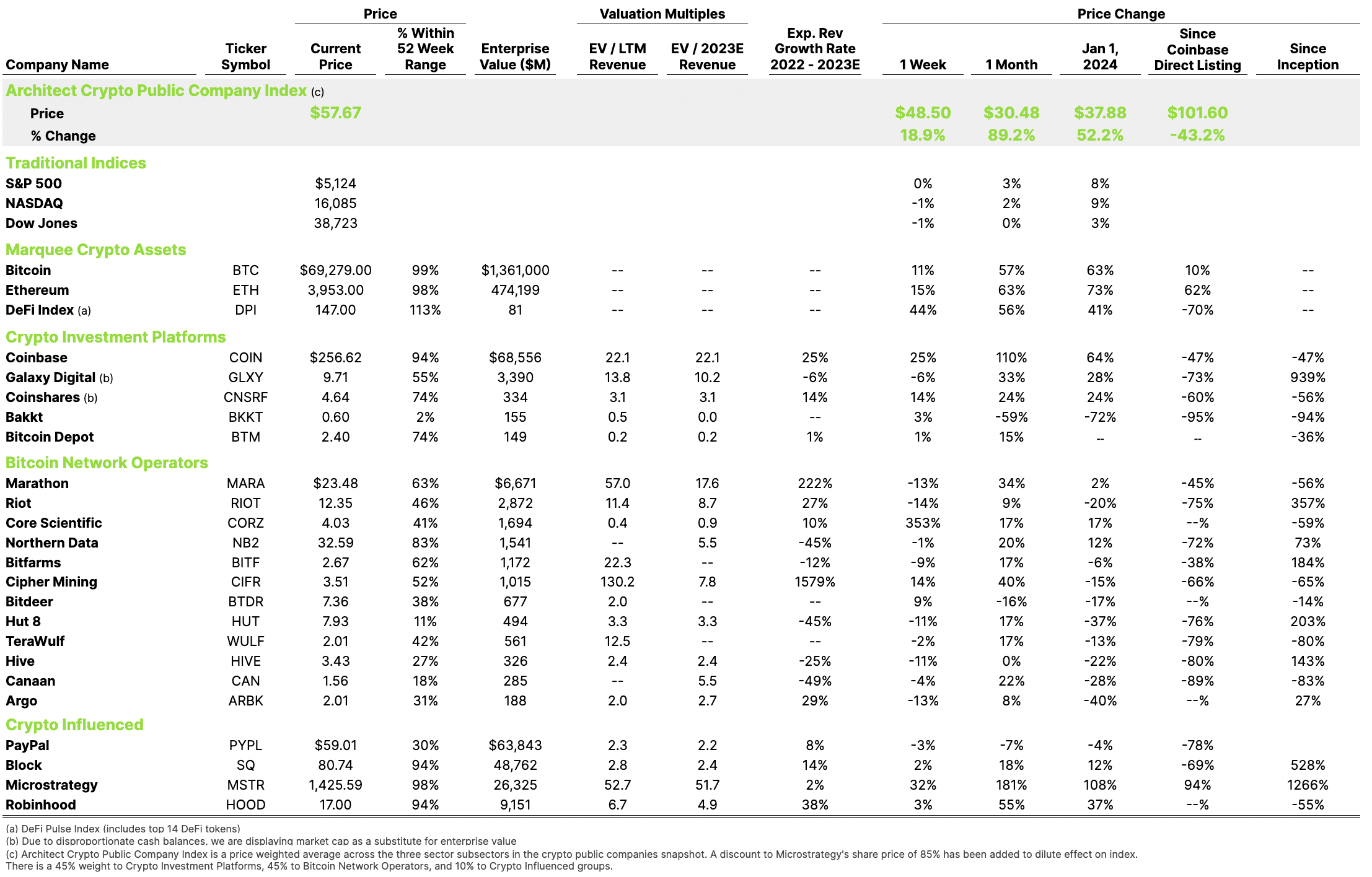

Crypto Public Company Activity

Bitcoin, digital assets, and the associated ecosystem have been a terrific investment category so far this year, far outpacing most stock portfolios (excluding AI). What is driving this appreciation?

Bitcoin’s rise seems to be tied to multiple catalysts:

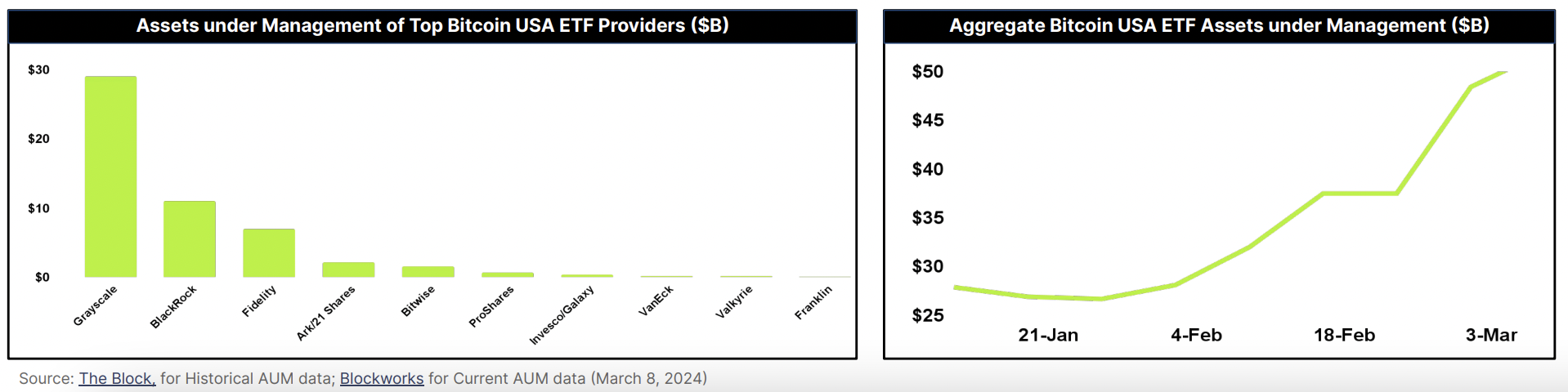

- ETFs – When gold ETFs were introduced in 2004 making gold more accessible, the price of gold quadrupled in the following seven years. Since Bitcoin ETFs were approved, much of Bitcoin’s rise has been fueled by ETF demand

- Economic Uncertainty – US real inflation since January 2021 is roughly 19% The US economy is better than most, and there is broad global economic and geopolitical uncertainty, increasing the value of safe harbors, including gold and Bitcoin

- Risk on Environment: The pace of asset appreciation encourages investors to move further out on the risk curve

- Regulatory & Institutional Adoption: The regulatory environment with Bitcoin is improving, leading to greater institutional adoption of digital assets.

However, despite Bitcoin’s rise itself this year, businesses tied to Bitcoin have, on average, faltered. This is most prominent among the miners:

Bitcoin +55%

Crypto Investment Platforms +26% (Coinbase +64%)

Mining Platforms -18% (Core Scientific +17%)

Crypto Influenced +25% (Microstrategy +108%)