News on Macro Economic Data

The Keynesian vs Supply Side debate took center stage this week. The Fed generally supports the Keynesian model with the Phillips curve being fundamental to the Fed’s argument that unemployment needs to increase to depress demand, which will in turn ease inflation. They do so despite the Phillips Curve rarely being historically accurate. Against all his previous statements, Fed Chair Powell this week seemed to side with the Supply Side/Pro Growth model when he acknowledged that economic growth and low unemployment may not be driving inflation, while holding rates steady for the 5th consecutive meeting and suggested three rate cuts were still in consideration for this year. Perhaps Mr. Powell is looking to stimulate economic activity through three cuts this year, since all his other previously stated criteria for rate cuts have not been met, given inflation slightly accelerated over the last two months.

There was some analysis regarding the effects of interest rates on jobs. While the unemployment rate remains nominally low, since February 2023, 280,000 full time jobs have been lost and 900,000 part-time jobs have been gained, with many of those representing multiple job holders. Taken in conjunction with household financial data, the collective information represents a weakened consumer.

Crypto Public Company Activity

Tokenization is projected to be a $10T market by 2030. Tokenizing real world assets democratizes ownership by making them accessible to a broader audience of investors which can acquire fractional ownership and make the tokenized assets more liquid. By leveraging blockchain technology, tokenized assets enjoy inherent security, and reduces the risk of fraud and manipulation. Tokenization will be a driving force for financial innovation.

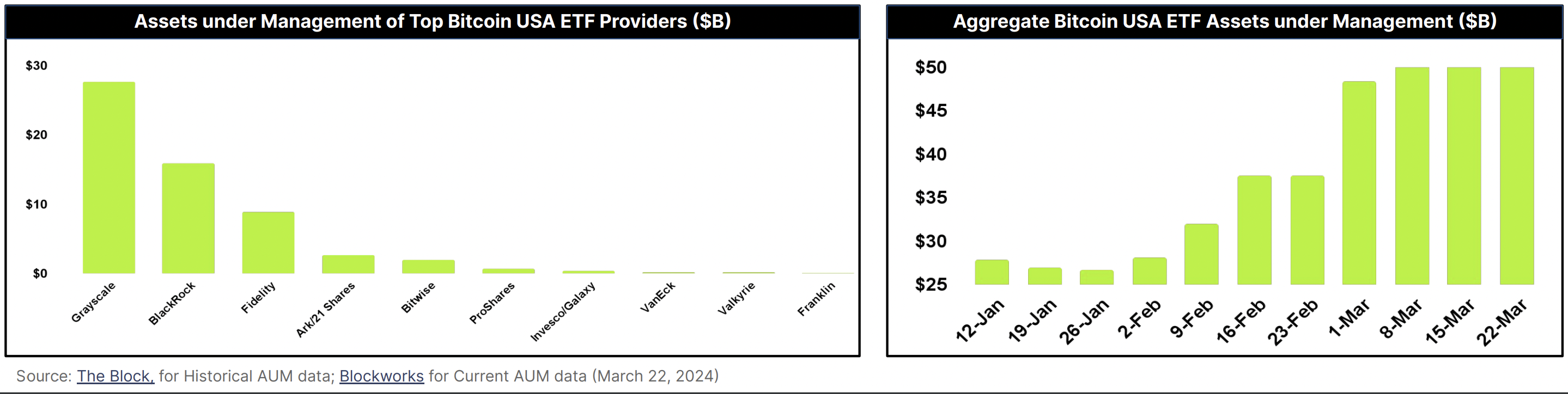

Larry Fink, CEO BlackRock, is known to want to “tokenize the world” and has embraced crypto markets, including their $13B Bitcoin ETF. Now, BlackRock is supporting the importance of the eventuality of tokenization by announcing the formation of a new private fund, BlackRock USD Institutional Digital Liquidity Fund (BUIDL) operating on the Ethereum Network. The fund is represented by the BUIDL token, and invests 100% of its total assets in cash, U.S. Treasury bills, and repurchase agreements. This allows investors to earn yield while holding the token on the blockchain.

Securitize (into which BlackRock also made a strategic investment) will be the tokenization and transfer platform, and BNY Mellon will custody funds assets. BitGo, Coinbase, Anchorage Digital and Fireblocks are additional custody options.

Digitizing financial products is just the beginning of tokenization of real world assets, and BlackRock now joins Franklin Templeton, JP Morgan, and Citi.