News on Macro Economic Data

Juxtaposed against a very strong Q1 stock market, PCE was announced today showing a 0.3% month-over-month increase and a 2.5% increase year-over-year. Core PCE came in at 0.3% month-over-month, slightly better than expected (0.4%), and a 2.8% increase year-over-year.

Spending and income data were also released today showing that with a 0.3% month-over-month increase, incomes are just keeping up with inflation. Spending was significantly greater than expected (0.8% actual vs. 0.5% expected), outstripping income, and supporting data showing continued growth of record consumer credit card balances.

With global growth seemingly accelerating, helping to drive commodity indexes and oil prices higher, US fiscal policy remaining a major cause of continued inflation by providing excess liquidity, and an inflation rate that seems to be increasing rather than declining, Fed Chair Powell said today that the Fed isn’t under pressure to cut rates and can wait to see how the inflation numbers come in.

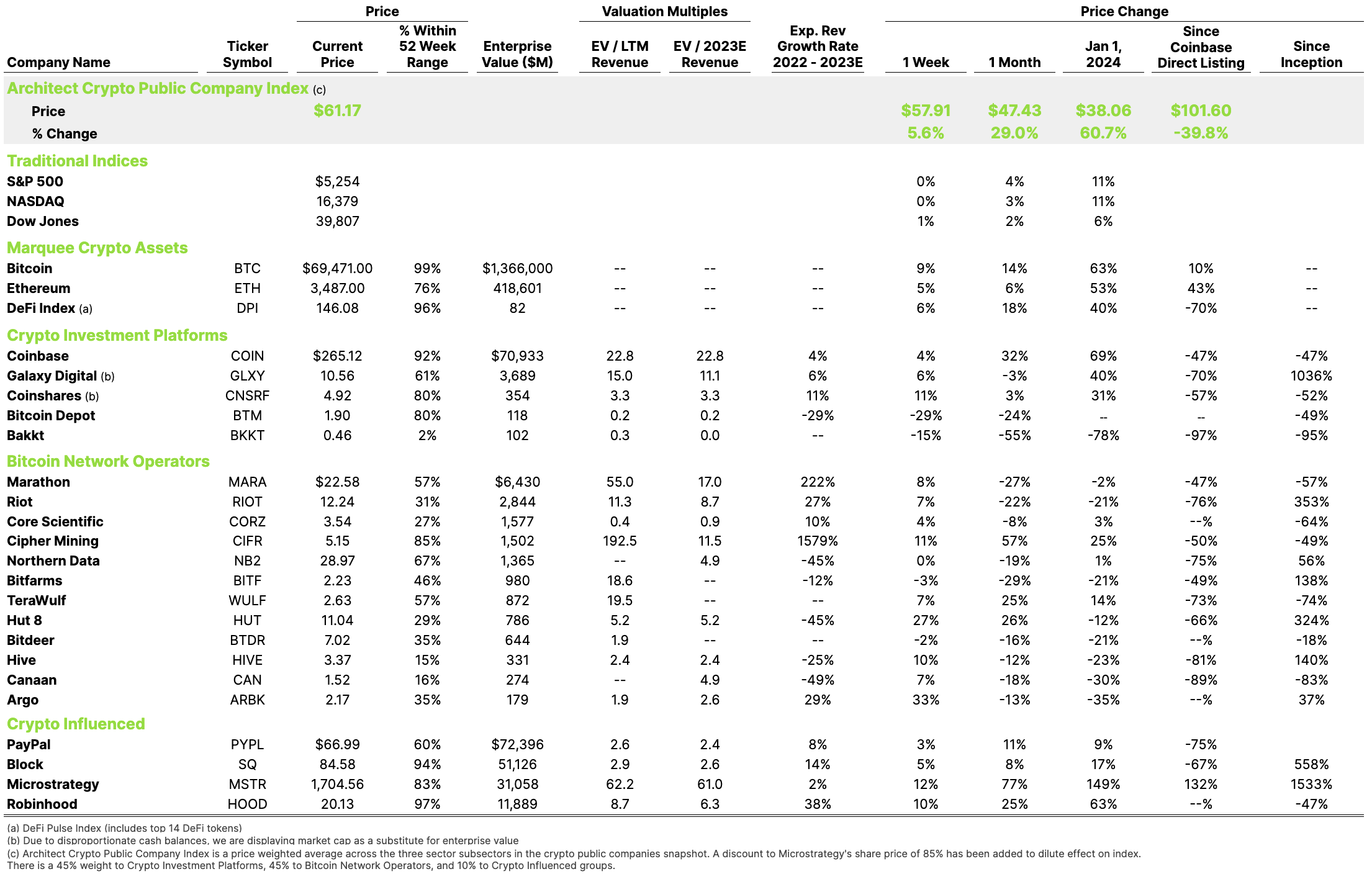

Crypto Public Company Activity

On March 26, U.S. District Judge Katherine Polk Failla denied Coinbase’s motion to dismiss the SEC’s lawsuit, which alleges that Coinbase violated investor-protection laws. The SEC claims that Coinbase operated as an unregistered intermediary of securities and engaged in the unregistered offer and sale of securities. While Judge Polk allowed the case to proceed, she also dismissed the claim that Coinbase acted as an unregistered broker through its crypto wallet.

The potential consequences for Coinbase are significant and could impact both the company and the broader cryptocurrency industry:

- Legal Liability: If found guilty of violating investor-protection laws, Coinbase could face monetary and other legal penalties.

- Business Impact: To comply with regulations, Coinbase may need to make consequential operational changes, and may experience lower trading volumes as some users might move to other platforms.

- Regulatory Scrutiny: The ruling enables increased SEC scrutiny and potential actions against other crypto exchanges and platforms. One important section stated that “When a customer purchases a token on Coinbase’s platform, she is not just purchasing a token, which in and of itself is valueless; rather, she is buying into the token’s digital ecosystem, the growth of which is necessarily tied to value of the token.” Tying the purchase of a token to the underlying ecosystem, much like a stock is tied to a company’s performance, is a potentially challenging view for the industry.

Overall, this case sets a precedent for how crypto exchanges are treated under U.S. securities laws. The outcome could influence future legal battles and regulatory decisions in the crypto space.